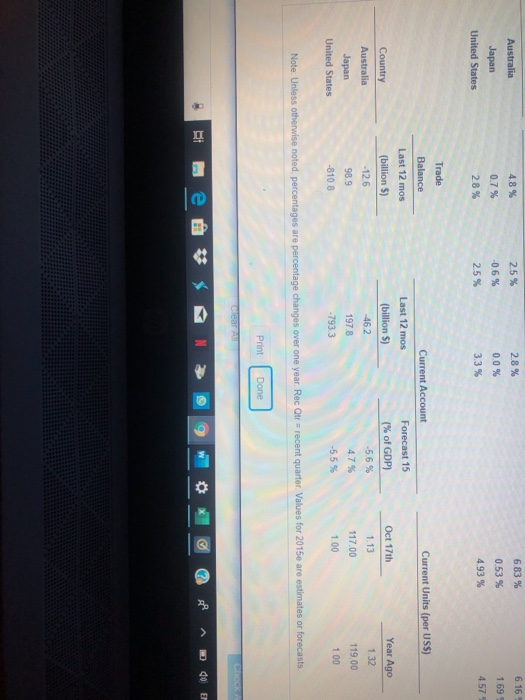

PTODIEn TO (ugommmmhe International Fischer Forecasts. Use the table E containing economic, fnancial, and business indicators to answer the following questions Assuming Intemational Fischer-one version of Purchasing Power Parity-applies to the coming year, forecast the folowing fature spot exchange rates using the government bond rates for the respective country cumencles a. Japanese yenUS dollar in one year b. Japanese yenAustralian dollar in one year c. Austraian dollanU S dolar in one year Assuming Intornational Flscher-one version of Purchasing Power Paty applies to the coming year, forecast the following futare spot exchange rates using the govemment bond rates for the respective country curmrencles a. Japanese yenUS. dollar in one year The Suhure spot exchange rabe Sor Japanese yentUS dollar in one year is Round to teo decinal places) Enter your answer n the answer box and then click Check Answer 2 pats remaining Cear A Check Ansr 1002 PM O Type here to search D de ENG 10/13/2019 44 5 Australia 4.8 % 2.5 % 2.8% 6.83 % 6.16 Japan 0.7% -06 % 0.0 % 0.53 % 1.69 United States 2.8% 2.5% 3.3% 4.93 % 4.57% Trade Balance Current Account Current Units (per USS) Last 12 mos Last 12 mos Forecast 15 Country (billion S) (billion S) (% of GDP) Oct 17th Year Ago Australia 12.6 46.2 -56 % 1.13 1.32 4.7% 117.00 119.00 Japan 98.9 197.8 United States -810 8 -793.3 -5.5 % 1.00 1.00 Note: Unless otherwise noted. percentages are percentage changes over one year. Rec Qtr recent quarter. Values for 2015e are estimates or forecasts Print Done Clear All CicCk EN PTODIEn TO (ugommmmhe International Fischer Forecasts. Use the table E containing economic, fnancial, and business indicators to answer the following questions Assuming Intemational Fischer-one version of Purchasing Power Parity-applies to the coming year, forecast the folowing fature spot exchange rates using the government bond rates for the respective country cumencles a. Japanese yenUS dollar in one year b. Japanese yenAustralian dollar in one year c. Austraian dollanU S dolar in one year Assuming Intornational Flscher-one version of Purchasing Power Paty applies to the coming year, forecast the following futare spot exchange rates using the govemment bond rates for the respective country curmrencles a. Japanese yenUS. dollar in one year The Suhure spot exchange rabe Sor Japanese yentUS dollar in one year is Round to teo decinal places) Enter your answer n the answer box and then click Check Answer 2 pats remaining Cear A Check Ansr 1002 PM O Type here to search D de ENG 10/13/2019 44 5 Australia 4.8 % 2.5 % 2.8% 6.83 % 6.16 Japan 0.7% -06 % 0.0 % 0.53 % 1.69 United States 2.8% 2.5% 3.3% 4.93 % 4.57% Trade Balance Current Account Current Units (per USS) Last 12 mos Last 12 mos Forecast 15 Country (billion S) (billion S) (% of GDP) Oct 17th Year Ago Australia 12.6 46.2 -56 % 1.13 1.32 4.7% 117.00 119.00 Japan 98.9 197.8 United States -810 8 -793.3 -5.5 % 1.00 1.00 Note: Unless otherwise noted. percentages are percentage changes over one year. Rec Qtr recent quarter. Values for 2015e are estimates or forecasts Print Done Clear All CicCk EN