Answered step by step

Verified Expert Solution

Question

1 Approved Answer

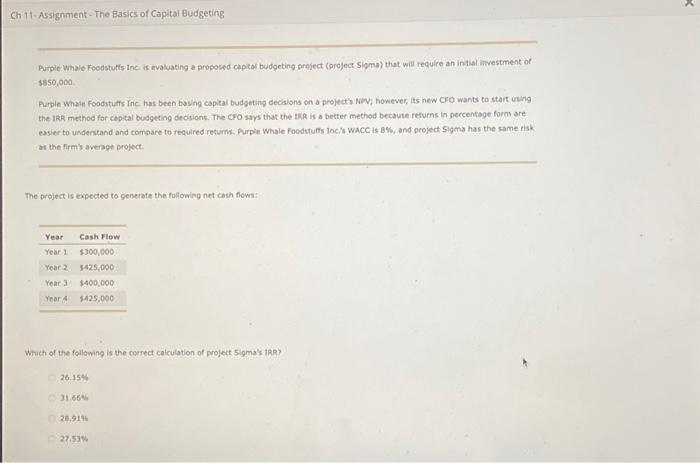

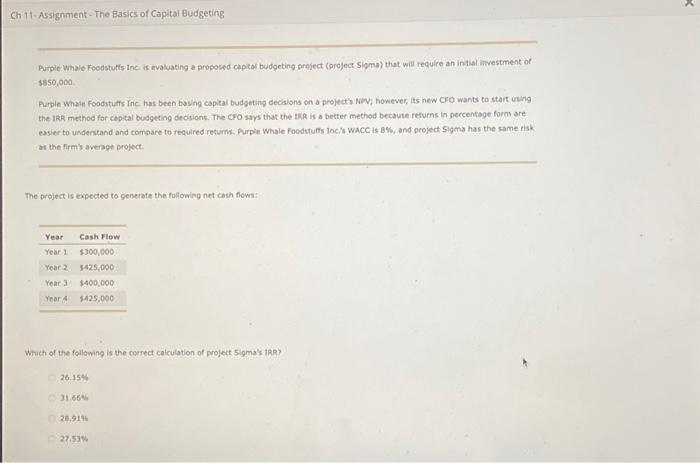

Purpio Whale Foodstuffs inc. is evaluating a proposed captor budgeting project (project Sigma) that will require an intial investment of 350,000 Purple Whain foodituls Inc

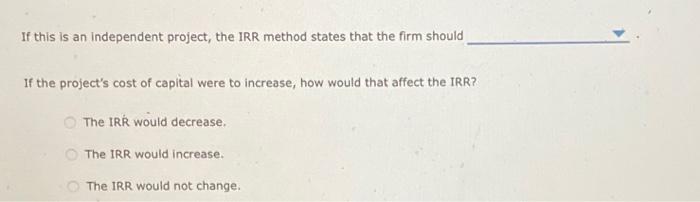

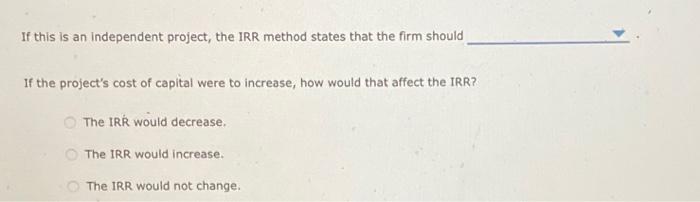

Purpio Whale Foodstuffs inc. is evaluating a proposed captor budgeting project (project Sigma) that will require an intial investment of 350,000 Purple Whain foodituls Inc has been baving capical budgeting decisions on o project's NipV, however, its new CFo wants to start using the IRR method for cupital budgeting decisions. The CrO says that the IRR is a better method because returns in percentage form are easier to understand and compare to required returns. Purple Whale Foodstuffs incis whCC is BW, and project Sigha has the rame risk on the firms average project. The project is expected to generate the following net cash flows: Whach of the following is the correct calculation of profect sigmas tRR? 26.15% 31.664 28.9146 27,53% If this is an independent project, the IRR method states that the firm should If the project's cost of capital were to increase, how would that affect the IRR? The IRR would decrease. The IRR would increase. The IRR would not change

Purpio Whale Foodstuffs inc. is evaluating a proposed captor budgeting project (project Sigma) that will require an intial investment of 350,000 Purple Whain foodituls Inc has been baving capical budgeting decisions on o project's NipV, however, its new CFo wants to start using the IRR method for cupital budgeting decisions. The CrO says that the IRR is a better method because returns in percentage form are easier to understand and compare to required returns. Purple Whale Foodstuffs incis whCC is BW, and project Sigha has the rame risk on the firms average project. The project is expected to generate the following net cash flows: Whach of the following is the correct calculation of profect sigmas tRR? 26.15% 31.664 28.9146 27,53% If this is an independent project, the IRR method states that the firm should If the project's cost of capital were to increase, how would that affect the IRR? The IRR would decrease. The IRR would increase. The IRR would not change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started