Answered step by step

Verified Expert Solution

Question

1 Approved Answer

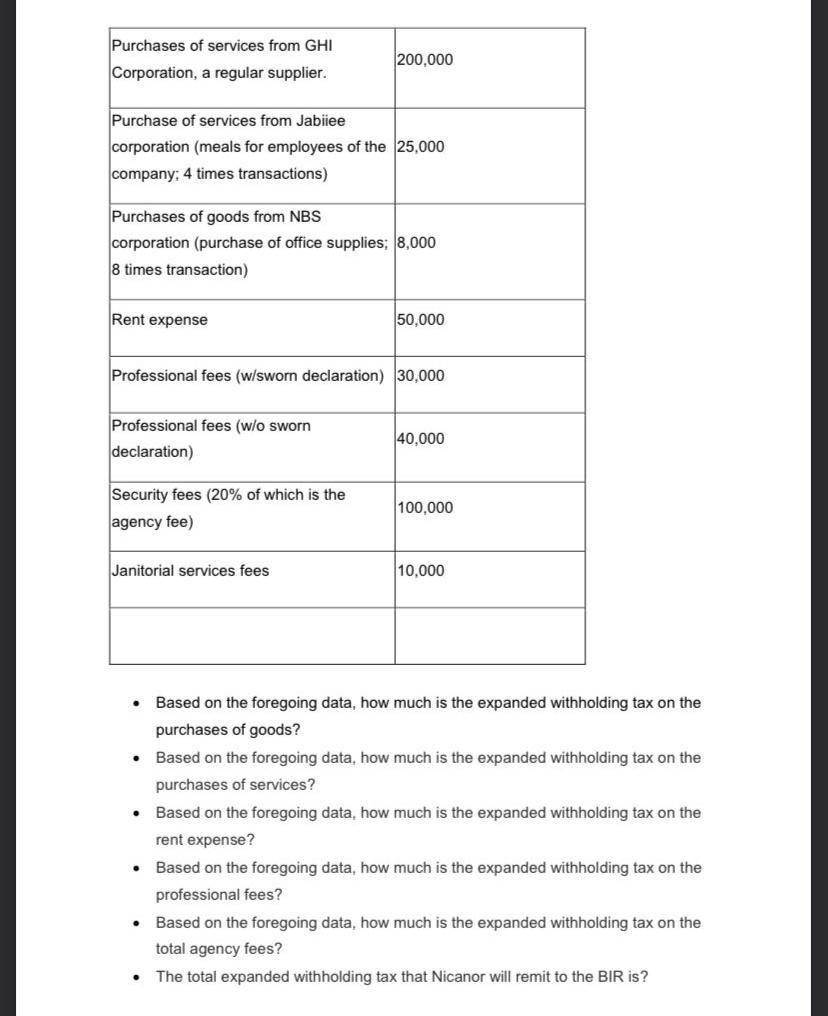

Purchases of services from GHI 200,000 Corporation, a regular supplier. Purchase of services from Jabiee corporation (meals for employees of the 25,000 company: 4

Purchases of services from GHI 200,000 Corporation, a regular supplier. Purchase of services from Jabiee corporation (meals for employees of the 25,000 company: 4 times transactions) Purchases of goods from NBSS corporation (purchase of office supplies; 8,000 8 times transaction) Rent expense 50,000 Professional fees (w/sworn declaration) 30,000 Professional fees (w/o sworn 40,000 declaration) Security fees (20% of which is the 100,000 agency fee) Janitorial services fees 10,000 Based on the foregoing data, how much is the expanded withholding tax on the purchases of goods? Based on the foregoing data, how much is the expanded withholding tax on the purchases of services? Based on the foregoing data, how much is the expanded withholding tax on the rent expense? Based on the foregoing data, how much is the expanded withholding tax on the professional fees? Based on the foregoing data, how much is the expanded withholding tax on the total agency fees? The total expanded withholding tax that Nicanor will remit to the BIR is?

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

tax on Ihe rent expenson tax on the purchales 7 800 000 IS the exp om ded cuith hol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started