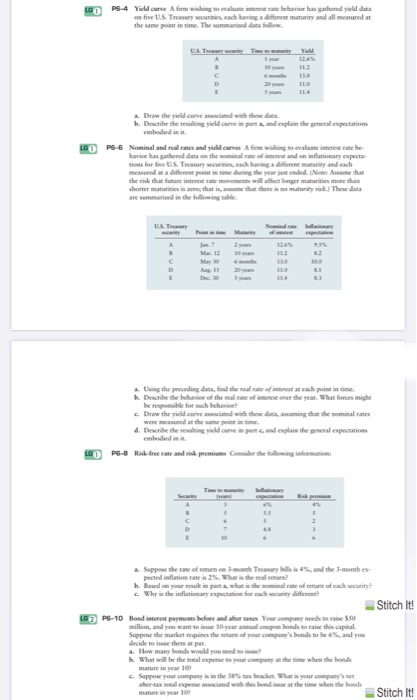

PS-4 Yidd curve firm wishing to behavia has gathered sed data e five US Treasury securities.cach having a different maturity and all measured at the same point in time. The summer follow ELS. THE TW 1 Draw the yield curved with these . Describe the red care explain the general expectations embodied in it LCD PS-6 Nominal and real rates and yildcarves Awaking to evaluate interest rate be havice has gathered data ce the late of interest and an inflationary expecta tions for five US Treasury securities, each having a different maturity and each measured at a different point in time during the year just ended. (Note: Assume that the risk that future interest rate memes feet longer maturities meetham shorter maturities in that is, there is no maturity risk. These data are marined in the following UST A D 2. Using the preceding data, find the rate of each point in time Describe the behavior of the scale of meer over the year. What forces might be responde for such ich Draw the yield come with the daming that the nominal rates were med at the same 4. Decribe the resulting yield care in parts and explain the general expectations PS-8 Risk free rate and risk premiums Consider the following information: . Suppose the rate of return Treasury Bills ist, and the months pected inflatiemates 2. What is there? Based on your main parts, weate of return of each security Why is the inflationary expect beach security differ? Stitch It! PG-10 Bond interest payments before and after as your company needs to be 550 million, and you want to 10-odstrae this capital Suppere the market requires the end your company's bonds to be and you decide to them at par a. How many bonds would you need to What will be the expense to your company at the time when the bonds mature in year 100 c. Suppose your company is in the back. What is your company's aber alexpected with beat the time when the bonds Stitch it! PS-4 Yidd curve firm wishing to behavia has gathered sed data e five US Treasury securities.cach having a different maturity and all measured at the same point in time. The summer follow ELS. THE TW 1 Draw the yield curved with these . Describe the red care explain the general expectations embodied in it LCD PS-6 Nominal and real rates and yildcarves Awaking to evaluate interest rate be havice has gathered data ce the late of interest and an inflationary expecta tions for five US Treasury securities, each having a different maturity and each measured at a different point in time during the year just ended. (Note: Assume that the risk that future interest rate memes feet longer maturities meetham shorter maturities in that is, there is no maturity risk. These data are marined in the following UST A D 2. Using the preceding data, find the rate of each point in time Describe the behavior of the scale of meer over the year. What forces might be responde for such ich Draw the yield come with the daming that the nominal rates were med at the same 4. Decribe the resulting yield care in parts and explain the general expectations PS-8 Risk free rate and risk premiums Consider the following information: . Suppose the rate of return Treasury Bills ist, and the months pected inflatiemates 2. What is there? Based on your main parts, weate of return of each security Why is the inflationary expect beach security differ? Stitch It! PG-10 Bond interest payments before and after as your company needs to be 550 million, and you want to 10-odstrae this capital Suppere the market requires the end your company's bonds to be and you decide to them at par a. How many bonds would you need to What will be the expense to your company at the time when the bonds mature in year 100 c. Suppose your company is in the back. What is your company's aber alexpected with beat the time when the bonds Stitch it