Publishing Company, Inc. (P) is a publicly traded C corporation engaged in the publication of professional textbooks. P has 5 million shares of voting

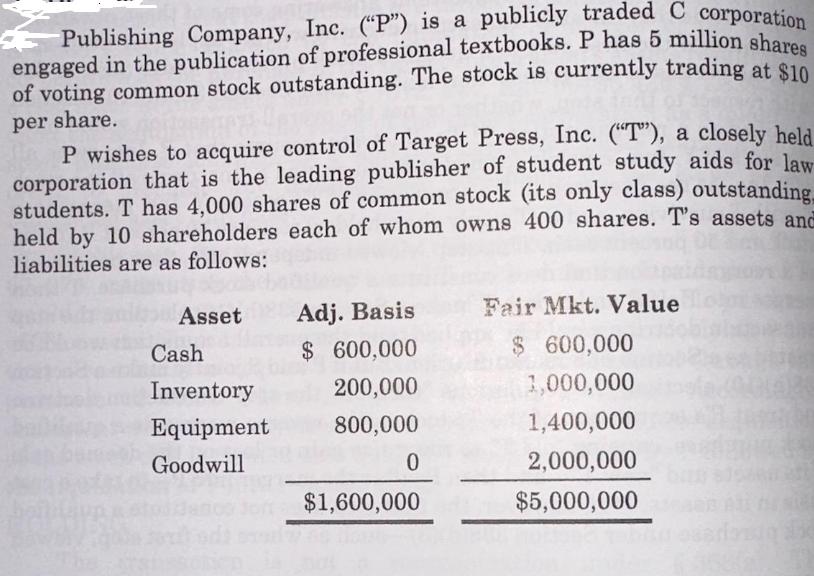

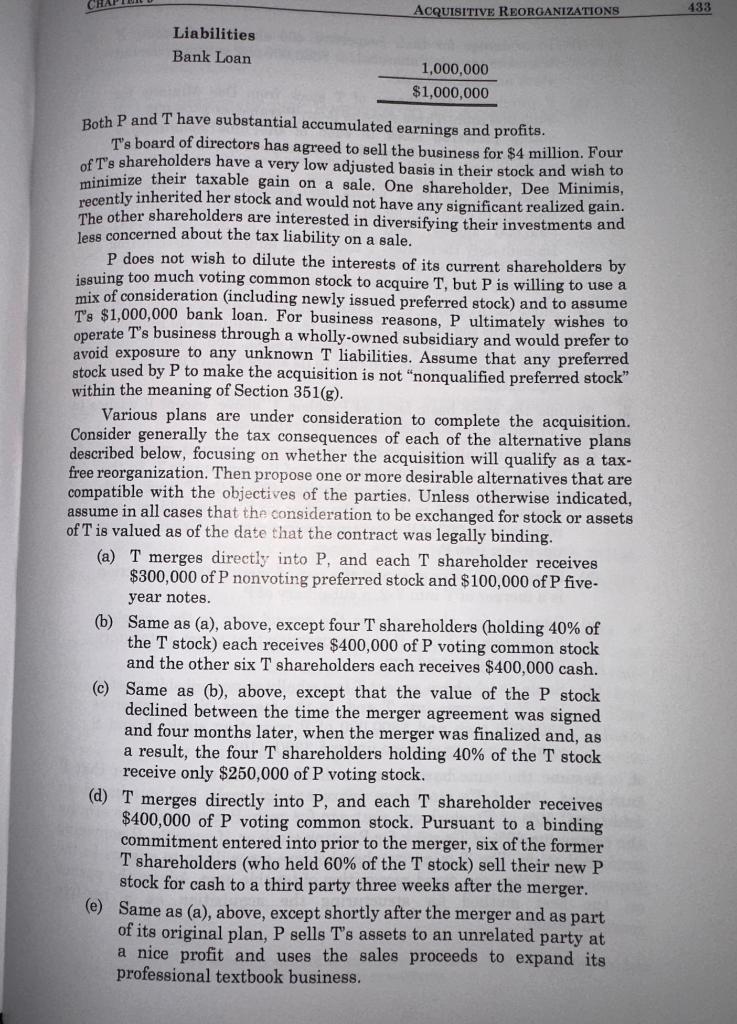

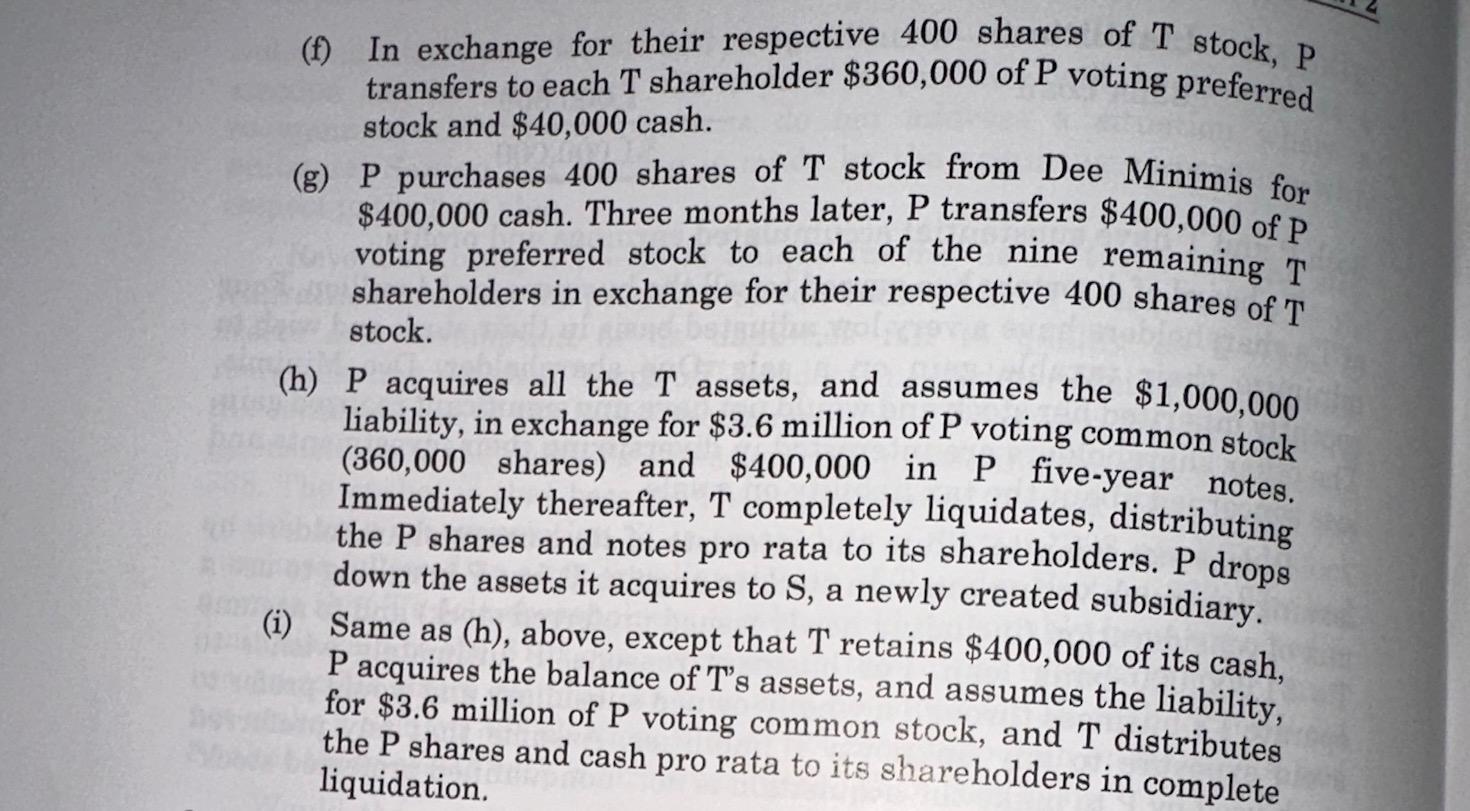

Publishing Company, Inc. ("P") is a publicly traded C corporation engaged in the publication of professional textbooks. P has 5 million shares of voting common stock outstanding. The stock is currently trading at $10 per share. P wishes to acquire control of Target Press, Inc. ("T"), a closely held corporation that is the leading publisher of student study aids for law students. T has 4,000 shares of common stock (its only class) outstanding held by 10 shareholders each of whom owns 400 shares. T's assets and liabilities are as follows: Asset Cash Inventory Equipment Goodwill Adj. Basis $ 600,000 200,000 800,000 0 $1,600,000 Fair Mkt. Value $ 600,000 1,000,000 1,400,000 2,000,000 $5,000,000 The S

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Tax Consequences The merger will not qualify as a taxfree reorganization under Section 368a1A because P is not using its voting stock to acquire Ts stock Moreover because P is issuing prefe...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started