Answered step by step

Verified Expert Solution

Question

1 Approved Answer

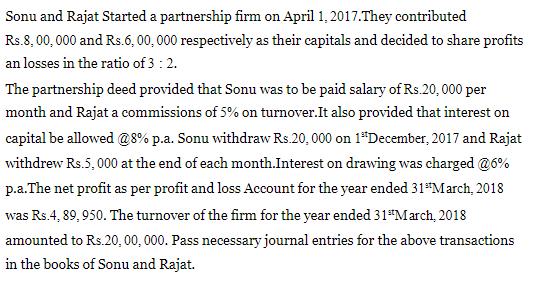

Sonu and Rajat Started a partnership firm on April 1, 2017. They contributed Rs.8,00,000 and Rs.6, 00, 000 respectively as their capitals and decided

Sonu and Rajat Started a partnership firm on April 1, 2017. They contributed Rs.8,00,000 and Rs.6, 00, 000 respectively as their capitals and decided to share profits an losses in the ratio of 3: 2. The partnership deed provided that Sonu was to be paid salary of Rs.20, 000 per month and Rajat a commissions of 5% on turnover. It also provided that interest on capital be allowed @8% p.a. Sonu withdraw Rs.20, 000 on 1 December, 2017 and Rajat withdrew Rs.5,000 at the end of each month.Interest on drawing was charged @ 6% p.a.The net profit as per profit and loss Account for the year ended 31 March, 2018 was Rs.4, 89,950. The turnover of the firm for the year ended 31 March, 2018 amounted to Rs.20,00, 000. Pass necessary journal entries for the above transactions in the books of Sonu and Rajat.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Date 2018 Mar31 Mar31 Mar31 Mar31 Mar31 Journal of Sonu and Rajat Parti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started