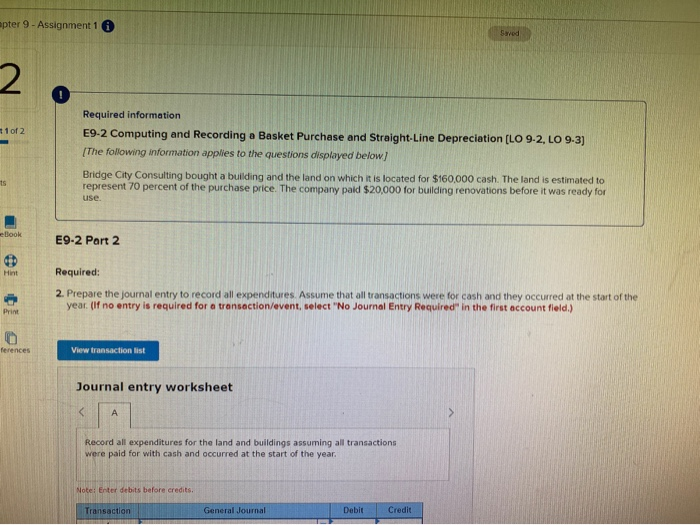

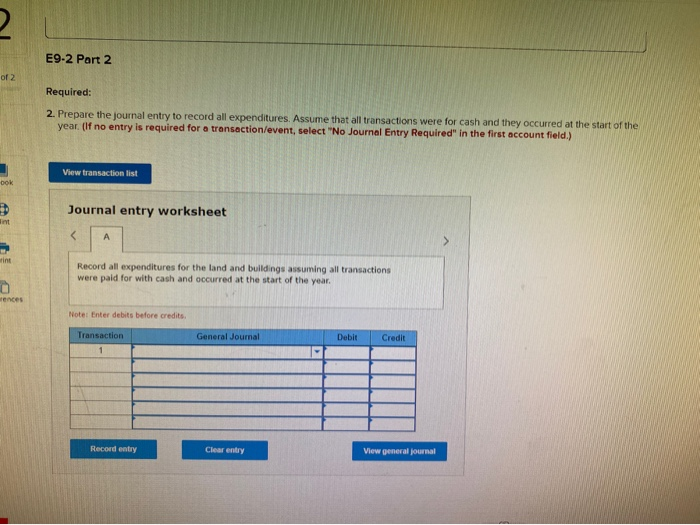

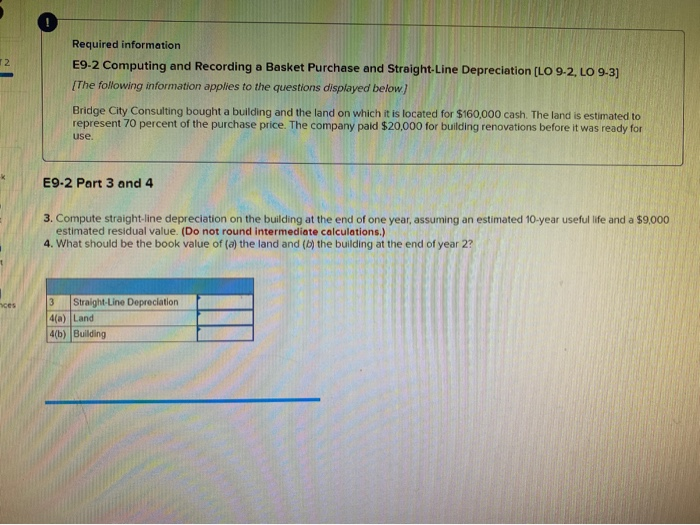

pter 9 - Assignment 16 1 of 2 Required information E9-2 Computing and Recording a Basket Purchase and Straight Line Depreciation (LO 9-2, LO 9-3) [The following information applies to the questions displayed below) Bridge City Consulting bought a building and the land on which it is located for $160,000 cash. The land is estimated to represent 70 percent of the purchase price. The company paid $20,000 for building renovations before it was ready for use E9-2 Part 2 Required: 2. Prepare the journal entry to record all expenditures. Assume that all transactions were for cash and they occurred at the start of the year (if no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet Record all expenditures for the land and buildings assuming all transactions were paid for with cash and occurred at the start of the year. Note: Enter debits before credits Transaction General Journal Debit Credit E9-2 Part 2 Required: 2. Prepare the journal entry to record all expenditures. Assume that all transactions were for cash and they occurred at the start of the year. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet Record all expenditures for the land and buildings assuming all transactions were paid for with cash and occurred at the start of the year. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal Required information E9-2 Computing and Recording a Basket Purchase and Straight-Line Depreciation (LO 9-2, LO 9-3] [The following information applies to the questions displayed below) Bridge City Consulting bought a building and the land on which it is located for $160,000 cash. The land is estimated to represent 70 percent of the purchase price. The company paid $20,000 for building renovations before it was ready for use. E9-2 Part 3 and 4 3. Compute straight-line depreciation on the building at the end of one year, assuming an estimated 10-year useful life and a $9,000 estimated residual value. (Do not round intermediate calculations.) 4. What should be the book value of (a) the land and the building at the end of year 2? Straight-Line Depreciation 4(a) Land 4 b) Building