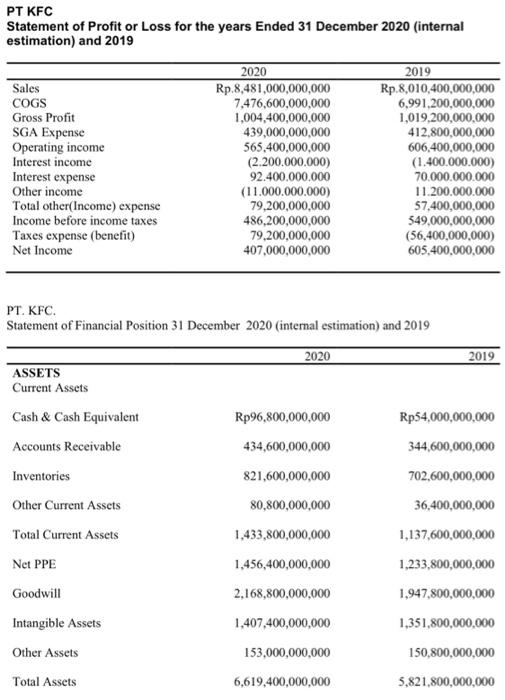

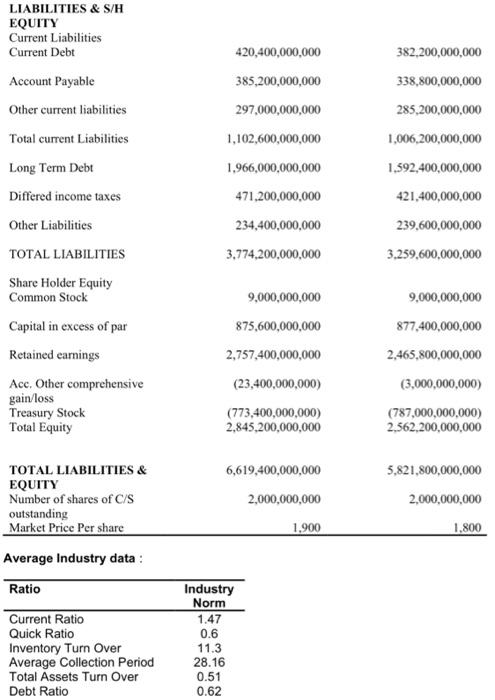

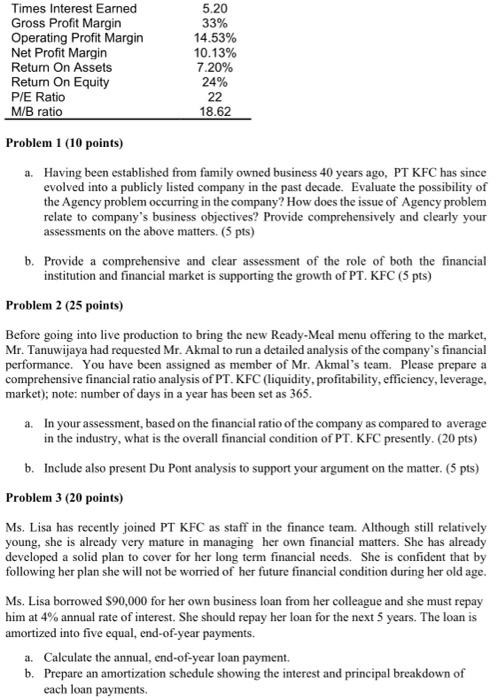

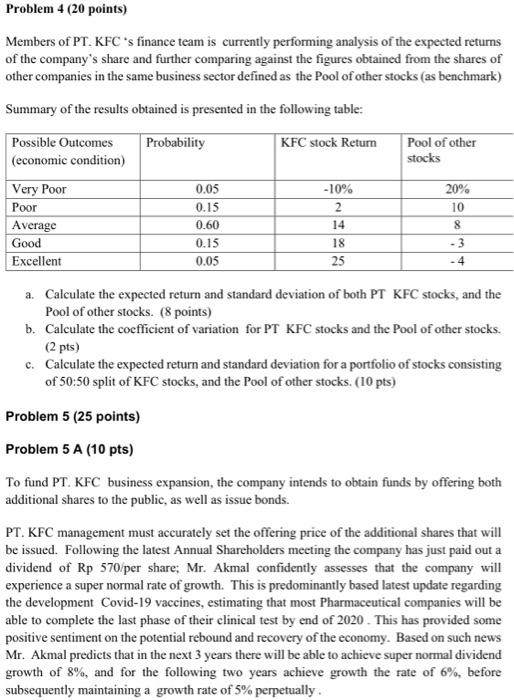

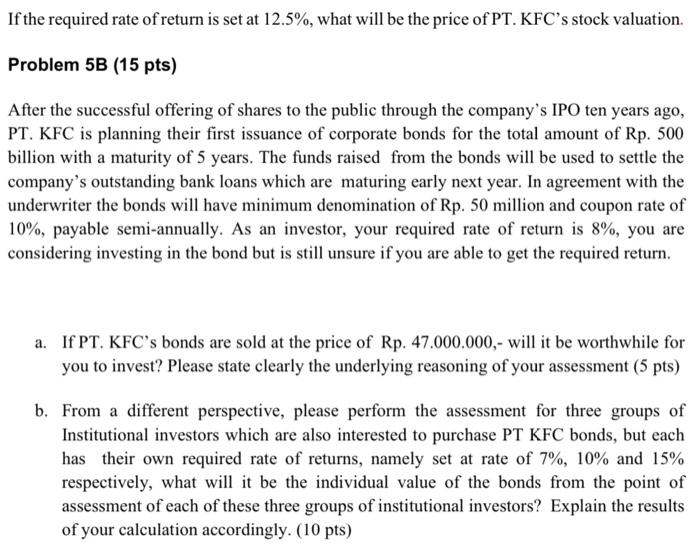

PT KFC Statement of Profit or Loss for the years Ended 31 December 2020 (internal estimation) and 2019 Sales COGS Gross Profit SGA Expense Operating income Interest income Interest expense Other income Total other(Income) expense Income before income taxes Taxes expense (benefit) Net Income 2020 Rp.8,481,000,000,000 7,476,600,000,000 1,004,400,000,000 439,000,000,000 565,400,000,000 (2.200.000.000) 92.400.000.000 (11.000.000.000) 79,200,000,000 486,200,000,000 79,200,000,000 407,000,000,000 2019 Rp.8,010,400,000,000 6,991,200,000,000 1,019,200,000,000 412,800,000,000 606,400,000,000 (1.400.000.000) 70.000.000.000 11.200.000.000 57,400,000,000 349,000,000,000 (56,400,000,000) 605,400,000,000 2019 PT. KFC. Statement of Financial Position 31 December 2020 (internal estimation) and 2019 2020 ASSETS Current Assets Cash & Cash Equivalent Rp96,800,000,000 Rp54,000,000,000 Accounts Receivable 434,600,000,000 344,600,000,000 Inventories 821,600,000,000 702,600,000,000 Other Current Assets 80,800,000,000 36,400,000,000 Total Current Assets 1,433,800,000,000 1,137,600,000,000 Net PPE 1,456,400,000,000 1,233,800,000,000 Goodwill 2,168,800,000,000 1,947,800,000,000 Intangible Assets 1,407,400,000,000 1,351,800,000,000 Other Assets 153,000,000,000 150,800,000,000 Total Assets 6,619,400,000,000 5,821,800,000,000 LIABILITIES & S/H EQUITY Current Liabilities Current Debt Account Payable Other current liabilities Total current Liabilities Long Term Debt Differed income taxes Other Liabilities TOTAL LIABILITIES Share Holder Equity Common Stock Capital in excess of par Retained earnings Ace. Other comprehensive gain/loss Treasury Stock Total Equity 420,400,000,000 385,200,000,000 297,000,000,000 1,102,600,000,000 1,966,000,000,000 471,200,000,000 234,400,000,000 3,774,200,000,000 382,200,000,000 338,800,000,000 285,200,000,000 1,006,200,000,000 1,592,400,000,000 421,400,000,000 239,600,000,000 3,259,600,000,000 9,000,000,000 875,600,000,000 2,757,400,000,000 (23,400,000,000) (773,400,000,000) 2,845,200,000,000 9,000,000,000 877,400,000,000 2,465,800,000,000 (3,000,000,000) (787,000,000,000) 2,562,200,000,000 TOTAL LIABILITIES & EQUITY Number of shares of C/S outstanding Market Price Per share Average Industry data: Ratio 6,619,400,000,000 2,000,000,000 1,900 5,821,800,000,000 2,000,000,000 1.800 Current Ratio Quick Ratio Inventory Turn Over Average Collection Period Total Assets Turn Over Debt Ratio Industry Norm 1.47 0.6 11.3 28.16 0.51 0.62 Times Interest Earned Gross Profit Margin Operating Profit Margin Net Profit Margin Return On Assets Return On Equity P/E Ratio M/B ratio 5.20 33% 14.53% 10.13% 7.20% 24% 22 18.62 Problem 1 (10 points) a. Having been established from family owned business 40 years ago, PT KFC has since evolved into a publicly listed company in the past decade. Evaluate the possibility of the Agency problem occurring in the company? How does the issue of Agency problem relate to company's business objectives? Provide comprehensively and clearly your assessments on the above matters. (5 pts) b. Provide a comprehensive and clear assessment of the role of both the financial institution and financial market is supporting the growth of PT. KFC (5 pts) Problem 2 (25 points) Before going into live production to bring the new Ready-Meal menu offering to the market, Mr. Tanuwijaya had requested Mr. Akmal to run a detailed analysis of the company's financial performance. You have been assigned as member of Mr. Akmal's team. Please prepare a comprehensive financial ratio analysis of PT. KFC (liquidity, profitability, efficiency, leverage, market); note: number of days in a year has been set as 365. a. In your assessment, based on the financial ratio of the company as compared to average in the industry, what is the overall financial condition of PT. KFC presently. (20 pts) b. Include also present Du Pont analysis to support your argument on the matter. (5 pts) Problem 3 (20 points) Ms. Lisa has recently joined PT KFC as staff in the finance team. Although still relatively young, she is already very mature in managing her own financial matters. She has already developed a solid plan to cover for her long term financial needs. She is confident that by following her plan she will not be worried of her future financial condition during her old age. Ms. Lisa borrowed $90,000 for her own business loan from her colleague and she must repay him at 4% annual rate of interest. She should repay her loan for the next 5 years. The loan is amortized into five equal, end-of-year payments. a. Calculate the annual, end-of-year loan payment. b. Prepare an amortization schedule showing the interest and principal breakdown of each loan payments. Problem 4 (20 points) Members of PT. KFC 's finance team is currently performing analysis of the expected returns of the company's share and further comparing against the figures obtained from the shares of other companies in the same business sector defined as the Pool of other stocks (as benchmark) Summary of the results obtained is presented in the following table: Probability KFC stock Return Pool of other stocks Possible Outcomes (economic condition) Very Poor Poor Average Good Excellent 0.05 0.15 0.60 0.15 0.05 -10% 2 14 18 25 20% 10 8 a. Calculate the expected return and standard deviation of both PT KFC stocks, and the Pool of other stocks. (8 points) b. Calculate the coefficient of variation for PT KFC stocks and the Pool of other stocks. (2 pts) c. Calculate the expected return and standard deviation for a portfolio of stocks consisting of 50:50 split of KFC stocks, and the Pool of other stocks. (10 pts) Problem 5 (25 points) Problem 5 A (10 pts) To fund PT. KFC business expansion, the company intends to obtain funds by offering both additional shares to the public, as well as issue bonds. PT. KFC management must accurately set the offering price of the additional shares that will be issued. Following the latest Annual Shareholders meeting the company has just paid out a dividend of Rp 570 per share; Mr. Akmal confidently assesses that the company will experience a super normal rate of growth. This is predominantly based latest update regarding the development Covid-19 vaccines, estimating that most Pharmaceutical companies will be able to complete the last phase of their clinical test by end of 2020. This has provided some positive sentiment on the potential rebound and recovery of the economy. Based on such news Mr. Akmal predicts that in the next 3 years there will be able to achieve super normal dividend growth of 8%, and for the following two years achieve growth the rate of 6%, before subsequently maintaining a growth rate of 5% perpetually. If the required rate of return is set at 12.5%, what will be the price of PT. KFC's stock valuation. Problem 5B (15 pts) After the successful offering of shares to the public through the company's IPO ten years ago, PT. KFC is planning their first issuance of corporate bonds for the total amount of Rp. 500 billion with a maturity of 5 years. The funds raised from the bonds will be used to settle the company's outstanding bank loans which are maturing early next year. In agreement with the underwriter the bonds will have minimum denomination of Rp. 50 million and coupon rate of 10%, payable semi-annually. As an investor, your required rate of return is 8%, you are considering investing in the bond but is still unsure if you are able to get the required return. a. If PT. KFC's bonds are sold at the price of Rp. 47.000.000,- will it be worthwhile for you to invest? Please state clearly the underlying reasoning of your assessment (5 pts) b. From a different perspective, please perform the assessment for three groups of Institutional investors which are also interested to purchase PT KFC bonds, but each has their own required rate of returns, namely set at rate of 7%, 10% and 15% respectively, what will it be the individual value of the bonds from the point of assessment of each of these three groups of institutional investors? Explain the results of your calculation accordingly. (10 pts) able to offer a variety of frozen chicken meat and processed chicken products such as Chicken Nuggets, Chicken Meatballs, Chicken Strips, Chicken Wings and Chicken Loaf. Presently PT. KFC owns 5 production plants strategically located around 4 of the largest cities in Indonesia. This is further supported by solid distributor and reseller network covering the entire span of Indonesia. PT. KFC management team is currently lead by Mr. Tanuwijaya. Besides serving as the CEO, being the third generation member of the Tanuwijaya family who founded the company he is also a major shareholder of the company. He is seen as a very capable leader and has been credited for the successful execution of highly complex and strategic initiatives of the company. Leading the company not only during the transition from second to third generation ownership, but also the further the transition from a private to a public company through IPO and indirectly as public company; increased transparency and credibility of PT. KFC management. The company intends to further seek further avenue of growth, by advancing downstream and to expand its product lines from frozen Ready-to-Cook into frozen Ready-to-Eat products. It has been a very dominant trend emerging from the Covid-19 pandemic, as a solution to serve the customers during the recent social restriction. Ms. Sharon, as Head of Business Development for PT. KFC is currently focusing the company's business strategy into the new market. Together with the members of the development team, they have completed a thorough analysis of the opportunities and constraints and formulated the business plan to produce and enter the market to serve Ready-Meal products. Mr. Tanuwijawa has requested Chief Financial Officer, Mr.Akmal to provide comprehensive analysis of PT.KFC financial condition. The information will be used to evaluate and assess the feasibility to advance with the proposed business expansion. In this regard, Mr. Akmal has directed his team to compile the necessary data on the company's finances. PT. KFC Financial Reports are further present below: PT KFC Statement of Profit or Loss for the years Ended 31 December 2020 (internal estimation) and 2019 Sales COGS Gross Profit SGA Expense Operating income Interest income Interest expense Other income Total other(Income) expense Income before income taxes Taxes expense (benefit) Net Income 2020 Rp.8,481,000,000,000 7,476,600,000,000 1,004,400,000,000 439,000,000,000 565,400,000,000 (2.200.000.000) 92.400.000.000 (11.000.000.000) 79,200,000,000 486,200,000,000 79,200,000,000 407,000,000,000 2019 Rp.8,010,400,000,000 6,991,200,000,000 1,019,200,000,000 412,800,000,000 606,400,000,000 (1.400.000.000) 70.000.000.000 11.200.000.000 57,400,000,000 349,000,000,000 (56,400,000,000) 605,400,000,000 2019 PT. KFC. Statement of Financial Position 31 December 2020 (internal estimation) and 2019 2020 ASSETS Current Assets Cash & Cash Equivalent Rp96,800,000,000 Rp54,000,000,000 Accounts Receivable 434,600,000,000 344,600,000,000 Inventories 821,600,000,000 702,600,000,000 Other Current Assets 80,800,000,000 36,400,000,000 Total Current Assets 1,433,800,000,000 1,137,600,000,000 Net PPE 1,456,400,000,000 1,233,800,000,000 Goodwill 2,168,800,000,000 1,947,800,000,000 Intangible Assets 1,407,400,000,000 1,351,800,000,000 Other Assets 153,000,000,000 150,800,000,000 Total Assets 6,619,400,000,000 5,821,800,000,000 LIABILITIES & S/H EQUITY Current Liabilities Current Debt Account Payable Other current liabilities Total current Liabilities Long Term Debt Differed income taxes Other Liabilities TOTAL LIABILITIES Share Holder Equity Common Stock Capital in excess of par Retained earnings Ace. Other comprehensive gain/loss Treasury Stock Total Equity 420,400,000,000 385,200,000,000 297,000,000,000 1,102,600,000,000 1,966,000,000,000 471,200,000,000 234,400,000,000 3,774,200,000,000 382,200,000,000 338,800,000,000 285,200,000,000 1,006,200,000,000 1,592,400,000,000 421,400,000,000 239,600,000,000 3,259,600,000,000 9,000,000,000 875,600,000,000 2,757,400,000,000 (23,400,000,000) (773,400,000,000) 2,845,200,000,000 9,000,000,000 877,400,000,000 2,465,800,000,000 (3,000,000,000) (787,000,000,000) 2,562,200,000,000 TOTAL LIABILITIES & EQUITY Number of shares of C/S outstanding Market Price Per share Average Industry data: Ratio 6,619,400,000,000 2,000,000,000 1,900 5,821,800,000,000 2,000,000,000 1.800 Current Ratio Quick Ratio Inventory Turn Over Average Collection Period Total Assets Turn Over Debt Ratio Industry Norm 1.47 0.6 11.3 28.16 0.51 0.62 Times Interest Earned Gross Profit Margin Operating Profit Margin Net Profit Margin Return On Assets Return On Equity P/E Ratio M/B ratio 5.20 33% 14.53% 10.13% 7.20% 24% 22 18.62 Problem 1 (10 points) a. Having been established from family owned business 40 years ago, PT KFC has since evolved into a publicly listed company in the past decade. Evaluate the possibility of the Agency problem occurring in the company? How does the issue of Agency problem relate to company's business objectives? Provide comprehensively and clearly your assessments on the above matters. (5 pts) b. Provide a comprehensive and clear assessment of the role of both the financial institution and financial market is supporting the growth of PT. KFC (5 pts) Problem 2 (25 points) Before going into live production to bring the new Ready-Meal menu offering to the market, Mr. Tanuwijaya had requested Mr. Akmal to run a detailed analysis of the company's financial performance. You have been assigned as member of Mr. Akmal's team. Please prepare a comprehensive financial ratio analysis of PT. KFC (liquidity, profitability, efficiency, leverage, market); note: number of days in a year has been set as 365. a. In your assessment, based on the financial ratio of the company as compared to average in the industry, what is the overall financial condition of PT. KFC presently. (20 pts) b. Include also present Du Pont analysis to support your argument on the matter. (5 pts) Problem 3 (20 points) Ms. Lisa has recently joined PT KFC as staff in the finance team. Although still relatively young, she is already very mature in managing her own financial matters. She has already developed a solid plan to cover for her long term financial needs. She is confident that by following her plan she will not be worried of her future financial condition during her old age. Ms. Lisa borrowed $90,000 for her own business loan from her colleague and she must repay him at 4% annual rate of interest. She should repay her loan for the next 5 years. The loan is amortized into five equal, end-of-year payments. a. Calculate the annual, end-of-year loan payment. b. Prepare an amortization schedule showing the interest and principal breakdown of each loan payments. Problem 4 (20 points) Members of PT. KFC 's finance team is currently performing analysis of the expected returns of the company's share and further comparing against the figures obtained from the shares of other companies in the same business sector defined as the Pool of other stocks (as benchmark) Summary of the results obtained is presented in the following table: Probability KFC stock Return Pool of other stocks Possible Outcomes (economic condition) Very Poor Poor Average Good Excellent 0.05 0.15 0.60 0.15 0.05 -10% 2 14 18 25 20% 10 8 a. Calculate the expected return and standard deviation of both PT KFC stocks, and the Pool of other stocks. (8 points) b. Calculate the coefficient of variation for PT KFC stocks and the Pool of other stocks. (2 pts) c. Calculate the expected return and standard deviation for a portfolio of stocks consisting of 50:50 split of KFC stocks, and the Pool of other stocks. (10 pts) Problem 5 (25 points) Problem 5 A (10 pts) To fund PT. KFC business expansion, the company intends to obtain funds by offering both additional shares to the public, as well as issue bonds. PT. KFC management must accurately set the offering price of the additional shares that will be issued. Following the latest Annual Shareholders meeting the company has just paid out a dividend of Rp 570 per share; Mr. Akmal confidently assesses that the company will experience a super normal rate of growth. This is predominantly based latest update regarding the development Covid-19 vaccines, estimating that most Pharmaceutical companies will be able to complete the last phase of their clinical test by end of 2020. This has provided some positive sentiment on the potential rebound and recovery of the economy. Based on such news Mr. Akmal predicts that in the next 3 years there will be able to achieve super normal dividend growth of 8%, and for the following two years achieve growth the rate of 6%, before subsequently maintaining a growth rate of 5% perpetually. If the required rate of return is set at 12.5%, what will be the price of PT. KFC's stock valuation. Problem 5B (15 pts) After the successful offering of shares to the public through the company's IPO ten years ago, PT. KFC is planning their first issuance of corporate bonds for the total amount of Rp. 500 billion with a maturity of 5 years. The funds raised from the bonds will be used to settle the company's outstanding bank loans which are maturing early next year. In agreement with the underwriter the bonds will have minimum denomination of Rp. 50 million and coupon rate of 10%, payable semi-annually. As an investor, your required rate of return is 8%, you are considering investing in the bond but is still unsure if you are able to get the required return. a. If PT. KFC's bonds are sold at the price of Rp. 47.000.000,- will it be worthwhile for you to invest? Please state clearly the underlying reasoning of your assessment (5 pts) b. From a different perspective, please perform the assessment for three groups of Institutional investors which are also interested to purchase PT KFC bonds, but each has their own required rate of returns, namely set at rate of 7%, 10% and 15% respectively, what will it be the individual value of the bonds from the point of assessment of each of these three groups of institutional investors? Explain the results of your calculation accordingly. (10 pts) able to offer a variety of frozen chicken meat and processed chicken products such as Chicken Nuggets, Chicken Meatballs, Chicken Strips, Chicken Wings and Chicken Loaf. Presently PT. KFC owns 5 production plants strategically located around 4 of the largest cities in Indonesia. This is further supported by solid distributor and reseller network covering the entire span of Indonesia. PT. KFC management team is currently lead by Mr. Tanuwijaya. Besides serving as the CEO, being the third generation member of the Tanuwijaya family who founded the company he is also a major shareholder of the company. He is seen as a very capable leader and has been credited for the successful execution of highly complex and strategic initiatives of the company. Leading the company not only during the transition from second to third generation ownership, but also the further the transition from a private to a public company through IPO and indirectly as public company; increased transparency and credibility of PT. KFC management. The company intends to further seek further avenue of growth, by advancing downstream and to expand its product lines from frozen Ready-to-Cook into frozen Ready-to-Eat products. It has been a very dominant trend emerging from the Covid-19 pandemic, as a solution to serve the customers during the recent social restriction. Ms. Sharon, as Head of Business Development for PT. KFC is currently focusing the company's business strategy into the new market. Together with the members of the development team, they have completed a thorough analysis of the opportunities and constraints and formulated the business plan to produce and enter the market to serve Ready-Meal products. Mr. Tanuwijawa has requested Chief Financial Officer, Mr.Akmal to provide comprehensive analysis of PT.KFC financial condition. The information will be used to evaluate and assess the feasibility to advance with the proposed business expansion. In this regard, Mr. Akmal has directed his team to compile the necessary data on the company's finances. PT. KFC Financial Reports are further present below