Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Purpose: To gain an understanding of how to prepare both a Quick Method and Basic Method HST return which could be required in a

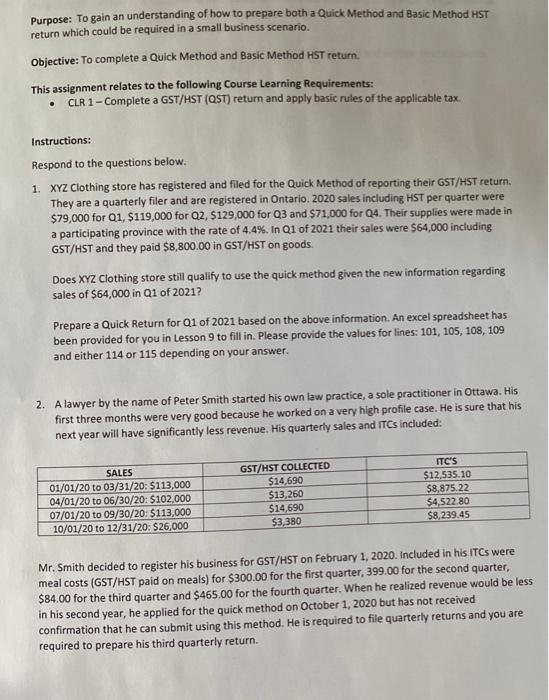

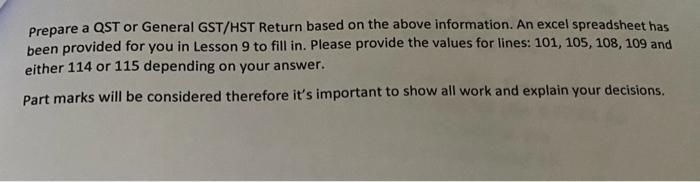

Purpose: To gain an understanding of how to prepare both a Quick Method and Basic Method HST return which could be required in a small business scenario. Objective: To complete a Quick Method and Basic Method HST return. This assignment relates to the following Course Learning Requirements: CLR 1-Complete a GST/HST (QST) return and apply basic rules of the applicable tax. Instructions: Respond to the questions below. 1. XYZ Clothing store has registered and filed for the Quick Method of reporting their GST/HST return. They are a quarterly filer and are registered in Ontario. 2020 sales including HST per quarter were $79,000 for Q1, $119,000 for Q2, $129,000 for Q3 and $71,000 for Q4. Their supplies were made in a participating province with the rate of 4.4%. In Q1 of 2021 their sales were $64,000 including GST/HST and they paid $8,800.00 in GST/HST on goods. Does XYZ Clothing store still qualify to use the quick method given the new information regarding sales of $64,000 in Q1 of 2021? Prepare a Quick Return for Q1 of 2021 based on the above information. An excel spreadsheet has been provided for you in Lesson 9 to fill in. Please provide the values for lines: 101, 105, 108, 109 and either 114 or 115 depending on your answer. 2. A lawyer by the name of Peter Smith started his own law practice, a sole practitioner in Ottawa. His first three months were very good because he worked on a very high profile case. He is sure that his next year will have significantly less revenue. His quarterly sales and ITCs included: SALES 01/01/20 to 03/31/20: $113,000 04/01/20 to 06/30/20: $102,000 07/01/20 to 09/30/20: $113,000 10/01/20 to 12/31/20: $26,000 GST/HST COLLECTED $14,690 $13,260 $14,690 $3,380 ITC'S $12,535.10 $8,875.22 $4,522.80 $8,239.45 Mr. Smith decided to register his business for GST/HST on February 1, 2020. Included in his ITCs were meal costs (GST/HST paid on meals) for $300.00 for the first quarter, 399.00 for the second quarter, $84.00 for the third quarter and $465.00 for the fourth quarter. When he realized revenue would be less in his second year, he applied for the quick method on October 1, 2020 but has not received confirmation that he can submit using this method. He is required to file quarterly returns and you are required to prepare his third quarterly return. Prepare a QST or General GST/HST Return based on the above information. An excel spreadsheet has been provided for you in Lesson 9 to fill in. Please provide the values for lines: 101, 105, 108, 109 and either 114 or 115 depending on your answer. Part marks will be considered therefore it's important to show all work and explain your decisions.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To determine if XYZ Clothing store still qualifies to use the quick method they would need to calculate their annual sales and compare them to the thr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started