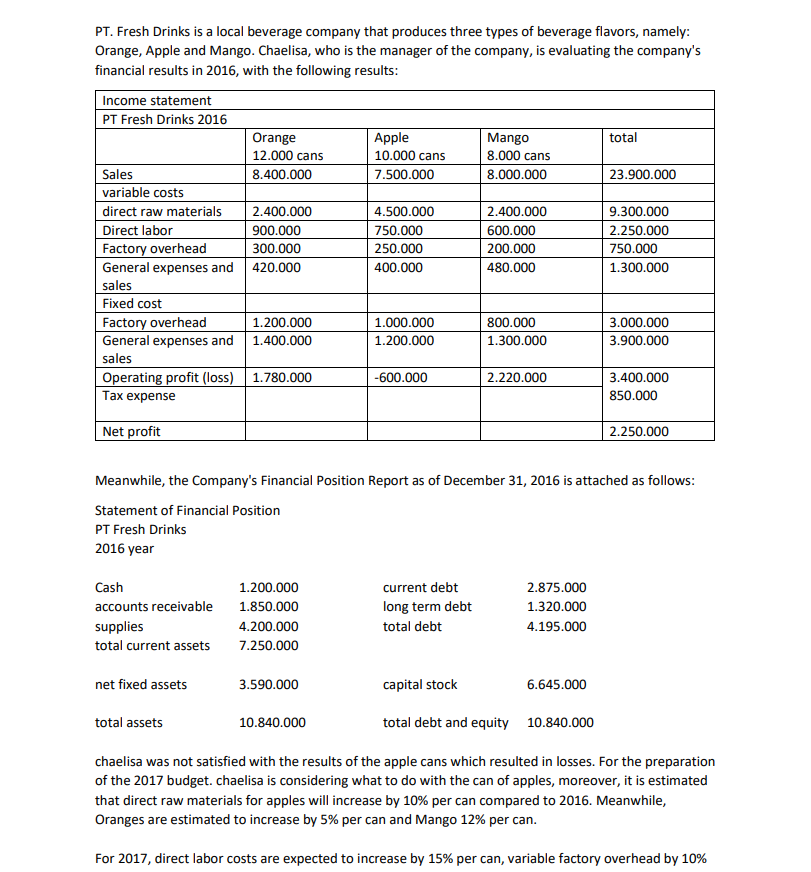

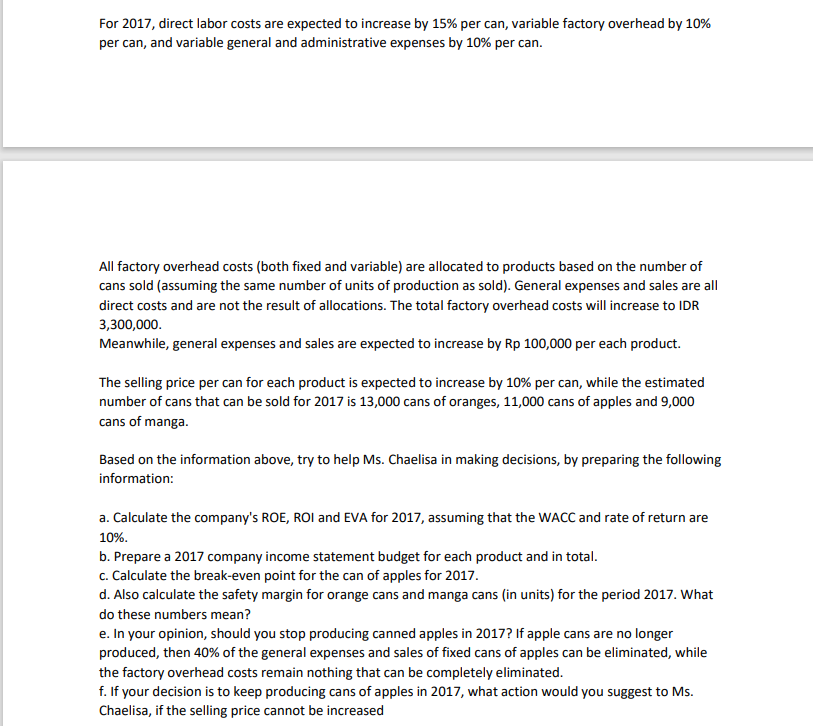

PT. Fresh Drinks is a local beverage company that produces three types of beverage flavors, namely: Orange, Apple and Mango. Chaelisa, who is the manager of the company, is evaluating the company's financial results in 2016, with the following results: Income statement PT Fresh Drinks 2016 total Orange 12.000 cans 8.400.000 Apple 10.000 cans 7.500.000 Mango 8.000 cans 8.000.000 23.900.000 2.400.000 900.000 300.000 420.000 4.500.000 750.000 250.000 400.000 2.400.000 600.000 200.000 480.000 9.300.000 2.250.000 750.000 1.300.000 Sales variable costs direct raw materials Direct labor Factory overhead General expenses and sales Fixed cost Factory overhead General expenses and sales Operating profit (loss) Tax expense 1.200.000 1.400.000 1.000.000 1.200.000 800.000 1.300.000 3.000.000 3.900.000 1.780.000 -600.000 2.220.000 3.400.000 850.000 Net profit 2.250.000 Meanwhile, the Company's Financial Position Report as of December 31, 2016 is attached as follows: Statement of Financial Position PT Fresh Drinks 2016 year Cash accounts receivable supplies total current assets 1.200.000 1.850.000 4.200.000 7.250.000 current debt long term debt total debt 2.875.000 1.320.000 4.195.000 net fixed assets 3.590.000 capital stock 6.645.000 total assets 10.840.000 total debt and equity 10.840.000 chaelisa was not satisfied with the results of the apple cans which resulted in losses. For the preparation of the 2017 budget. chaelisa is considering what to do with the can of apples, moreover, it is estimated that direct raw materials for apples will increase by 10% per can compared to 2016. Meanwhile, Oranges are estimated to increase by 5% per can and Mango 12% per can. For 2017, direct labor costs are expected to increase by 15% per can, variable factory overhead by 10% For 2017, direct labor costs are expected to increase by 15% per can, variable factory overhead by 10% per can, and variable general and administrative expenses by 10% per can. All factory overhead costs (both fixed and variable) are allocated to products based on the number of cans sold (assuming the same number of units of production as sold). General expenses and sales are all direct costs and are not the result of allocations. The total factory overhead costs will increase to IDR 3,300,000 Meanwhile, general expenses and sales are expected to increase by Rp 100,000 per each product. The selling price per can for each product is expected to increase by 10% per can, while the estimated number of cans that can be sold for 2017 is 13,000 cans of oranges, 11,000 cans of apples and 9,000 cans of manga. Based on the information above, try to help Ms. Chaelisa in making decisions, by preparing the following information: a. Calculate the company's ROE, ROI and EVA for 2017, assuming that the WACC and rate of return are 10%. b. Prepare a 2017 company income statement budget for each product and in total. c. Calculate the break-even point for the can of apples for 2017. d. Also calculate the safety margin for orange cans and manga cans (in units) for the period 2017. What do these numbers mean? e. In your opinion, should you stop producing canned apples in 2017? If apple cans are no longer produced, then 40% of the general expenses and sales of fixed cans of apples can be eliminated, while the factory overhead costs remain nothing that can be completely eliminated. f. If your decision is to keep producing cans of apples in 2017, what action would you suggest to Ms. Chaelisa, if the selling price cannot be increased