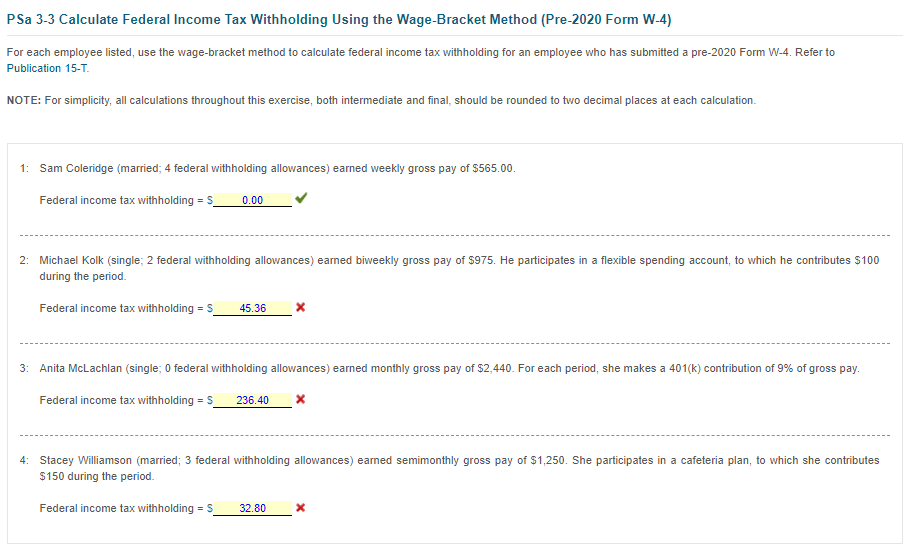

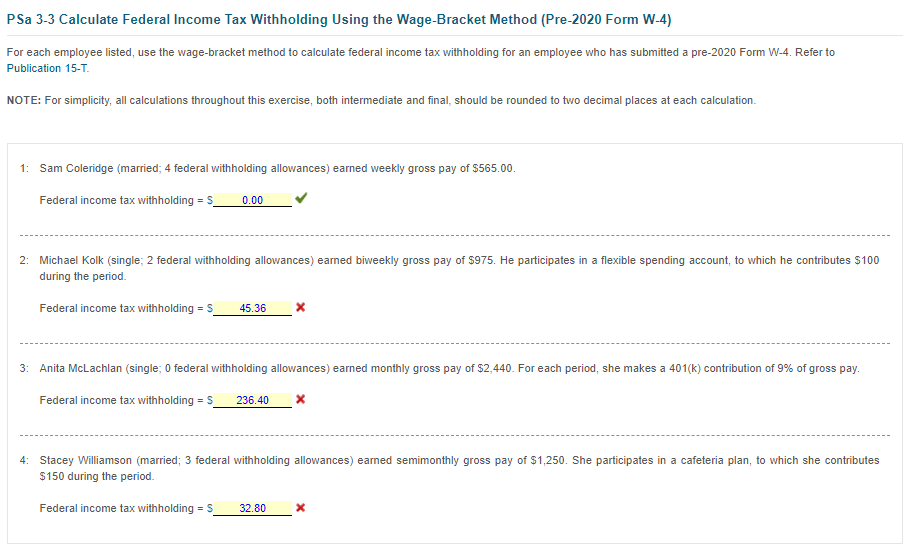

PSa 3-3 Calculate Federal Income Tax Withholding Using the Wage-Bracket Method (Pre-2020 Form W-4) For each employee listed, use the wage-bracket method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4. Refer to Publication 15-T. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Sam Coleridge (married; 4 federal withholding allowances) earned weekly gross pay of $565.00. Federal income tax withholding =$ 2: Michael Kolk (single; 2 federal withholding allowances) earned biweekly gross pay of $975. He participates in a flexible spending account, to which he contributes $100 during the period. Federal income tax withholding =$ 3: Anita McLachlan (single; 0 federal withholding allowances) earned monthly gross pay of $2,440. For each period, she makes a 401(k ) contribution of 9% of gross pay. Federal income tax withholding =x 4: Stacey Williamson (married; 3 federal withholding allowances) earned semimonthly gross pay of $1,250. She participates in a cafeteria plan, to which she contributes $150 during the period. Federal income tax withholding =$x PSa 3-3 Calculate Federal Income Tax Withholding Using the Wage-Bracket Method (Pre-2020 Form W-4) For each employee listed, use the wage-bracket method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4. Refer to Publication 15-T. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Sam Coleridge (married; 4 federal withholding allowances) earned weekly gross pay of $565.00. Federal income tax withholding =$ 2: Michael Kolk (single; 2 federal withholding allowances) earned biweekly gross pay of $975. He participates in a flexible spending account, to which he contributes $100 during the period. Federal income tax withholding =$ 3: Anita McLachlan (single; 0 federal withholding allowances) earned monthly gross pay of $2,440. For each period, she makes a 401(k ) contribution of 9% of gross pay. Federal income tax withholding =x 4: Stacey Williamson (married; 3 federal withholding allowances) earned semimonthly gross pay of $1,250. She participates in a cafeteria plan, to which she contributes $150 during the period. Federal income tax withholding =$x