Answered step by step

Verified Expert Solution

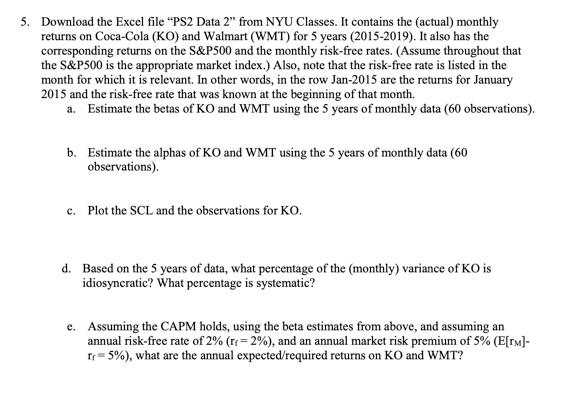

Question

1 Approved Answer

ps2 DATA Date KO WMT S&P500 RF Jan-15 5.17% -1.24% 5.49% 0.02% Feb-15 -6.35% -2.00% -1.74% 0.02% Mar-15 0.02% -5.11% 0.85% 0.02% Apr-15 0.99% -4.84%

ps2 DATA

| Date | KO | WMT | S&P500 | RF |

| Jan-15 | 5.17% | -1.24% | 5.49% | 0.02% |

| Feb-15 | -6.35% | -2.00% | -1.74% | 0.02% |

| Mar-15 | 0.02% | -5.11% | 0.85% | 0.02% |

| Apr-15 | 0.99% | -4.84% | 1.05% | 0.01% |

| May-15 | -4.22% | -4.50% | -2.10% | 0.01% |

| Jun-15 | 4.72% | 1.48% | 1.97% | 0.03% |

| Jul-15 | -4.28% | -10.07% | -6.26% | 0.04% |

| Aug-15 | 2.03% | 0.17% | -2.64% | 0.01% |

| Sep-15 | 5.56% | -11.72% | 8.30% | 0.01% |

| Oct-15 | 0.64% | 2.80% | 0.05% | 0.07% |

| Nov-15 | 0.80% | 4.18% | -1.75% | 0.17% |

| Dec-15 | -0.09% | 8.25% | -5.07% | 0.23% |

| Jan-16 | 0.49% | -0.03% | -0.41% | 0.26% |

| Feb-16 | 7.56% | 3.24% | 6.60% | 0.25% |

| Mar-16 | -3.43% | -2.37% | 0.27% | 0.19% |

| Apr-16 | -0.45% | 5.85% | 1.53% | 0.23% |

| May-16 | 1.64% | 3.16% | 0.09% | 0.22% |

| Jun-16 | -3.75% | -0.07% | 3.56% | 0.26% |

| Jul-16 | -0.46% | -2.10% | -0.12% | 0.26% |

| Aug-16 | -2.56% | 0.95% | -0.12% | 0.19% |

| Sep-16 | 0.19% | -2.91% | -1.94% | 0.24% |

| Oct-16 | -4.83% | 0.59% | 3.42% | 0.30% |

| Nov-16 | 4.09% | -1.86% | 1.82% | 0.42% |

| Dec-16 | -1.02% | -3.44% | 1.79% | 0.50% |

| Jan-17 | 0.94% | 6.28% | 3.72% | 0.48% |

| Feb-17 | 1.14% | 1.62% | -0.04% | 0.66% |

| Mar-17 | 1.67% | 4.30% | 0.91% | 0.75% |

| Apr-17 | 5.38% | 4.55% | 1.16% | 0.73% |

| May-17 | -1.36% | -3.72% | 0.48% | 0.84% |

| Jun-17 | 2.21% | 5.70% | 1.93% | 0.97% |

| Jul-17 | -0.63% | -2.40% | 0.05% | 0.98% |

| Aug-17 | -1.19% | 0.09% | 1.93% | 0.99% |

| Sep-17 | 2.16% | 11.74% | 2.22% | 1.00% |

| Oct-17 | -0.46% | 11.36% | 0.37% | 1.09% |

| Nov-17 | 0.24% | 1.56% | 3.43% | 1.20% |

| Dec-17 | 3.73% | 7.95% | 5.62% | 1.30% |

| Jan-18 | -9.18% | -15.56% | -3.89% | 1.38% |

| Feb-18 | 0.49% | -1.16% | -2.69% | 1.64% |

| Mar-18 | -0.51% | -0.57% | 0.27% | 1.66% |

| Apr-18 | -0.49% | -6.69% | 2.16% | 1.71% |

| May-18 | 2.00% | 3.77% | 0.48% | 1.81% |

| Jun-18 | 6.32% | 4.18% | 3.60% | 1.89% |

| Jul-18 | -4.42% | 7.43% | 3.03% | 1.94% |

| Aug-18 | 3.63% | -2.03% | 0.43% | 2.04% |

| Sep-18 | 3.66% | 6.78% | -6.94% | 2.17% |

| Oct-18 | 5.26% | -2.62% | 1.79% | 2.24% |

| Nov-18 | -6.05% | -4.61% | -9.18% | 2.37% |

| Dec-18 | 1.65% | 2.88% | 7.87% | 2.40% |

| Jan-19 | -5.80% | 3.30% | 2.97% | 2.43% |

| Feb-19 | 3.35% | -1.47% | 1.79% | 2.45% |

| Mar-19 | 4.69% | 5.44% | 3.93% | 2.43% |

| Apr-19 | 0.14% | -1.36% | -6.58% | 2.40% |

| May-19 | 3.64% | 8.92% | 6.89% | 2.22% |

| Jun-19 | 3.36% | -0.10% | 1.31% | 2.15% |

| Jul-19 | 4.58% | 3.52% | -1.81% | 2.07% |

| Aug-19 | -1.09% | 3.87% | 1.72% | 1.99% |

| Sep-19 | -0.02% | -1.20% | 2.04% | 1.73% |

| Oct-19 | -1.89% | 1.56% | 3.40% | 1.58% |

| Nov-19 | 3.65% | -0.21% | 2.86% | 1.55% |

| Dec-19 | 5.51% | -3.66% | -0.16% | 1.53% |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started