Purchase the less expensive package, sell short the more expensive package, pocket the difference, positions cancel out down the road. Suppose Vu> VL Eu

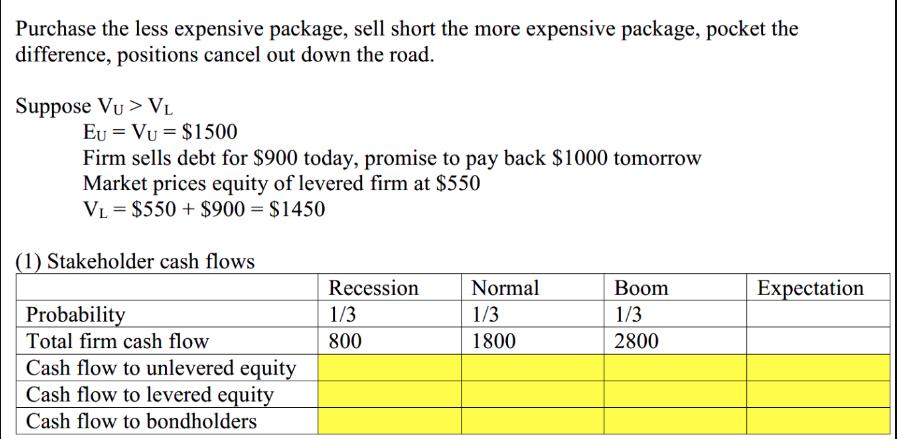

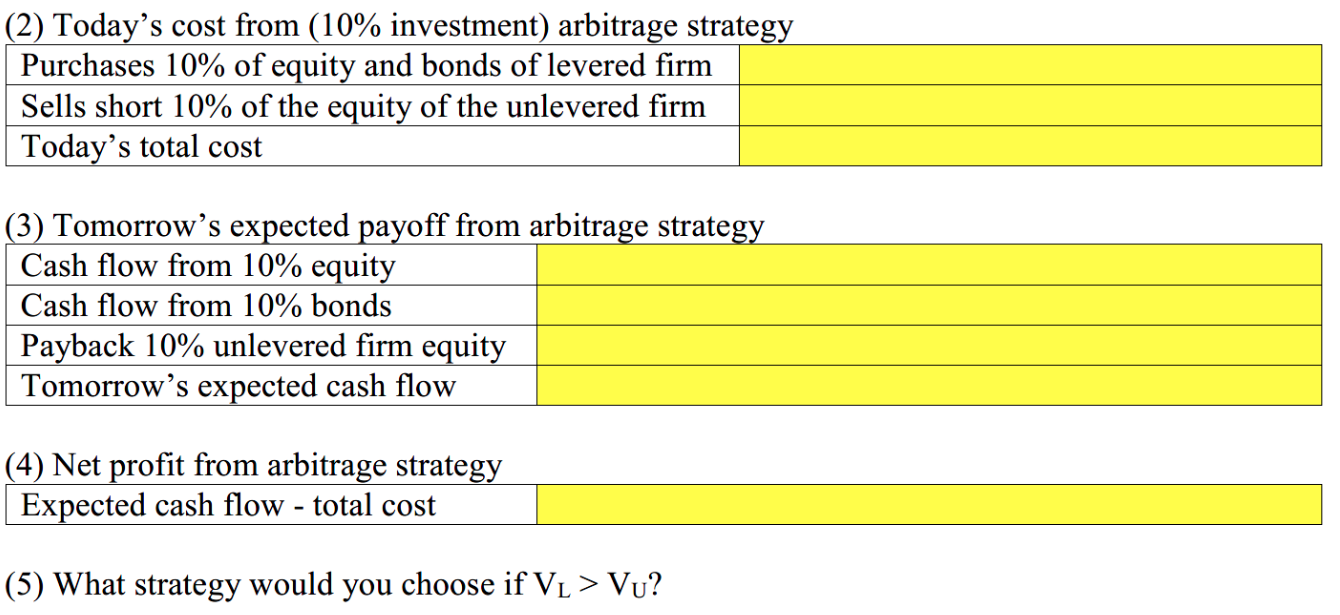

Purchase the less expensive package, sell short the more expensive package, pocket the difference, positions cancel out down the road. Suppose Vu> VL Eu Vu $1500 Firm sells debt for $900 today, promise to pay back $1000 tomorrow Market prices equity of levered firm at $550 V = $550 +$900 = $1450 (1) Stakeholder cash flows Probability Total firm cash flow Cash flow to unlevered equity Cash flow to levered equity Cash flow to bondholders Recession Normal Boom Expectation 1/3 1/3 1/3 800 1800 2800 (2) Today's cost from (10% investment) arbitrage strategy Purchases 10% of equity and bonds of levered firm Sells short 10% of the equity of the unlevered firm Today's total cost (3) Tomorrow's expected payoff from arbitrage strategy Cash flow from 10% equity Cash flow from 10% bonds Payback 10% unlevered firm equity Tomorrow's expected cash flow (4) Net profit from arbitrage strategy Expected cash flow - total cost (5) What strategy would you choose if VL > VU?

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

If VL Value of Levered Firm is greater than Vu Value of Unlevered Firm the strategy to choose would be to purchase the less expensive package unlevere...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started