Answered step by step

Verified Expert Solution

Question

1 Approved Answer

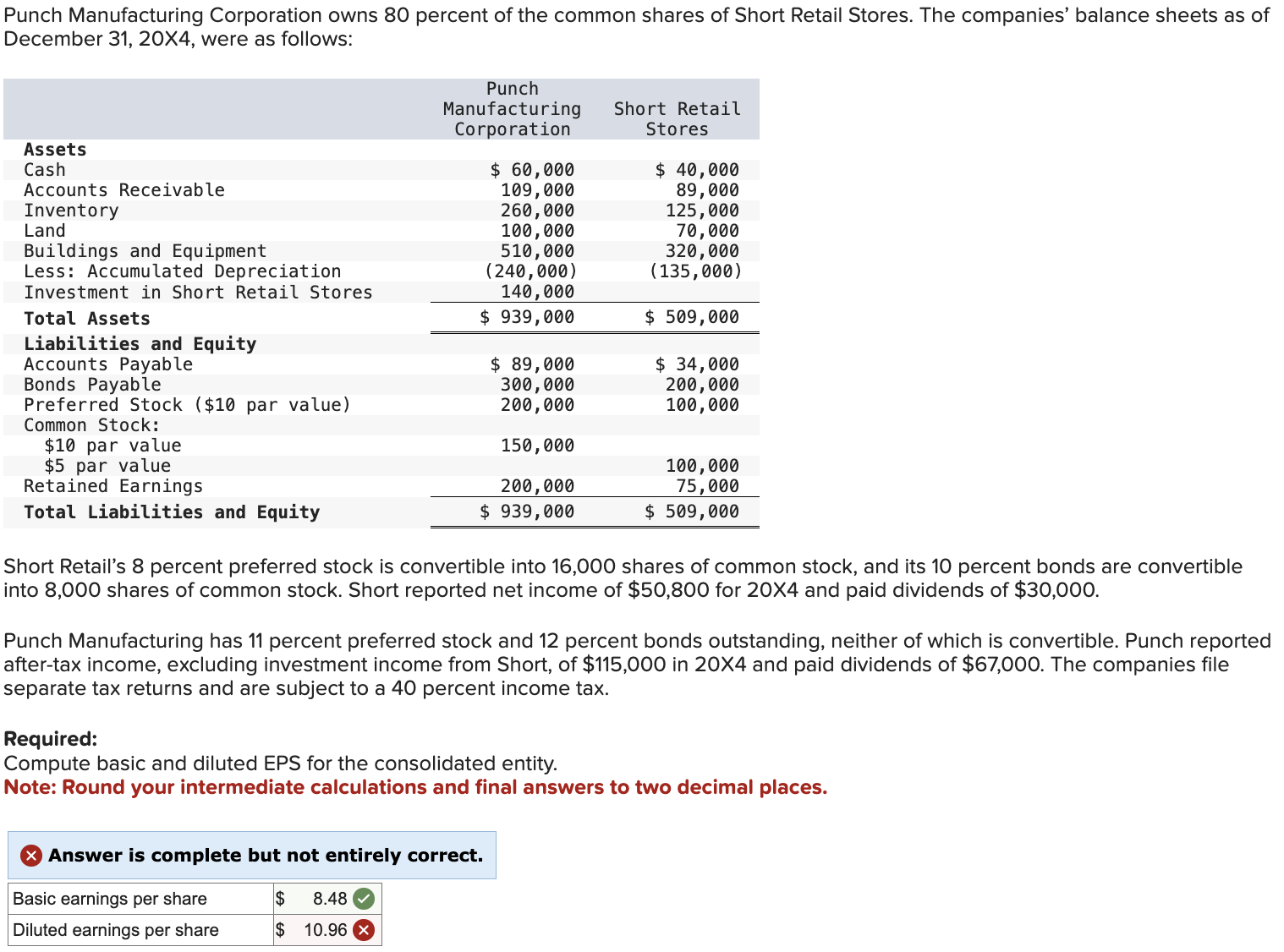

Punch Manufacturing Corporation owns 8 0 percent of the common shares of Short Retail Stores. The companies' balance sheets as of December 3 1 ,

Punch Manufacturing Corporation owns percent of the common shares of Short Retail Stores. The companies' balance sheets as of

December X were as follows:

Short Retail's percent preferred stock is convertible into shares of common stock, and its percent bonds are convertible

into shares of common stock. Short reported net income of $ for and paid dividends of $

Punch Manufacturing has percent preferred stock and percent bonds outstanding, neither of which is convertible. Punch reported

aftertax income, excluding investment income from Short, of $ in and paid dividends of $ The companies file

separate tax returns and are subject to a percent income tax.

Required:

Compute basic and diluted EPS for the consolidated entity.

Note: Round your intermediate calculations and final answers to two decimal places.

Answer is complete but not entirely correct.Short Retails percent preferred stock is convertible into shares of common stock, and its percent bonds are convertible into shares of common stock. Short reported net income of $ for X and paid dividends of $ Punch Manufacturing has percent preferred stock and percent bonds outstanding, neither of which is convertible. Punch reported aftertax income, excluding investment income from Short, of $ in X and paid dividends of $ The companies file separate tax returns and are subject to a percent income tax. Required: Compute basic earnings per share Round your intermediate calculations and final answers to two decimal places. Compute diluted earning per share Round your intermediate calculations and final answers to two decimal places.

Can you please show stepbystep solution for Diluted earnings per share? Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started