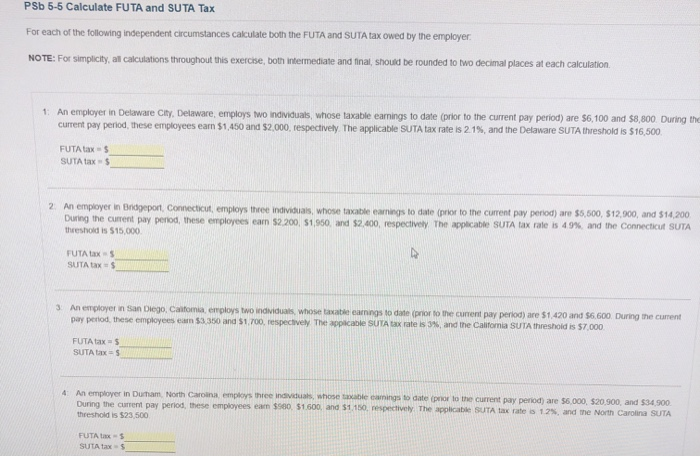

PSb 5-5 Calculate FUTA and SUTA Tax For each of the following independent circumstances calculate both the FUTA and SUTA tax owed by the employer NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation 1: An employer in Delaware City, Delaware, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $6,100 and $8,800. During the current pay period, these employees earn $1,450 and $2,000, respectively. The applicable SUTA tax rate is 2.1%, and the Delaware SUTA threshold is $16,500 FUTA as SUTA An employer in Bridgeport Connecticut, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $5,500, $12.900, and $14,200 During the current pay period, these employees earn 52.200, 51,950, and $2,400, respectively. The applicable SUTA tax rate is 49%, and the Connecticut SUTA threshold is $15,000 FUTA LAS SUTALES 3. An employer in San Diego, Caitomia, employs two individuals whose taxable earnings to date (prior to the current pay period) are $1.420 and $6.600. During the current pay period. These employees can $3 350 and 51.700, respectively. The applicable SUYA tax rates and the California SUTA threshold is $7,000 FUTA Lax-5 SUTA = 5 4 An employer in Durham, North Carolina, employs three individuals whose taxable amings to date prior to the current pay period) are 56,000, 520,900, and $34.900 During the current pay period, these employees eam $500 $1600, and $1.150. respectively. The applicable SUTA tax rates 12%, and the North Carolina SUTA threshold is $23.500 - $ FUTA SUTA PSb 5-5 Calculate FUTA and SUTA Tax For each of the following independent circumstances calculate both the FUTA and SUTA tax owed by the employer NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation 1: An employer in Delaware City, Delaware, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $6,100 and $8,800. During the current pay period, these employees earn $1,450 and $2,000, respectively. The applicable SUTA tax rate is 2.1%, and the Delaware SUTA threshold is $16,500 FUTA as SUTA An employer in Bridgeport Connecticut, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $5,500, $12.900, and $14,200 During the current pay period, these employees earn 52.200, 51,950, and $2,400, respectively. The applicable SUTA tax rate is 49%, and the Connecticut SUTA threshold is $15,000 FUTA LAS SUTALES 3. An employer in San Diego, Caitomia, employs two individuals whose taxable earnings to date (prior to the current pay period) are $1.420 and $6.600. During the current pay period. These employees can $3 350 and 51.700, respectively. The applicable SUYA tax rates and the California SUTA threshold is $7,000 FUTA Lax-5 SUTA = 5 4 An employer in Durham, North Carolina, employs three individuals whose taxable amings to date prior to the current pay period) are 56,000, 520,900, and $34.900 During the current pay period, these employees eam $500 $1600, and $1.150. respectively. The applicable SUTA tax rates 12%, and the North Carolina SUTA threshold is $23.500 - $ FUTA SUTA