Question

Purkerson, Smith, and Traynor have operated a bookstore for a number of years as a partnership. At the beginning of 2021, capital balances were as

Purkerson, Smith, and Traynor have operated a bookstore for a number of years as a partnership. At the beginning of 2021, capital balances were as follows:

| Purkerson | $ | 82,000 |

| Smith | 62,000 | |

| Traynor | 30,000 | |

Due to a cash shortage, Purkerson invests an additional $6,000 in the business on April 1, 2021.

Each partner is allowed to withdraw $700 cash each month.

The partners have used the same method of allocating profits and losses since the business's inception:

- Each partner is given the following compensation allowance for work done in the business: Purkerson, $14,000; Smith, $24,000; and Traynor, $4,000.

- Each partner is credited with interest equal to 20 percent of the average monthly capital balance for the year without regard for normal drawings.

- Any remaining profit or loss is allocated 3:2:5 to Purkerson, Smith, and Traynor, respectively. The net income for 2021 is $24,000. Each partner withdraws the allotted amount each month.

Prepare a schedule showing calculations for the partners' 2021 ending capital balances. (Amounts to be deducted should be indicated with minus sign.)

Not sure what is incorrect.

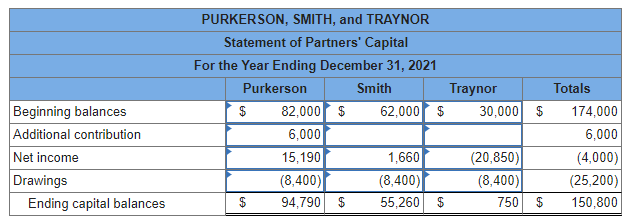

Beginning balances Additional contribution Net income Drawings Ending capital balances PURKERSON, SMITH, and TRAYNOR Statement of Partners' Capital For the Year Ending December 31, 2021 Purkerson Smith Traynor $ 82,000 $ 62,000 $ 30,000 $ 6,000 15,190 1,660 (20,850) (8,400) (8,400) (8,400) $ 94,790 $ 55,260 $ 750 Totals 174,000 6,000 (4,000) (25,200) 150,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started