Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pure Beginnings Limited is a company with a 31 December year-end. On submitting the 2021 income tax assessment, the accountant calculated the com- pany's

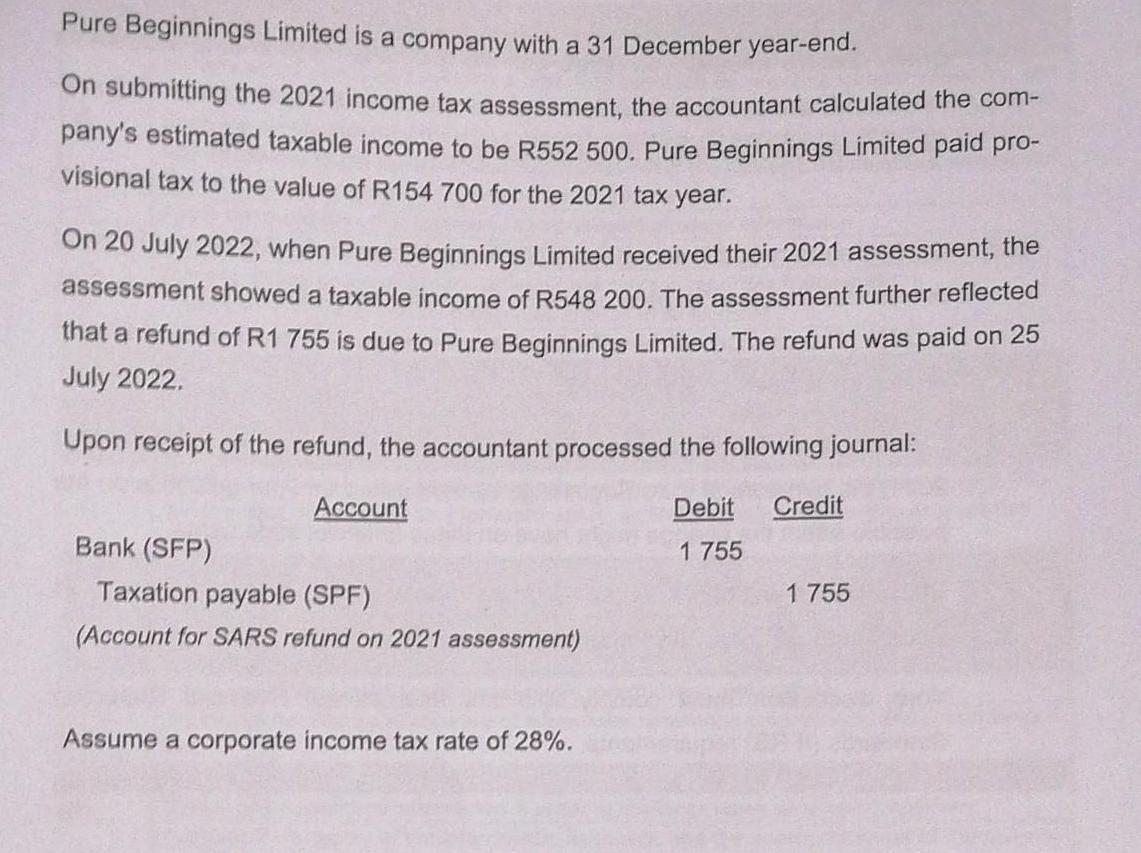

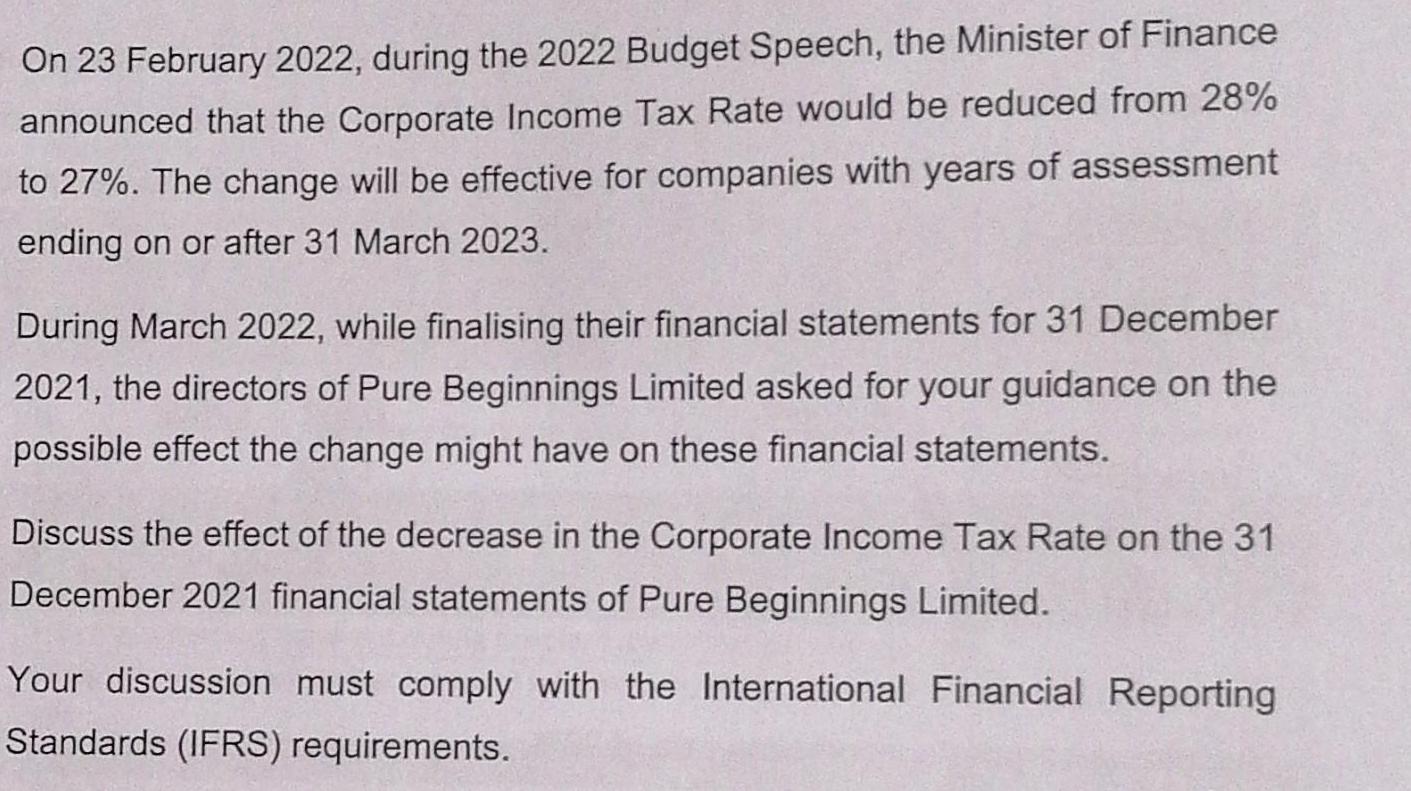

Pure Beginnings Limited is a company with a 31 December year-end. On submitting the 2021 income tax assessment, the accountant calculated the com- pany's estimated taxable income to be R552 500. Pure Beginnings Limited paid pro- visional tax to the value of R154 700 for the 2021 tax year. On 20 July 2022, when Pure Beginnings Limited received their 2021 assessment, the assessment showed a taxable income of R548 200. The assessment further reflected that a refund of R1 755 is due to Pure Beginnings Limited. The refund was paid on 25 July 2022. Upon receipt of the refund, the accountant processed the following journal: Account Bank (SFP) Taxation payable (SPF) (Account for SARS refund on 2021 assessment) Assume a corporate income tax rate of 28%. Debit 1 755 Credit 1 755 On 23 February 2022, during the 2022 Budget Speech, the Minister of Finance announced that the Corporate Income Tax Rate would be reduced from 28% to 27%. The change will be effective for companies with years of assessment ending on or after 31 March 2023. During March 2022, while finalising their financial statements for 31 December 2021, the directors of Pure Beginnings Limited asked for your guidance on the possible effect the change might have on these financial statements. Discuss the effect of the decrease in the Corporate Income Tax Rate on the 31 December 2021 financial statements of Pure Beginnings Limited. Your discussion must comply with the International Financial Reporting Standards (IFRS) requirements.

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER The decrease in the Corporate Income Tax Rate will have the following effects on the 31 Dece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started