Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PSa 6 - 6 Complete Form W - 2 Complete the W - 2 Form for the two employees of Flywheel Outfitters Inc. ( employer

PSa Complete Form W

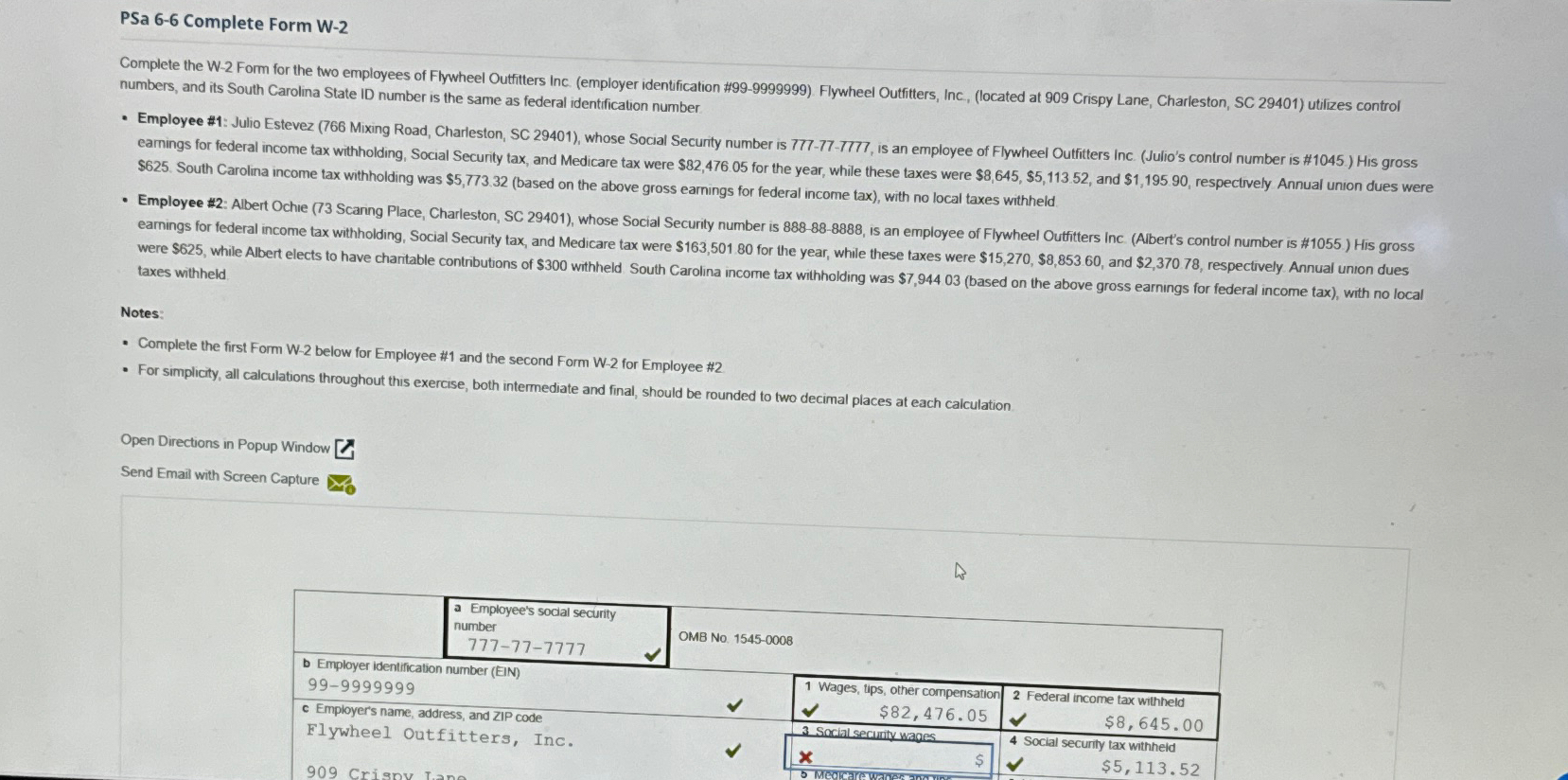

Complete the W Form for the two employees of Flywheel Outfitters Inc. employer identification # Flywheel Outfitters, Inc, located at Crispy Lane, Charleston, SC utilizes control numbers, and its South Carolina State ID number is the same as federal identfication number

Employee #: Julio Estevez Mixing Road, Charleston, SC whose Social Security number is is an employee of Flywheel Outfitters Inc. Julios control number is # His gross earnings for federal income tax withholding, Social Security tax, and Medicare tax were $ or for the year, while these taxes were $$ and $ respectively Annual union dues were $ South Carolina income tax withholding was $based on the above gross earnings for federal income tax with no local taxes withheld

Employee #: Albert Ochie Scaring Place, Charleston, SC whose Social Security number is is an employee of Flywheel Outfitters Inc. Aiberts control number is # His gross earnings for federal income tax withholding, Social Security tax, and Medicare tax were $ for the year, while these taxes were $$ and $ respectively Annual union dues were $ while Albert elects to have chantable contributions of $ withheld South Carolina income tax withholding was $based on the above gross earnings for federal income tax with no local taxes withheld

Notes:

Complete the first Form W below for Employee # and the second Form W for Employee #

For simplicity, all calculations throughout this exercise, both internediate and final, should be rounded to two decimal places at each calculation.

Open Directions in Popup Window

Send Email with Screen Capture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started