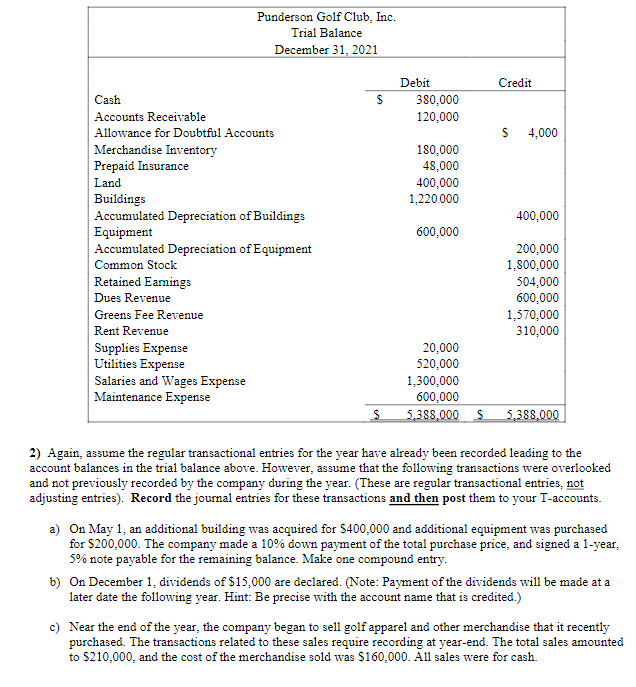

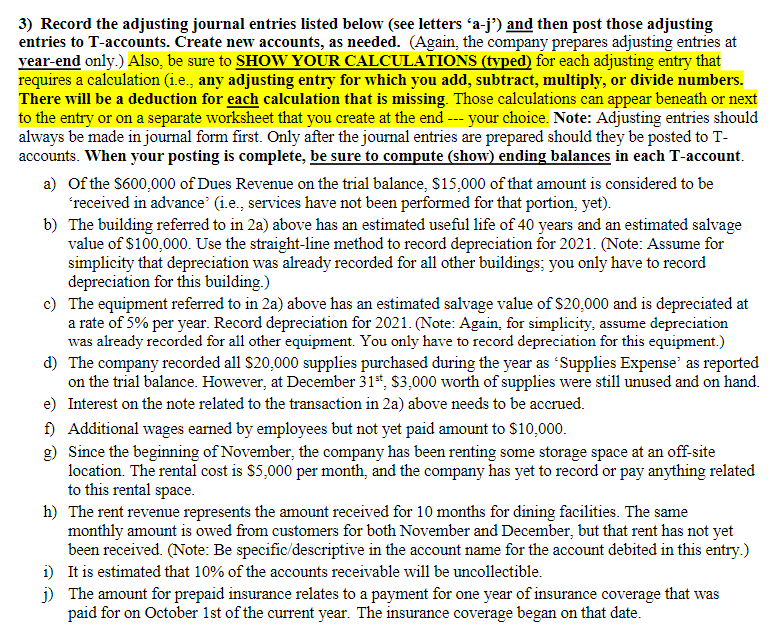

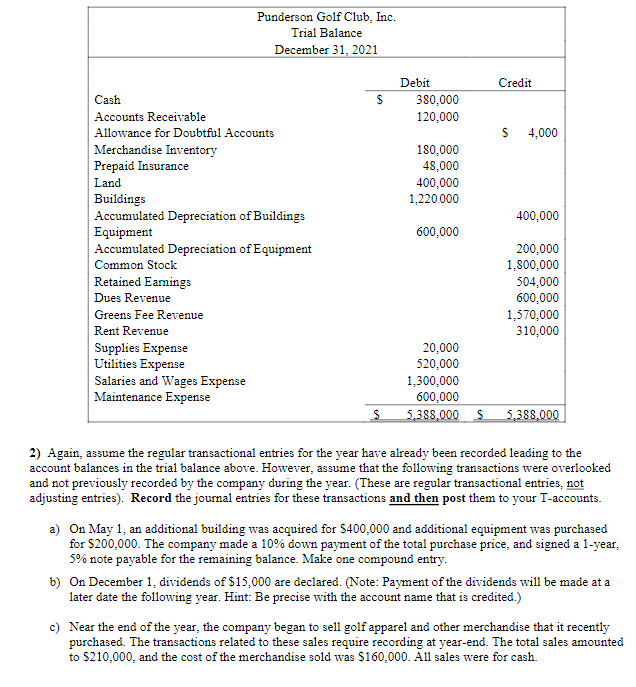

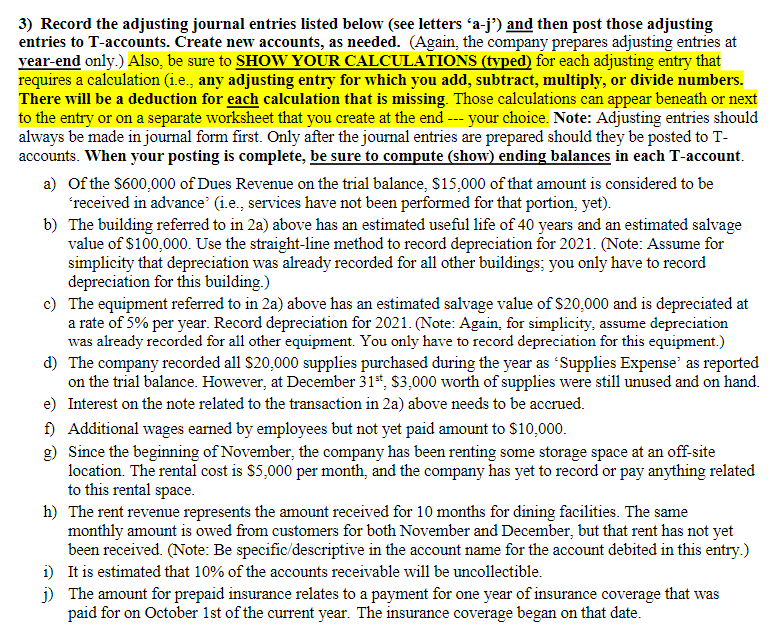

Punderson Golf Club, Inc. Trial Balance December 31, 2021 Credit $ Debit 380,000 120,000 $ 4.000 180,000 48,000 400,000 1,220.000 400,000 600,000 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Prepaid Insurance Land Buildings Accumulated Depreciation of Buildings Equipment Accumulated Depreciation of Equipment Common Stock Retained Earnings Dues Revenue Greens Fee Revenue Rent Revenue Supplies Expense Utilities Expense Salaries and Wages Expense Maintenance Expense 200,000 1,800,000 504.000 600.000 1,570,000 310,000 20,000 520,000 1,300,000 600,000 5,388,000 $5,388,000 $ 2) Again, assume the regular transactional entries for the year have already been recorded leading to the account balances in the trial balance above. However, assume that the following transactions were overlooked and not previously recorded by the company during the year. (These are regular transactional entries, not adjusting entries). Record the journal entries for these transactions and then post them to your T-accounts. a) On May 1, an additional building was acquired for $400,000 and additional equipment was purchased for $200,000. The company made a 10% down payment of the total purchase price, and signed a 1-year, 5% note payable for the remaining balance. Make one compound entry. b) On December 1. dividends of $15,000 are declared. (Note: Payment of the dividends will be made at a later date the following year. Hint: Be precise with the account name that is credited.) c) Near the end of the year, the company began to sell golf apparel and other merchandise that it recently purchased. The transactions related to these sales require recording at year-end. The total sales amounted to $210,000, and the cost of the merchandise sold was $160,000. All sales were for cash. 3) Record the adjusting journal entries listed below (see letters a-j) and then post those adjusting entries to T-accounts. Create new accounts, as needed. (Again, the company prepares adjusting entries at year-end only.) Also, be sure to SHOW YOUR CALCULATIONS (typed) for each adjusting entry that requires a calculation (1.e., any adjusting entry for which you add, subtract, multiply, or divide numbers. There will be a deduction for each calculation that is missing. Those calculations can appear beneath or next to the entry or on a separate worksheet that you create at the end --- your choice. Note: Adjusting entries should always be made in journal form first. Only after the journal entries are prepared should they be posted to T- accounts. When your posting is complete, be sure to compute (show) ending balances in each T-account. a) Of the $600,000 of Dues Revenue on the trial balance, $15,000 of that amount is considered to be received in advance' (1.e., services have not been performed for that portion, yet). b) The building referred to in 2a) above has an estimated useful life of 40 years and an estimated salvage value of $100,000. Use the straight-line method to record depreciation for 2021. (Note: Assume for simplicity that depreciation was already recorded for all other buildings, you only have to record depreciation for this building.) c) The equipment referred to in 2a) above has an estimated salvage value of $20,000 and is depreciated at a rate of 5% per year. Record depreciation for 2021. (Note: Again, for simplicity, assume depreciation was already recorded for all other equipment. You only have to record depreciation for this equipment.) d) The company recorded all $20.000 supplies purchased during the year as 'Supplies Expense as reported on the trial balance. However, at December 31", $3,000 worth of supplies were still unused and on hand. e) Interest on the note related to the transaction in 2a) above needs to be accrued. f) Additional wages earned by employees but not yet paid amount to $10,000. g) Since the beginning of November, the company has been renting some storage space at an off-site location. The rental cost is $5,000 per month, and the company has yet to record or pay anything related to this rental space. h) The rent revenue represents the amount received for 10 months for dining facilities. The same monthly amount is owed from customers for both November and December, but that rent has not yet been received. (Note: Be specific/descriptive in the account name for the account debited in this entry) i) It is estimated that 10% of the accounts receivable will be uncollectible. j) The amount for prepaid insurance relates to a payment for one year of insurance coverage that was paid for on October 1st of the current year. The insurance coverage began on that date