Answered step by step

Verified Expert Solution

Question

1 Approved Answer

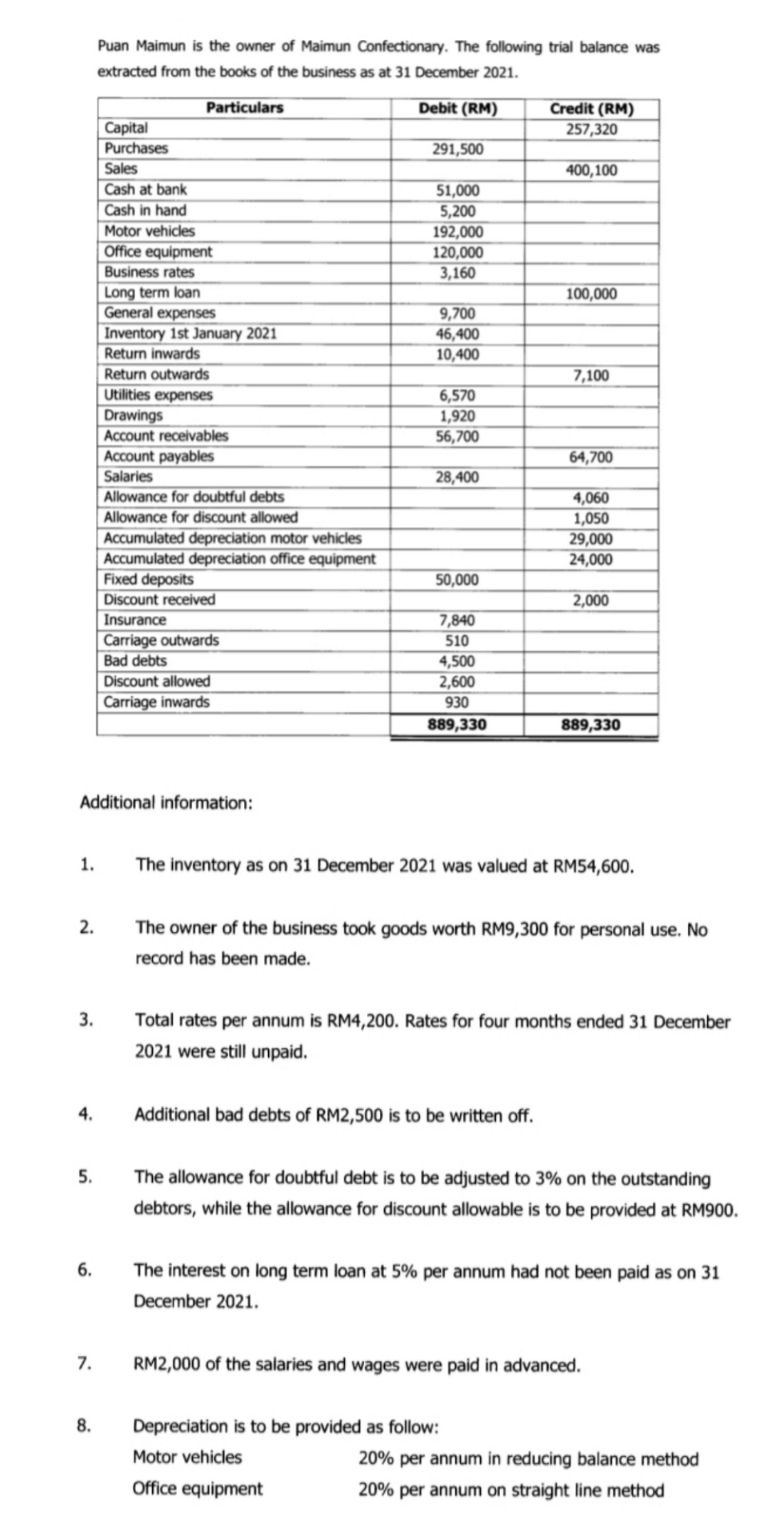

Puan Maimun is the owner of Maimun Confectionary. The following trial balance was extracted from the books of the business as at 31 December

Puan Maimun is the owner of Maimun Confectionary. The following trial balance was extracted from the books of the business as at 31 December 2021. Particulars Capital Purchases Sales Debit (RM) Credit (RM) 257,320 291,500 400,100 Cash at bank Cash in hand Motor vehicles Office equipment Business rates 51,000 5,200 192,000 120,000 3,160 Long term loan 100,000 General expenses 9,700 Inventory 1st January 2021 46,400 Return inwards 10,400 Return outwards 7,100 Utilities expenses 6,570 Drawings 1,920 Account receivables 56,700 Account payables 64,700 Salaries 28,400 Allowance for doubtful debts 4,060 Allowance for discount allowed 1,050 Accumulated depreciation motor vehicles 29,000 Accumulated depreciation office equipment 24,000 Fixed deposits 50,000 Discount received 2,000 Insurance 7,840 Carriage outwards 510 Bad debts 4,500 Discount allowed 2,600 Carriage inwards 930 889,330 889,330 Additional information: 1. The inventory as on 31 December 2021 was valued at RM54,600. 2. 3. The owner of the business took goods worth RM9,300 for personal use. No record has been made. Total rates per annum is RM4,200. Rates for four months ended 31 December 2021 were still unpaid. 4. Additional bad debts of RM2,500 is to be written off. 5. 6. 7. The allowance for doubtful debt is to be adjusted to 3% on the outstanding debtors, while the allowance for discount allowable is to be provided at RM900. The interest on long term loan at 5% per annum had not been paid as on 31 December 2021. RM2,000 of the salaries and wages were paid in advanced. Depreciation is to be provided as follow: 8. Motor vehicles Office equipment 20% per annum in reducing balance method 20% per annum on straight line method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started