Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pure Chase Level Strategy is provided. Can you do the PURE CHASE and HYBRID STRATEGY for this case and Explain /show your analysis ; elaborate

Pure Chase Level Strategy is provided. Can you do the PURE CHASE and HYBRID STRATEGY for this case and Explain /show your analysis ; elaborate on the Manufacturing Policies and Demand characteristics. Which strategy is the best one for this problem? Please give a detail explanation. Thank you.

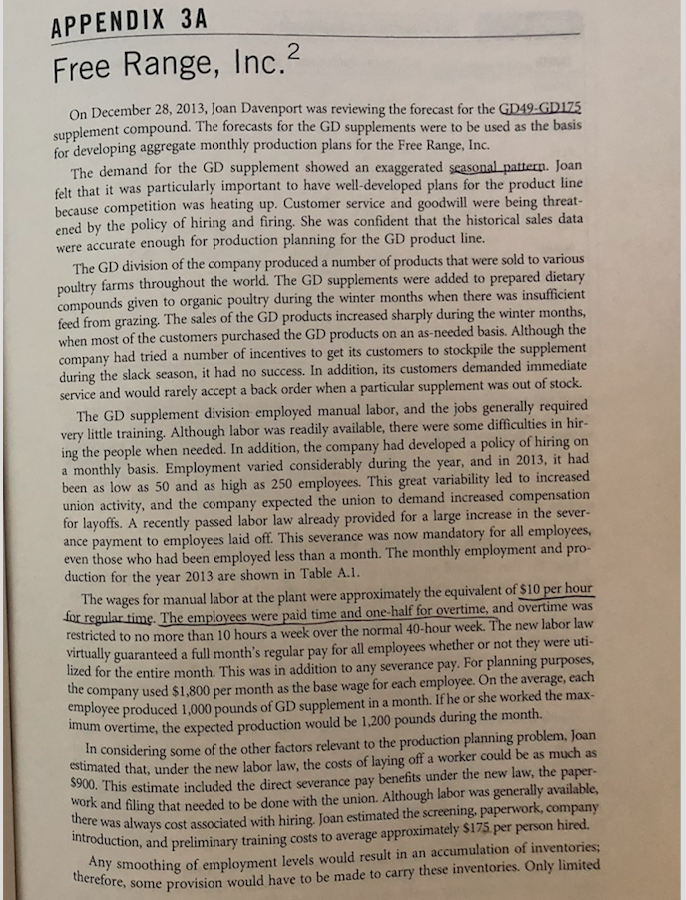

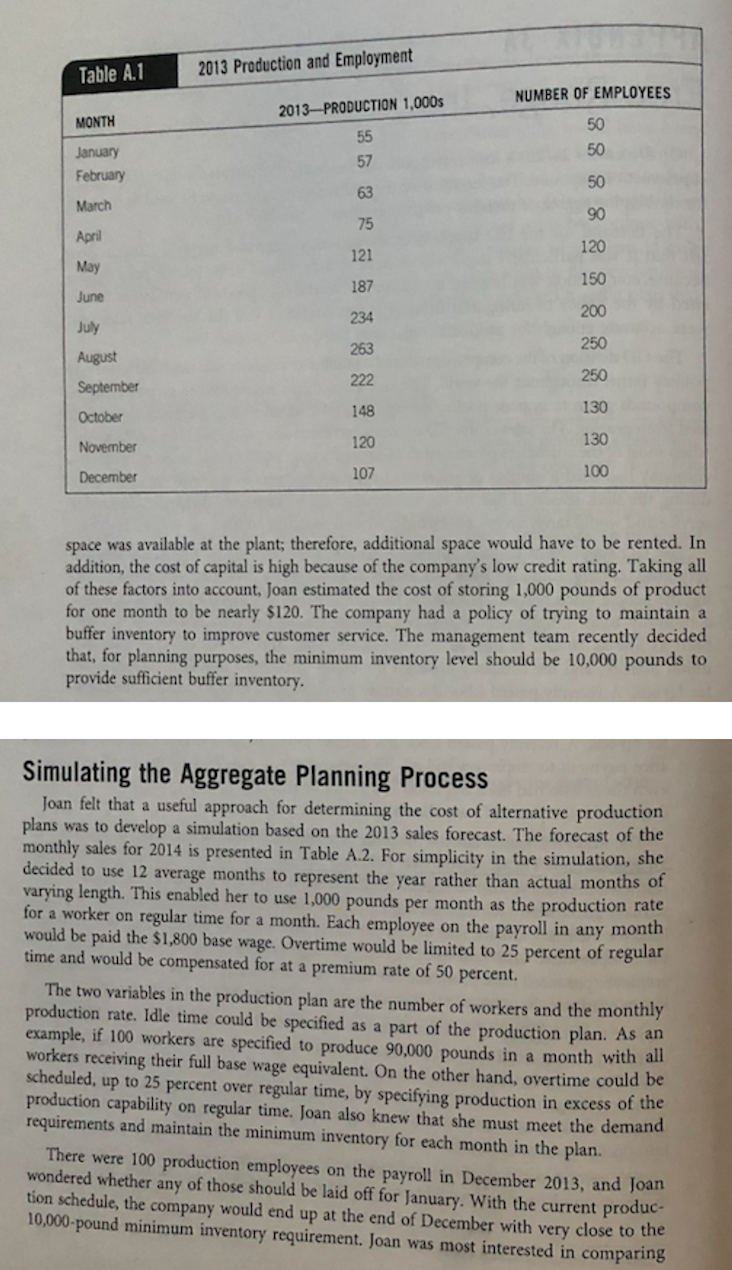

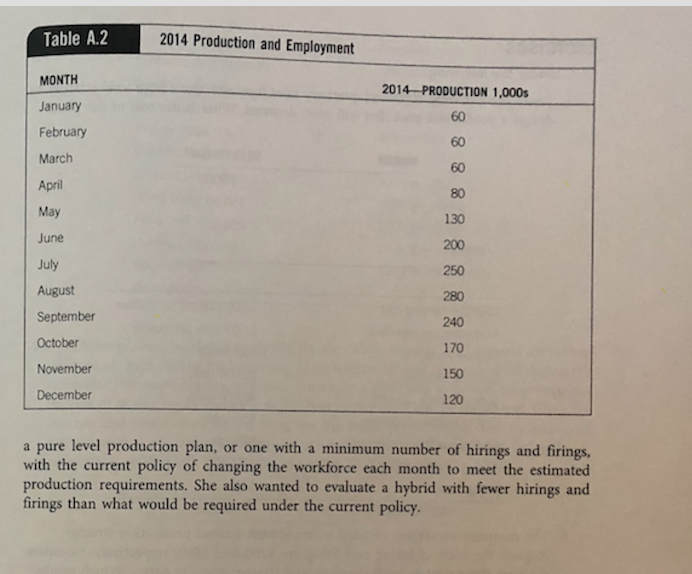

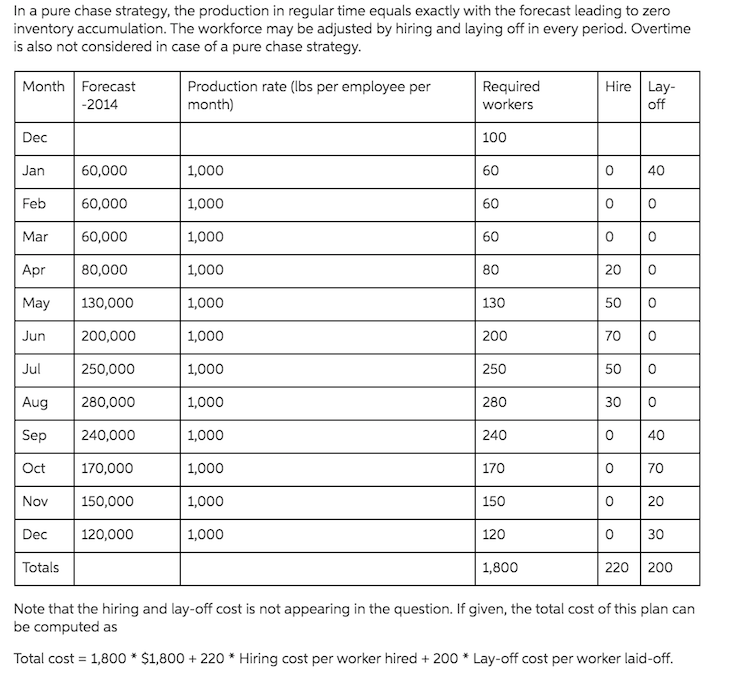

APPENDIX 3A Free Range, Inc.? December 28, 2013, Joan Davenport was reviewing the forecast for the GD49-GD173 supplement compound. The forecasts for the GD supplements were to be used as the basis for developing aggregate monthly production plans for the Free Range, Inc. The demand for the GD supplement showed an exaggerated seasonal pattern. Joan Cole that it was particularly important to have well-developed plans for the product line because competition was heating up. Customer service and goodwill were being threat- ened by the policy of hiring and firing. She was confident that the historical sales data were accurate enough for production planning for the GD product line. The GD division of the company produced a number of products that were sold to various poultry farms throughout the world. The GD supplements were added to prepared dietary compounds given to organic poultry during the winter months when there was insufficient feed from grazing. The sales of the GD products increased sharply during the winter months, when most of the customers purchased the GD products on an as-needed basis. Although the company had tried a number of incentives to get its customers to stockpile the supplement during the slack season, it had no success. In addition, its customers demanded immediate service and would rarely accept a back order when a particular supplement was out of stock. The GD supplement division employed manual labor, and the jobs generally required very little training. Although labor was readily available, there were some difficulties in hir- ing the people when needed. In addition, the company had developed a policy of hiring on a monthly basis. Employment varied considerably during the year, and in 2013, it had been as low as 50 and as high as 250 employees. This great variability led to increased union activity, and the company expected the union to demand increased compensation for layoffs. A recently passed labor law already provided for a large increase in the sever- ance payment to employees laid off. This severance was now mandatory for all employees, even those who had been employed less than a month. The monthly employment and pro- duction for the year 2013 are shown in Table A.1. The wages for manual labor at the plant were approximately the equivalent of $10 per hour for regular time. The employees were paid time and one-half for overtime, and overtime was restricted to no more than 10 hours a week over the normal 40-hour week. The new labor law virtually guaranteed a full month's regular pay for all employees whether or not they were uti- azed for the entire month This was in addition to any severance pay. For planning purposes, the company used $1,800 per month as the base wage for each employee. On the average, each employee produced 1,000 pounds of GD supplement in a month. If he or she worked the max- um overtime, the expected production would be 1,200 pounds during the month. In considering some of the other factors relevant to the production planning problem, Joan mated that, under the new labor law, the costs of laying off a worker could be as much as 0. This estimate included the direct severance pay benefits under the new law, the paper- and filing that needed to be done with the union. Although labor was generally available, was always cost associated with hiring. Joan estimated the screening, paperwork, company action, and preliminary training costs to average approximately $175 per person hired. ny smoothing of employment levels would result in an accumulation of inventories: ore, some provision would have to be made to carry these inventories. Only limited introduction, and prelim therefore, some Table A.1 2013 Production and Employment NUMBER OF EMPLOYEES 2013-PRODUCTION 1,000s MONTH January February March April May June 234 263 July August September October November 222 148 120 107 December space was available at the plant; therefore, additional space would have to be rented. In addition, the cost of capital is high because of the company's low credit rating. Taking all of these factors into account, Joan estimated the cost of storing 1,000 pounds of product for one month to be nearly $120. The company had a policy of trying to maintain a buffer inventory to improve customer service. The management team recently decided that, for planning purposes, the minimum inventory level should be 10,000 pounds to provide sufficient buffer inventory. Simulating the Aggregate Planning Process Joan felt that a useful approach for determining the cost of alternative production plans was to develop a simulation based on the 2013 sales forecast. The forecast of the monthly sales for 2014 is presented in Table A.2. For simplicity in the simulation, she decided to use 12 average months to represent the year rather than actual months of varying length. This enabled her to use 1,000 pounds per month as the production rate for a worker on regular time for a month. Each employee on the payroll in any month would be paid the $1,800 base wage. Overtime would be limited to 25 percent of regular time and would be compensated for at a premium rate of 50 percent. The two variables in the production plan are the number of workers and the monthly production rate. Idle time could be specified as a part of the production plan. As an example, if 100 workers are specified to produce 90,000 pounds in a month with all workers receiving their full base wage equivalent. On the other hand, overtime could be scheduled, up to 25 percent over regular time, by specifying production in excess of the production capability on regular time. Joan also knew that she must meet the demand requirements and maintain the minimum inventory for each month in the plan. There were 100 production employees on the payroll in December 2013, and Joan wondered whether any of those should be laid off for January. With the current produc tion schedule, the company would end up at the end of December with very close to the 10,000-pound minimum inventory requirement. Joan was most interested in comparing Table A.2 2014 Production and Employment MONTH 2014 PRODUCTION 1,000s January February March April May June July August September October November December a pure level production plan, or one with a minimum number of hirings and firings, with the current policy of changing the workforce each month to meet the estimated production requirements. She also wanted to evaluate a hybrid with fewer hirings and firings than what would be required under the current policy. In a pure chase strategy, the production in regular time equals exactly with the forecast leading to zero inventory accumulation. The workforce may be adjusted by hiring and laying off in every period. Overtime is also not considered in case of a pure chase strategy. Month Hire Forecast -2014 Lay- Production rate (lbs per employee per month) Required workers off Dec 100 60 Jan 1,000 60,000 60,000 Feb 1,000 60 Mar 60,000 1,000 Apr 80,000 1,000 May 130,000 1,000 130 Jun 200,000 1,000 200 Jul 250,000 1,000 50 250 280 Aug 280,000 1,000 Sep 240,000 1,000 TA Oct 1,000 170 Nov 170,000 150,000 120,000 1,000 150 Dec 1,000 120 020 0 30 220 200 Totals 1,800 Note that the hiring and lay-off cost is not appearing in the question. If given, the total cost of this plan can be computed as Total cost = 1,800 * $1,800 + 220 * Hiring cost per worker hired + 200 * Lay-off cost per worker laid-off. APPENDIX 3A Free Range, Inc.? December 28, 2013, Joan Davenport was reviewing the forecast for the GD49-GD173 supplement compound. The forecasts for the GD supplements were to be used as the basis for developing aggregate monthly production plans for the Free Range, Inc. The demand for the GD supplement showed an exaggerated seasonal pattern. Joan Cole that it was particularly important to have well-developed plans for the product line because competition was heating up. Customer service and goodwill were being threat- ened by the policy of hiring and firing. She was confident that the historical sales data were accurate enough for production planning for the GD product line. The GD division of the company produced a number of products that were sold to various poultry farms throughout the world. The GD supplements were added to prepared dietary compounds given to organic poultry during the winter months when there was insufficient feed from grazing. The sales of the GD products increased sharply during the winter months, when most of the customers purchased the GD products on an as-needed basis. Although the company had tried a number of incentives to get its customers to stockpile the supplement during the slack season, it had no success. In addition, its customers demanded immediate service and would rarely accept a back order when a particular supplement was out of stock. The GD supplement division employed manual labor, and the jobs generally required very little training. Although labor was readily available, there were some difficulties in hir- ing the people when needed. In addition, the company had developed a policy of hiring on a monthly basis. Employment varied considerably during the year, and in 2013, it had been as low as 50 and as high as 250 employees. This great variability led to increased union activity, and the company expected the union to demand increased compensation for layoffs. A recently passed labor law already provided for a large increase in the sever- ance payment to employees laid off. This severance was now mandatory for all employees, even those who had been employed less than a month. The monthly employment and pro- duction for the year 2013 are shown in Table A.1. The wages for manual labor at the plant were approximately the equivalent of $10 per hour for regular time. The employees were paid time and one-half for overtime, and overtime was restricted to no more than 10 hours a week over the normal 40-hour week. The new labor law virtually guaranteed a full month's regular pay for all employees whether or not they were uti- azed for the entire month This was in addition to any severance pay. For planning purposes, the company used $1,800 per month as the base wage for each employee. On the average, each employee produced 1,000 pounds of GD supplement in a month. If he or she worked the max- um overtime, the expected production would be 1,200 pounds during the month. In considering some of the other factors relevant to the production planning problem, Joan mated that, under the new labor law, the costs of laying off a worker could be as much as 0. This estimate included the direct severance pay benefits under the new law, the paper- and filing that needed to be done with the union. Although labor was generally available, was always cost associated with hiring. Joan estimated the screening, paperwork, company action, and preliminary training costs to average approximately $175 per person hired. ny smoothing of employment levels would result in an accumulation of inventories: ore, some provision would have to be made to carry these inventories. Only limited introduction, and prelim therefore, some Table A.1 2013 Production and Employment NUMBER OF EMPLOYEES 2013-PRODUCTION 1,000s MONTH January February March April May June 234 263 July August September October November 222 148 120 107 December space was available at the plant; therefore, additional space would have to be rented. In addition, the cost of capital is high because of the company's low credit rating. Taking all of these factors into account, Joan estimated the cost of storing 1,000 pounds of product for one month to be nearly $120. The company had a policy of trying to maintain a buffer inventory to improve customer service. The management team recently decided that, for planning purposes, the minimum inventory level should be 10,000 pounds to provide sufficient buffer inventory. Simulating the Aggregate Planning Process Joan felt that a useful approach for determining the cost of alternative production plans was to develop a simulation based on the 2013 sales forecast. The forecast of the monthly sales for 2014 is presented in Table A.2. For simplicity in the simulation, she decided to use 12 average months to represent the year rather than actual months of varying length. This enabled her to use 1,000 pounds per month as the production rate for a worker on regular time for a month. Each employee on the payroll in any month would be paid the $1,800 base wage. Overtime would be limited to 25 percent of regular time and would be compensated for at a premium rate of 50 percent. The two variables in the production plan are the number of workers and the monthly production rate. Idle time could be specified as a part of the production plan. As an example, if 100 workers are specified to produce 90,000 pounds in a month with all workers receiving their full base wage equivalent. On the other hand, overtime could be scheduled, up to 25 percent over regular time, by specifying production in excess of the production capability on regular time. Joan also knew that she must meet the demand requirements and maintain the minimum inventory for each month in the plan. There were 100 production employees on the payroll in December 2013, and Joan wondered whether any of those should be laid off for January. With the current produc tion schedule, the company would end up at the end of December with very close to the 10,000-pound minimum inventory requirement. Joan was most interested in comparing Table A.2 2014 Production and Employment MONTH 2014 PRODUCTION 1,000s January February March April May June July August September October November December a pure level production plan, or one with a minimum number of hirings and firings, with the current policy of changing the workforce each month to meet the estimated production requirements. She also wanted to evaluate a hybrid with fewer hirings and firings than what would be required under the current policy. In a pure chase strategy, the production in regular time equals exactly with the forecast leading to zero inventory accumulation. The workforce may be adjusted by hiring and laying off in every period. Overtime is also not considered in case of a pure chase strategy. Month Hire Forecast -2014 Lay- Production rate (lbs per employee per month) Required workers off Dec 100 60 Jan 1,000 60,000 60,000 Feb 1,000 60 Mar 60,000 1,000 Apr 80,000 1,000 May 130,000 1,000 130 Jun 200,000 1,000 200 Jul 250,000 1,000 50 250 280 Aug 280,000 1,000 Sep 240,000 1,000 TA Oct 1,000 170 Nov 170,000 150,000 120,000 1,000 150 Dec 1,000 120 020 0 30 220 200 Totals 1,800 Note that the hiring and lay-off cost is not appearing in the question. If given, the total cost of this plan can be computed as Total cost = 1,800 * $1,800 + 220 * Hiring cost per worker hired + 200 * Lay-off cost per worker laid-offStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started