Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Purpose This assignment is intended to help you learn to do the following: Identify other tax-advantaged plans. Compare and contrast qualified plans with other tax-advantaged

Purpose

This assignment is intended to help you learn to do the following:

- Identify other tax-advantaged plans.

- Compare and contrast qualified plans with other tax-advantaged plans.

- Explain how SIMPLEs work and when they should be considered.

- Compare the similarities and differences between 403(b) plans and 401(k) plans.

- Describe how the deferral limits for SIMPLEs, SARSEPs, 401(k) plans and 403(b) plans work together.

- Differentiate between private and public eligible 457 plans as well as ineligible 457 plans.

Action Items

- Make sure that you study Chapter 10 in the textbook before you start working on this assignment.

- Respond to the following questions in Chapter 15 of your textbook:

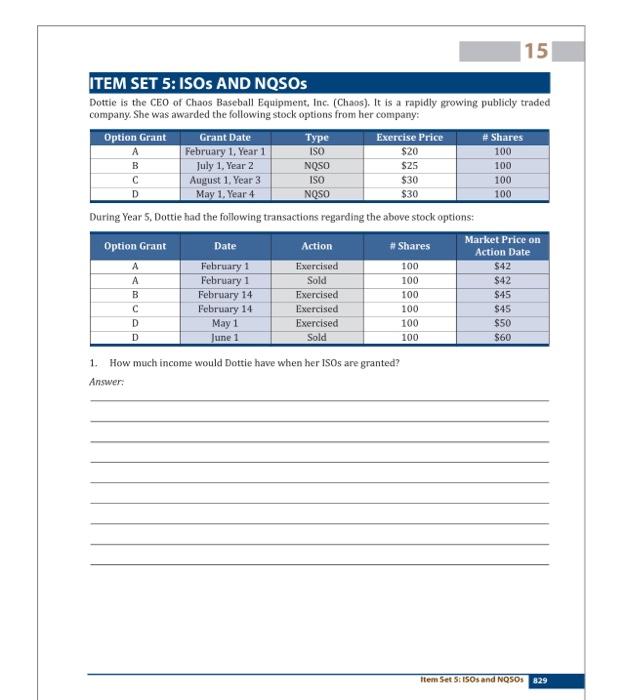

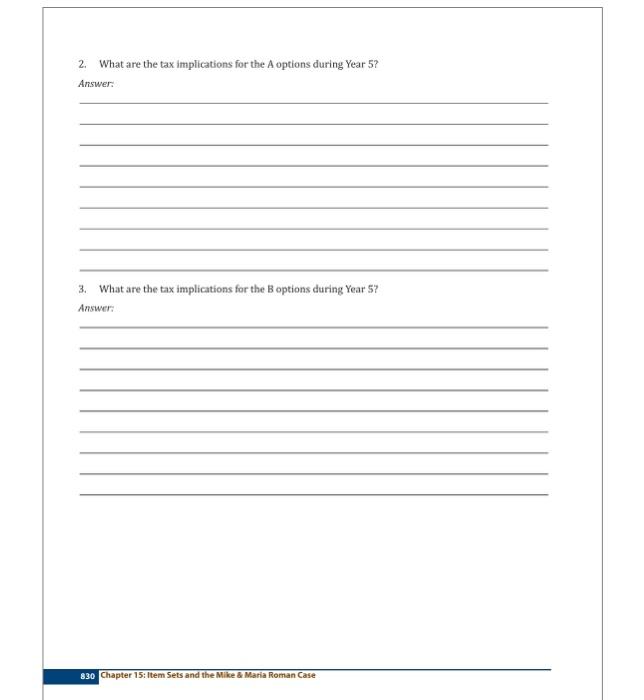

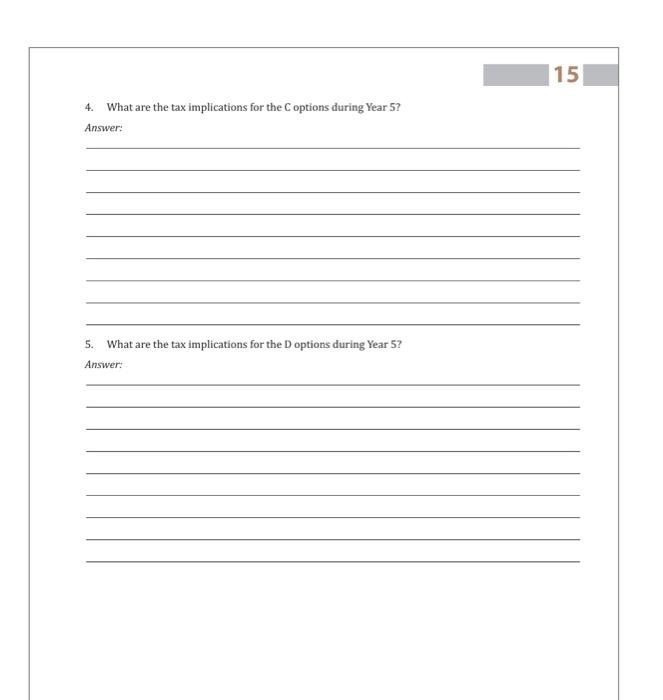

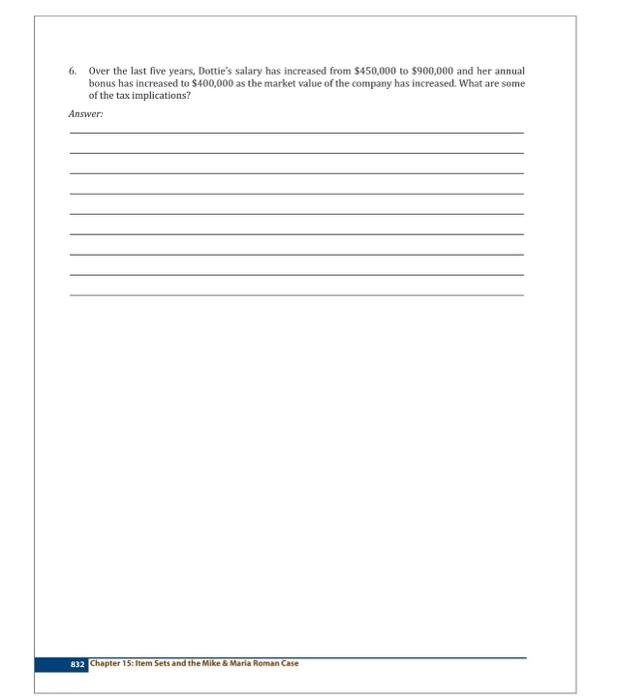

- Item Set 5: ISOs and NQSOs Questions 1-6.

- Item Set 6: Qualified Plan Rules Questions 1-8.

- Item Set 7: 403(b) Plans Questions 1-2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started