Answered step by step

Verified Expert Solution

Question

1 Approved Answer

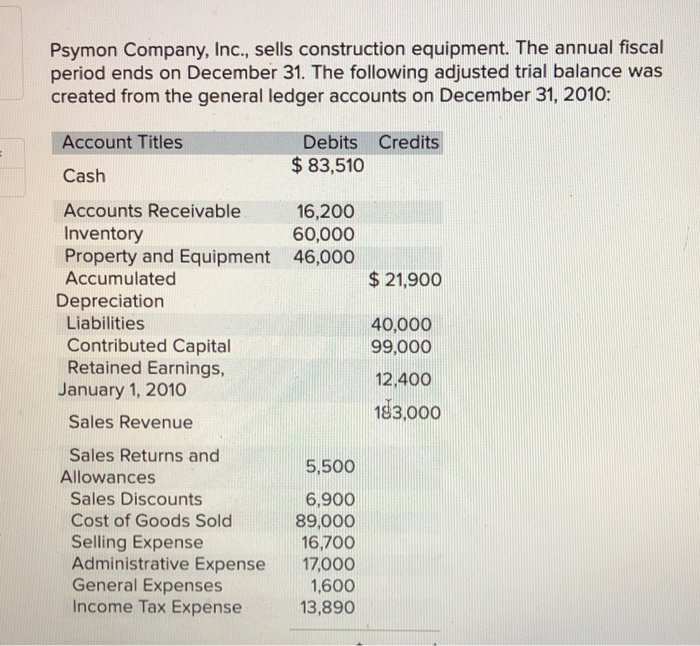

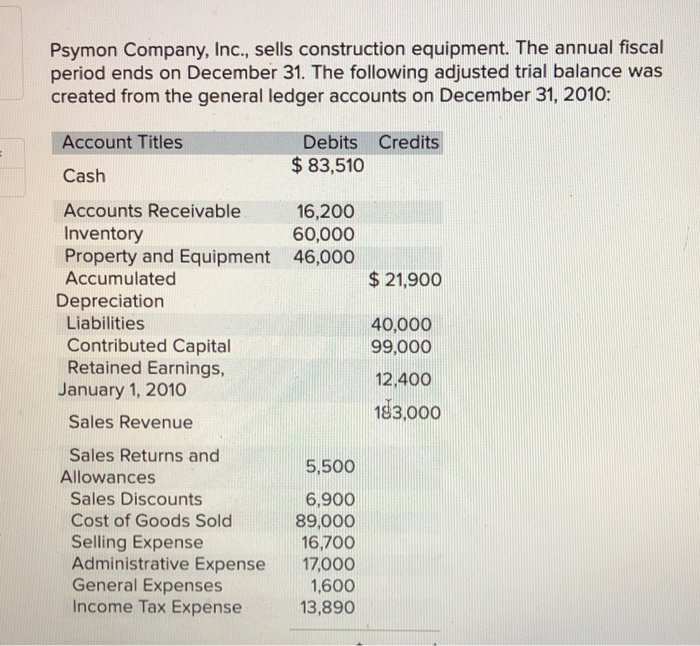

Psymon Company, Inc., sells construction equipment. The annual fiscal period ends on December 31. The following adjusted trial balance was created from the general ledger

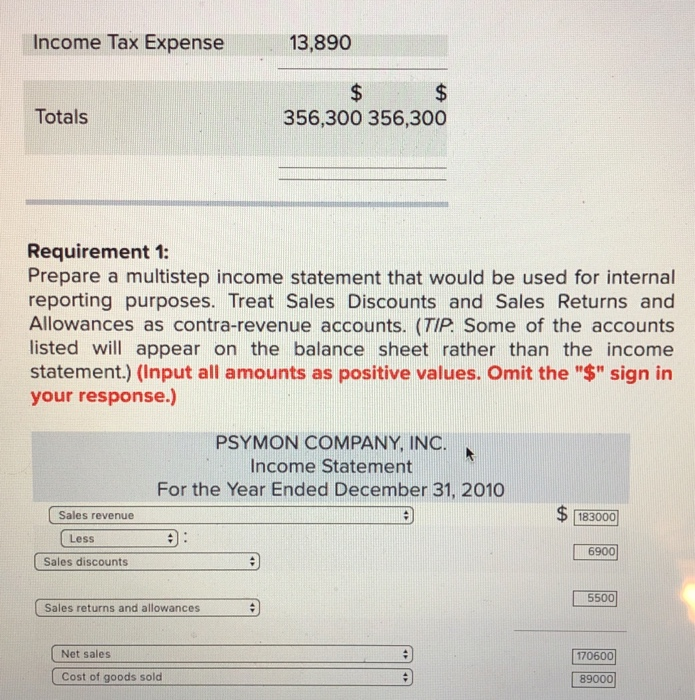

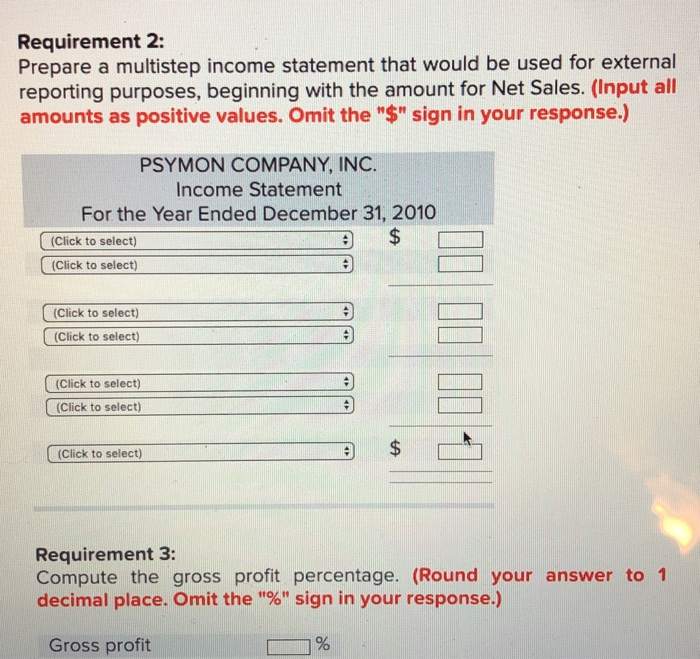

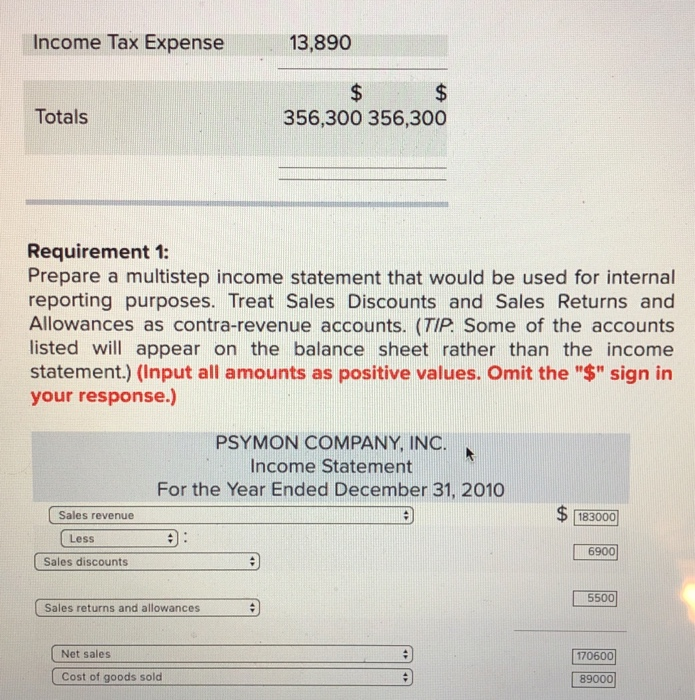

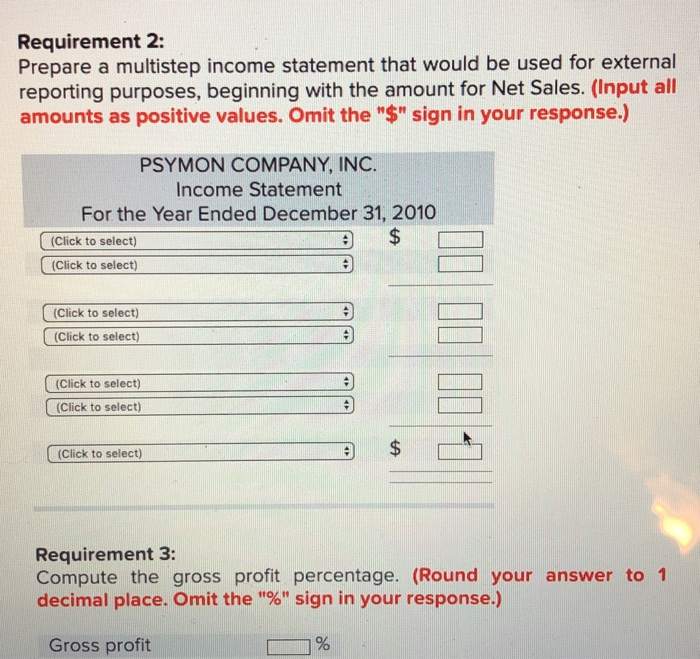

Psymon Company, Inc., sells construction equipment. The annual fiscal period ends on December 31. The following adjusted trial balance was created from the general ledger accounts on December 31, 2010: Debits Credits $83,510 Account Titles Cash Accounts Receivable Inventory Property and Equipment Accumulated 16,200 60,000 46,000 $21,900 Depreciation Liabilities Contributed Capital Retained Earnings, 40,000 99,000 12.400 183,000 January 1, 2010 Sales Revenue Sales Returns and 5,500 Allowances Sales Discounts Cost of Goods Sold Selling Expense Administrative Expense General Expenses Income Tax Expense 6,900 89,000 16,700 17,000 1,600 13,890 Income Tax Expense 13,890 Totals 356,300 356,300 Requirement 1: Prepare a multistep income statement that would be used for internal reporting purposes. Treat Sales Discounts and Sales Returns and Allowances as contra-revenue accounts. (TIP Some of the accounts listed will appear on the balance sheet rather than the income statement.) (Input all amounts as positive values. Omit the "$" sign in your response.) PSYMON COMPANY, INC. Income Statement For the Year Ended December 31, 2010 $183000 6900 5500 [17060 Sales revenue Less Sales discounts Sales returns and allowances Net sales Cost of goods sold 89000 Requirement 2: Prepare a multistep income statement that would be used for external reporting purposes, beginning with the amount for Net Sales. (Input all amounts as positive values. Omit the "$" sign in your response.) PSYMON COMPANY, INC. Income Statement For the Year Ended December 31, 2010 (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) Requirement 3: Compute the gross profit percentage. (Round your answer to1 decimal place. Omit the "%" sign in your response.) Gross profit

Psymon Company, Inc., sells construction equipment. The annual fiscal period ends on December 31. The following adjusted trial balance was created from the general ledger accounts on December 31, 2010: Debits Credits $83,510 Account Titles Cash Accounts Receivable Inventory Property and Equipment Accumulated 16,200 60,000 46,000 $21,900 Depreciation Liabilities Contributed Capital Retained Earnings, 40,000 99,000 12.400 183,000 January 1, 2010 Sales Revenue Sales Returns and 5,500 Allowances Sales Discounts Cost of Goods Sold Selling Expense Administrative Expense General Expenses Income Tax Expense 6,900 89,000 16,700 17,000 1,600 13,890 Income Tax Expense 13,890 Totals 356,300 356,300 Requirement 1: Prepare a multistep income statement that would be used for internal reporting purposes. Treat Sales Discounts and Sales Returns and Allowances as contra-revenue accounts. (TIP Some of the accounts listed will appear on the balance sheet rather than the income statement.) (Input all amounts as positive values. Omit the "$" sign in your response.) PSYMON COMPANY, INC. Income Statement For the Year Ended December 31, 2010 $183000 6900 5500 [17060 Sales revenue Less Sales discounts Sales returns and allowances Net sales Cost of goods sold 89000 Requirement 2: Prepare a multistep income statement that would be used for external reporting purposes, beginning with the amount for Net Sales. (Input all amounts as positive values. Omit the "$" sign in your response.) PSYMON COMPANY, INC. Income Statement For the Year Ended December 31, 2010 (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) Requirement 3: Compute the gross profit percentage. (Round your answer to1 decimal place. Omit the "%" sign in your response.) Gross profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started