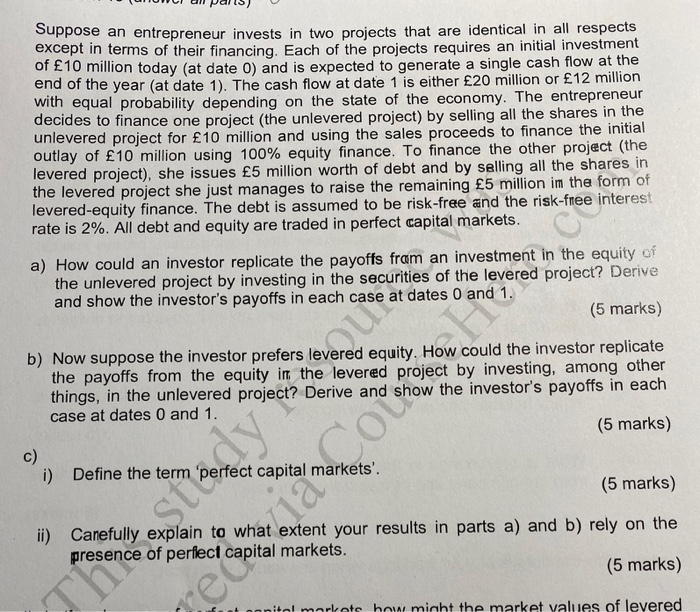

PU ) Suppose an entrepreneur invests in two projects that are identical in all respects except in terms of their financing. Each of the projects requires an initial investment of 10 million today (at date 0) and is expected to generate a single cash flow at the end of the year (at date 1). The cash flow at date 1 is either 20 million or 12 million with equal probability depending on the state of the economy. The entrepreneur decides to finance one project (the unlevered project) by selling all the shares in the unlevered project for 10 million and using the sales proceeds to finance the initial outlay of 10 million using 100% equity finance. To finance the other project (the levered project), she issues 5 million worth of debt and by selling all the shares in the levered project she just manages to raise the remaining 5 million in the form of levered-equity finance. The debt is assumed to be risk-free and the risk-free interest rate is 2%. All debt and equity are traded in perfect capital markets. a) How could an investor replicate the payoffs fram an investment in the equity of the unlevered project by investing in the securities of the levered project? Derive and show the investor's payoffs in each case at dates 0 and 1. (5 marks) b) Now suppose the investor prefers levered equity. How could the investor replicate the payoffs from the equity in the levered project by investing, among other things, in the unlevered project? Derive and show the investor's payoffs in each case at dates 0 and 1. (5 marks) c) i) Define the term 'perfect capital markets'. (5 marks) ii) Carefully explain to what extent your results in parts a) and b) rely on the presence of perfect capital markets. (5 marks) antal merlate how micht the market value of lavere PU ) Suppose an entrepreneur invests in two projects that are identical in all respects except in terms of their financing. Each of the projects requires an initial investment of 10 million today (at date 0) and is expected to generate a single cash flow at the end of the year (at date 1). The cash flow at date 1 is either 20 million or 12 million with equal probability depending on the state of the economy. The entrepreneur decides to finance one project (the unlevered project) by selling all the shares in the unlevered project for 10 million and using the sales proceeds to finance the initial outlay of 10 million using 100% equity finance. To finance the other project (the levered project), she issues 5 million worth of debt and by selling all the shares in the levered project she just manages to raise the remaining 5 million in the form of levered-equity finance. The debt is assumed to be risk-free and the risk-free interest rate is 2%. All debt and equity are traded in perfect capital markets. a) How could an investor replicate the payoffs fram an investment in the equity of the unlevered project by investing in the securities of the levered project? Derive and show the investor's payoffs in each case at dates 0 and 1. (5 marks) b) Now suppose the investor prefers levered equity. How could the investor replicate the payoffs from the equity in the levered project by investing, among other things, in the unlevered project? Derive and show the investor's payoffs in each case at dates 0 and 1. (5 marks) c) i) Define the term 'perfect capital markets'. (5 marks) ii) Carefully explain to what extent your results in parts a) and b) rely on the presence of perfect capital markets. (5 marks) antal merlate how micht the market value of lavere