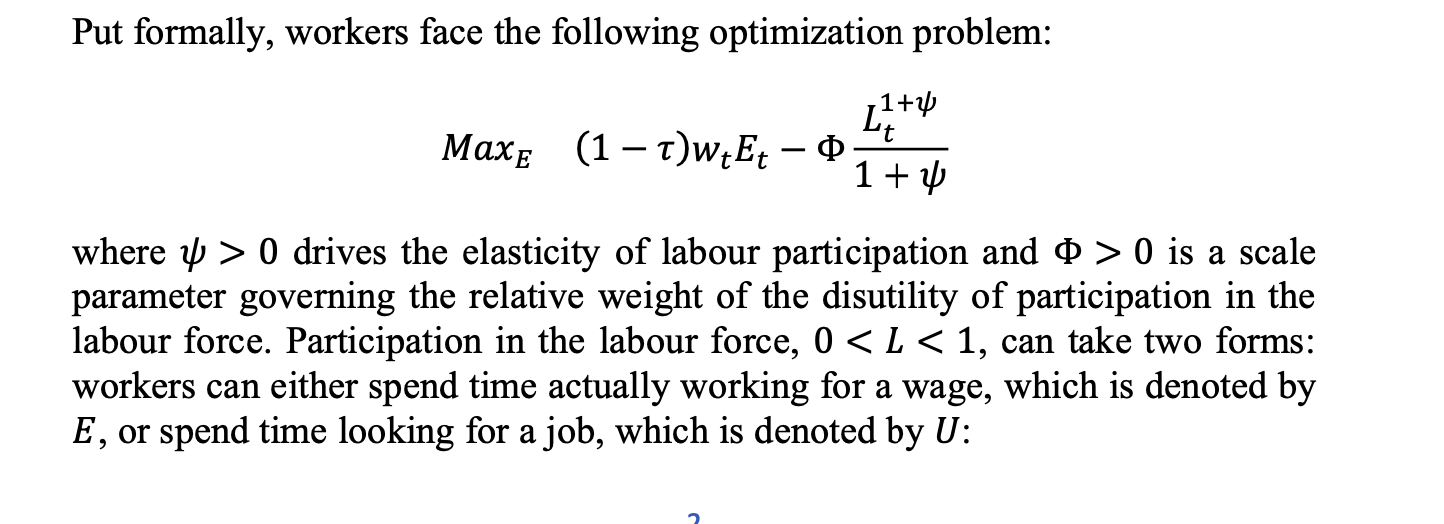

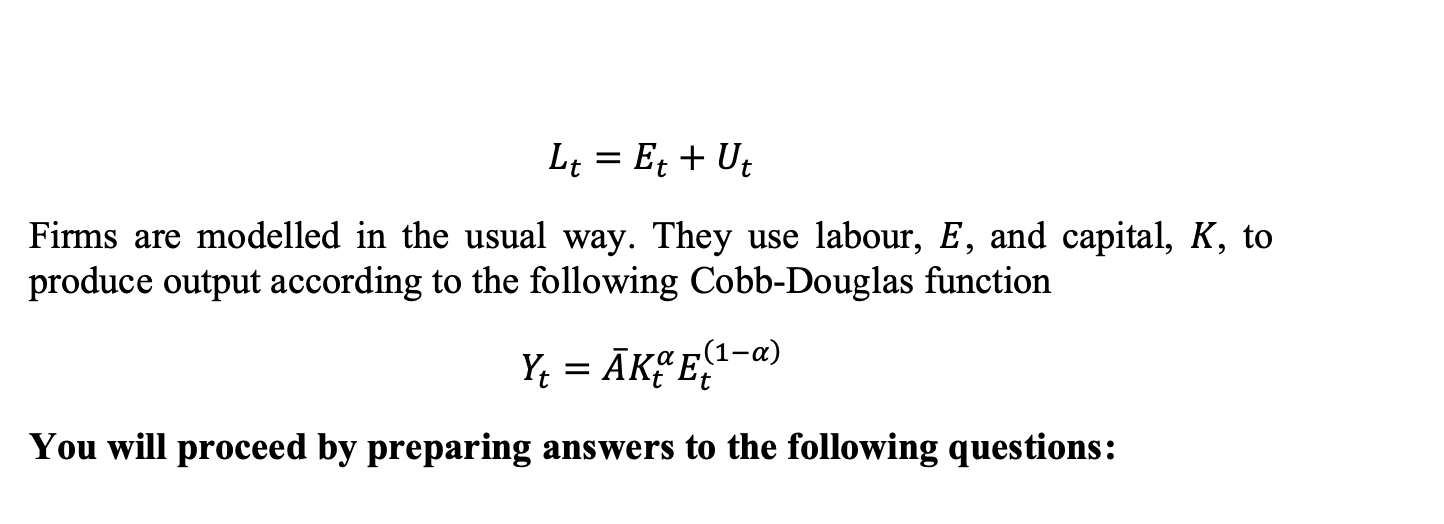

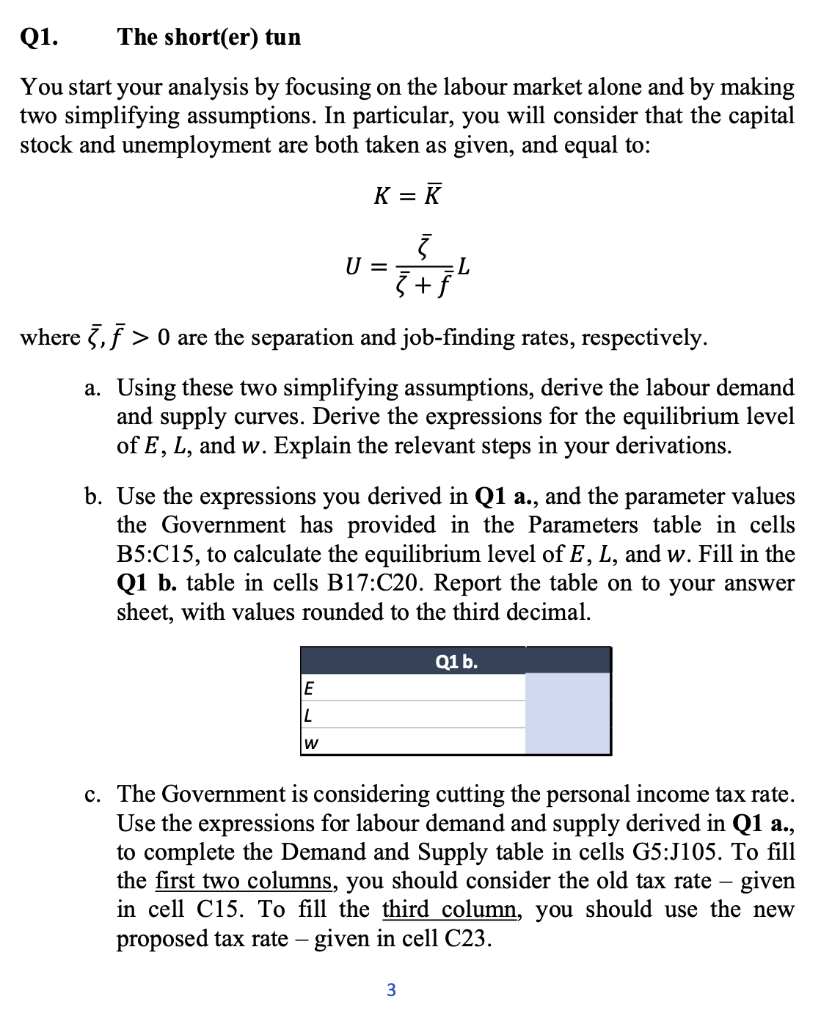

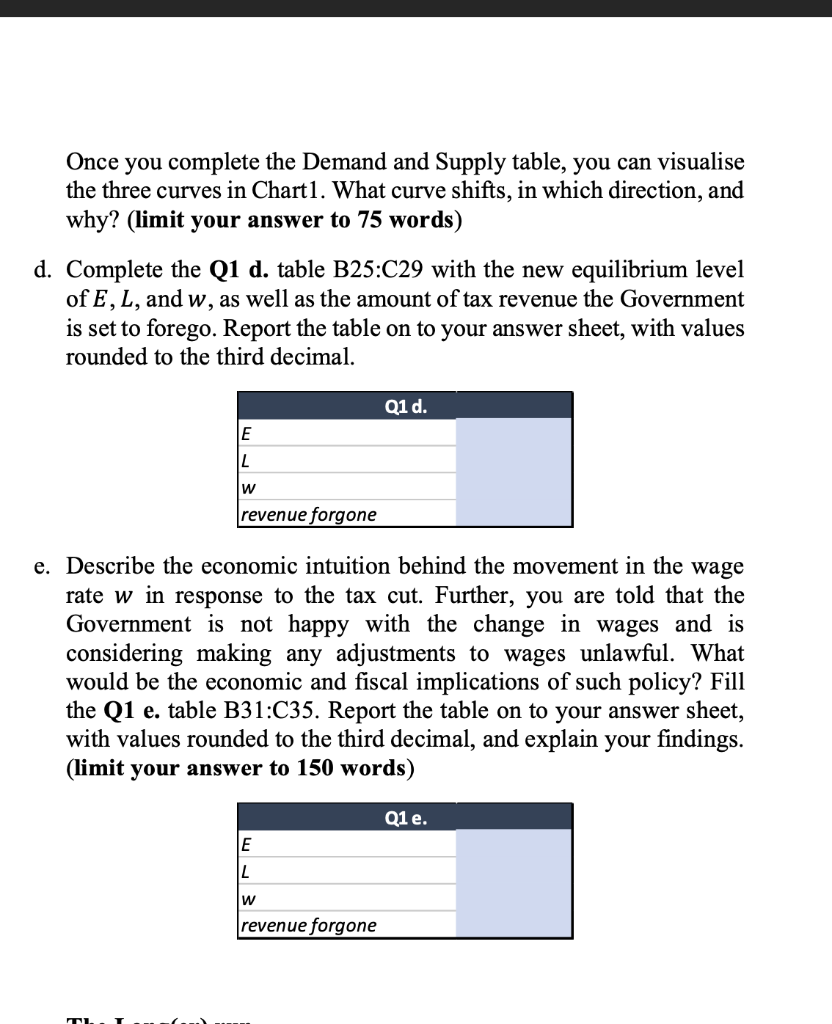

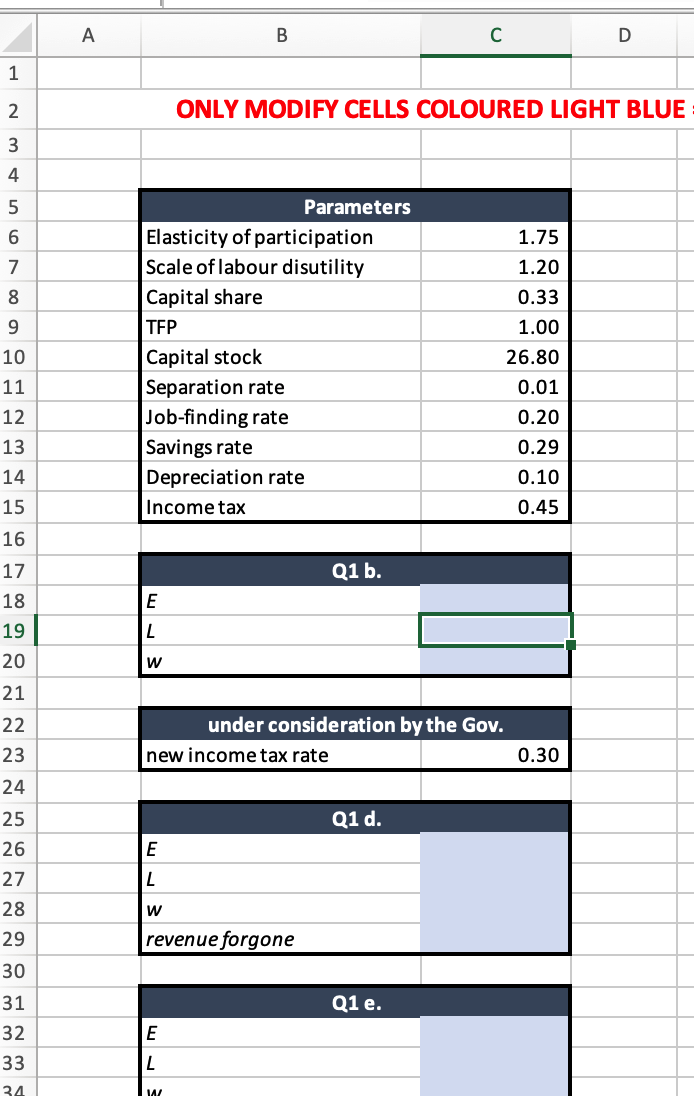

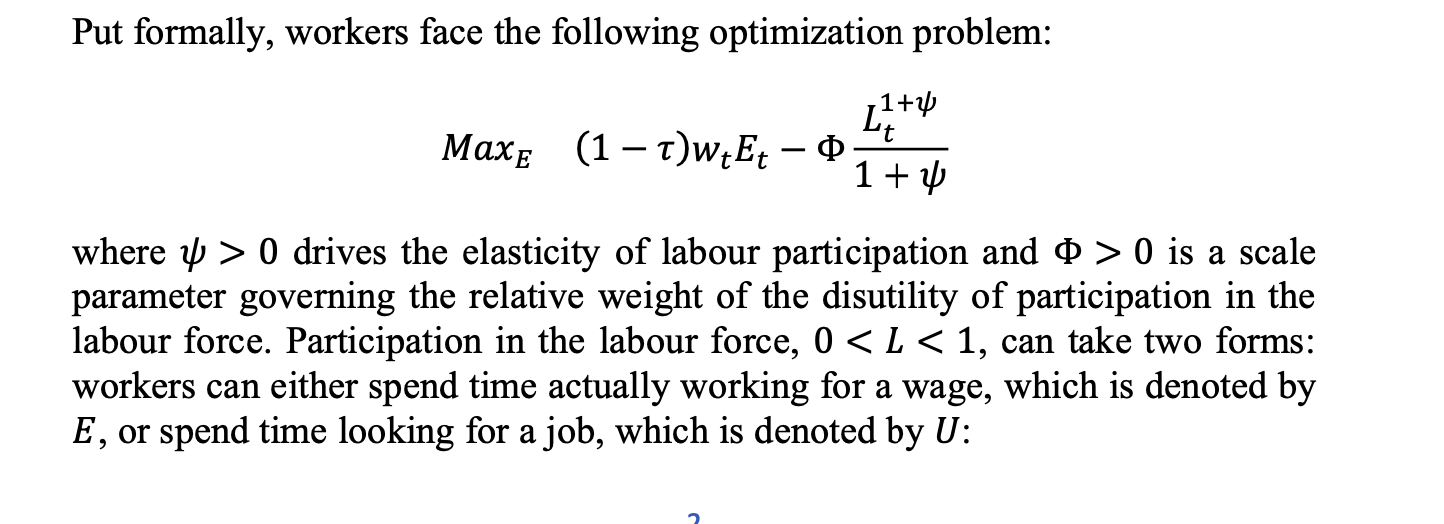

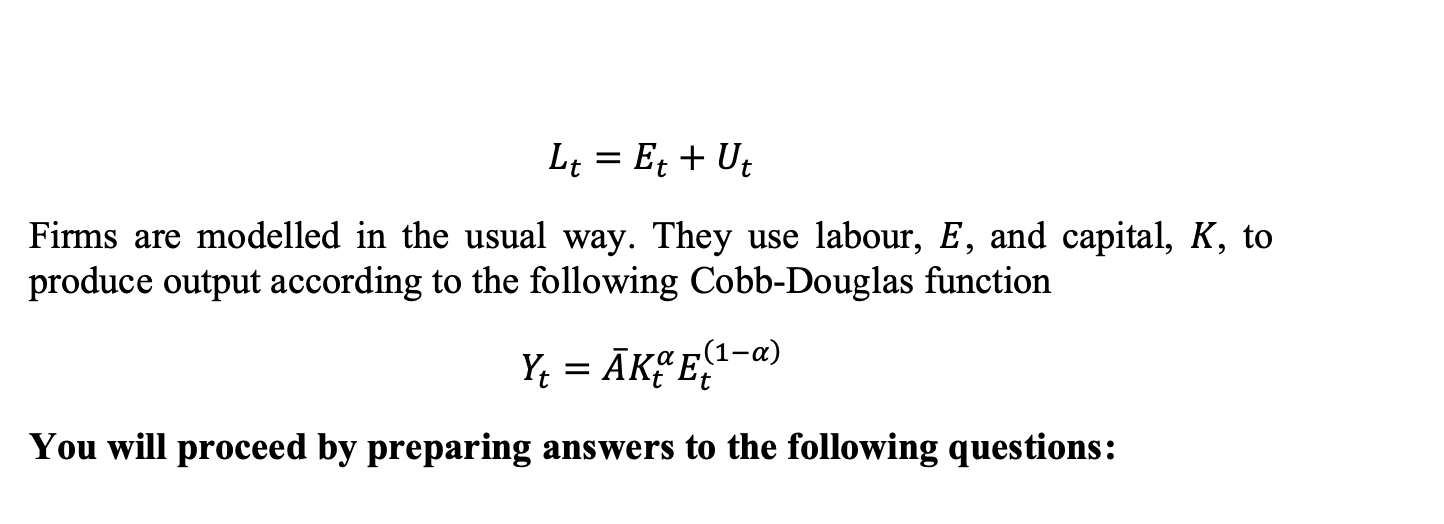

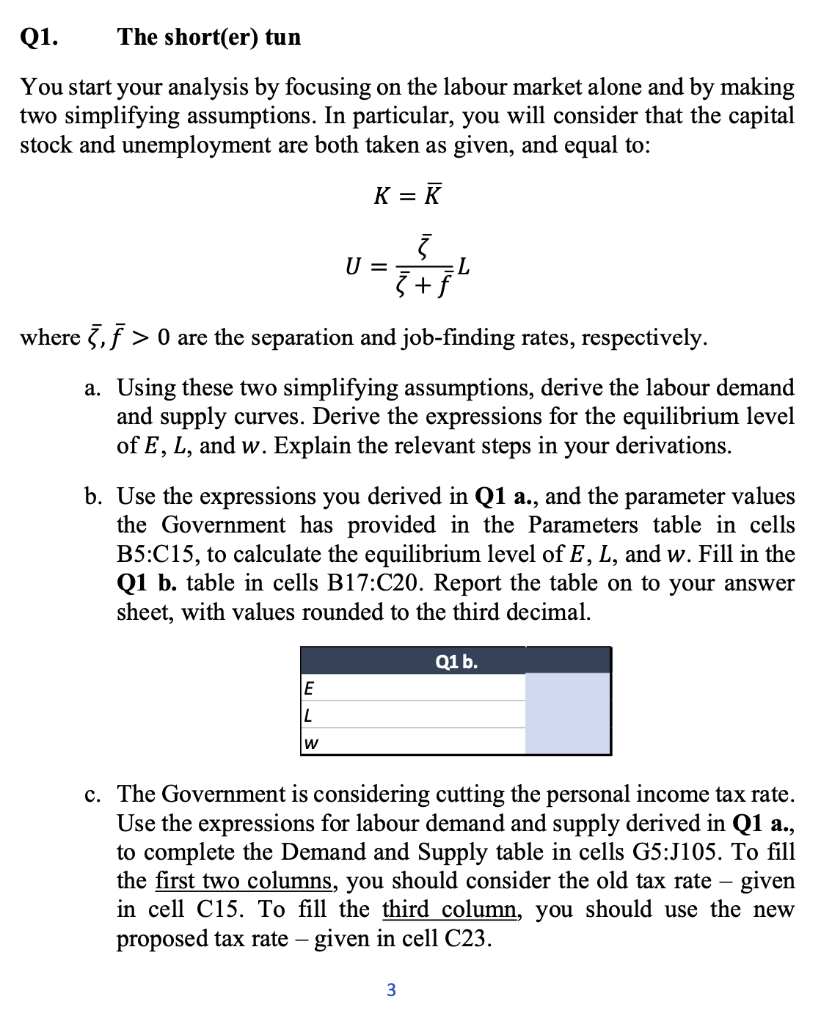

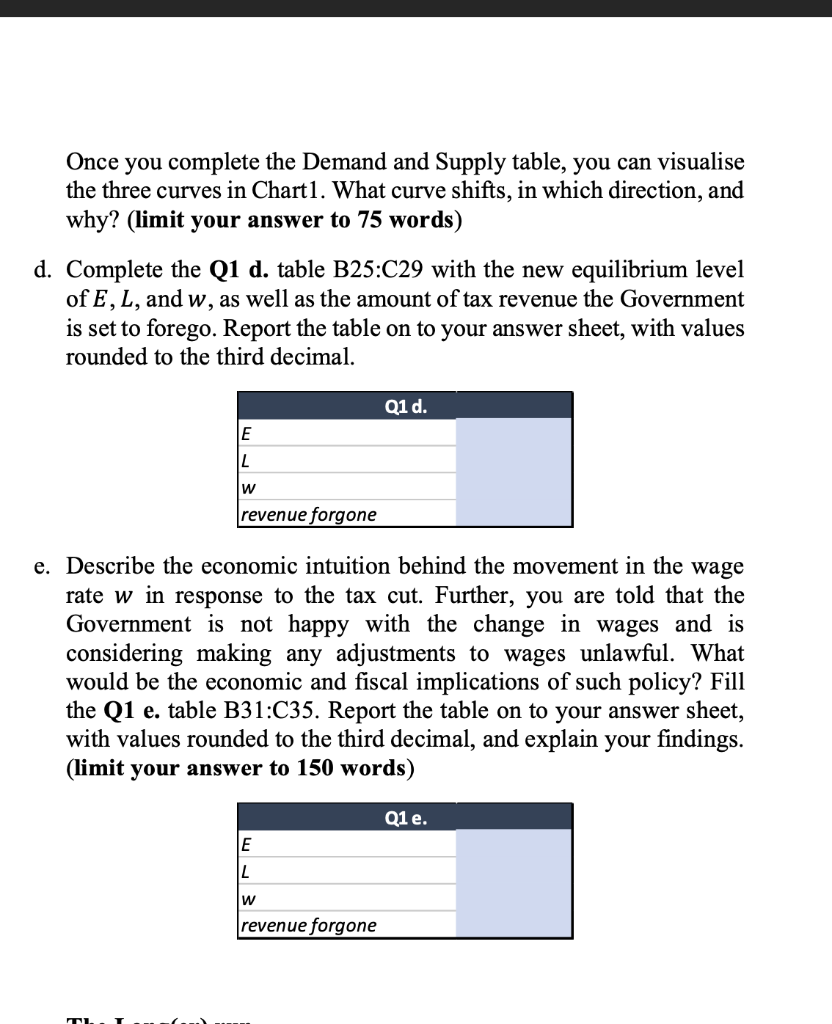

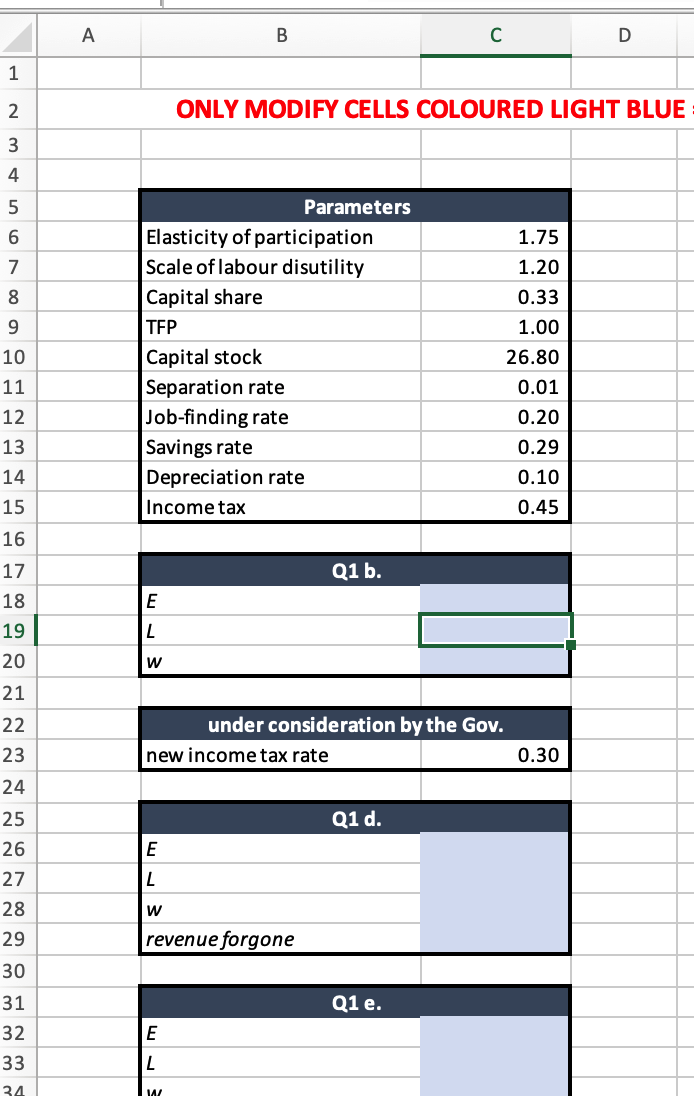

Put formally, workers face the following optimization problem: 1+4 Lt Maxe (1 t)w Et - 0 1+ where y > 0 drives the elasticity of labour participation and 0 > 0 is a scale parameter governing the relative weight of the disutility of participation in the labour force. Participation in the labour force, 0 0 are the separation and job-finding rates, respectively. a. Using these two simplifying assumptions, derive the labour demand and supply curves. Derive the expressions for the equilibrium level of E, L, and w. Explain the relevant steps in your derivations. b. Use the expressions you derived in Q1 a., and the parameter values the Government has provided in the Parameters table in cells B5:C15, to calculate the equilibrium level of E, L, and w. Fill in the Q1 b. table in cells B17:C20. Report the table on to your answer sheet, with values rounded to the third decimal. Q1 b. E L W c. The Government is considering cutting the personal income tax rate. Use the expressions for labour demand and supply derived in Q1 a., to complete the Demand and Supply table in cells 65:J105. To fill the first two columns, you should consider the old tax rate given in cell C15. To fill the third column, you should use the new proposed tax rate - given in cell C23. 3 Once you complete the Demand and Supply table, you can visualise the three curves in Chart1. What curve shifts, in which direction, and why? (limit your answer to 75 words) d. Complete the Q1 d. table B25:C29 with the new equilibrium level of E, L, and w, as well as the amount of tax revenue the Government is set to forego. Report the table on to your answer sheet, with values rounded to the third decimal. Q1 d. E L w revenue forgone e. Describe the economic intuition behind the movement in the wage rate w in response to the tax cut. Further, you are told that the Government is not happy with the change in wages and is considering making any adjustments to wages unlawful. What would be the economic and fiscal implications of such policy? Fill the Q1 e. table B31:C35. Report the table on to your answer sheet, with values rounded to the third decimal, and explain your findings. (limit your answer to 150 words) Q1e. E L w revenue forgone A B D 1 2 ONLY MODIFY CELLS COLOURED LIGHT BLUE 3 4 5 6 1.75 1.20 7 8 9 Parameters Elasticity of participation Scale of labour disutility Capital share TEP Capital stock Separation rate Job-finding rate Savings rate Depreciation rate Income tax 0.33 1.00 26.80 10 11 12 13 0.01 0.20 0.29 0.10 0.45 14 15 16 Q1 b. 17 18 E L 19 20 w 21 22 23 under consideration by the Gov. new income tax rate 0.30 24 Q1 d. E L w 25 26 27 28 29 30 31 32 33 revenue forgone Q1 e. E L 34 14 Put formally, workers face the following optimization problem: 1+4 Lt Maxe (1 t)w Et - 0 1+ where y > 0 drives the elasticity of labour participation and 0 > 0 is a scale parameter governing the relative weight of the disutility of participation in the labour force. Participation in the labour force, 0 0 are the separation and job-finding rates, respectively. a. Using these two simplifying assumptions, derive the labour demand and supply curves. Derive the expressions for the equilibrium level of E, L, and w. Explain the relevant steps in your derivations. b. Use the expressions you derived in Q1 a., and the parameter values the Government has provided in the Parameters table in cells B5:C15, to calculate the equilibrium level of E, L, and w. Fill in the Q1 b. table in cells B17:C20. Report the table on to your answer sheet, with values rounded to the third decimal. Q1 b. E L W c. The Government is considering cutting the personal income tax rate. Use the expressions for labour demand and supply derived in Q1 a., to complete the Demand and Supply table in cells 65:J105. To fill the first two columns, you should consider the old tax rate given in cell C15. To fill the third column, you should use the new proposed tax rate - given in cell C23. 3 Once you complete the Demand and Supply table, you can visualise the three curves in Chart1. What curve shifts, in which direction, and why? (limit your answer to 75 words) d. Complete the Q1 d. table B25:C29 with the new equilibrium level of E, L, and w, as well as the amount of tax revenue the Government is set to forego. Report the table on to your answer sheet, with values rounded to the third decimal. Q1 d. E L w revenue forgone e. Describe the economic intuition behind the movement in the wage rate w in response to the tax cut. Further, you are told that the Government is not happy with the change in wages and is considering making any adjustments to wages unlawful. What would be the economic and fiscal implications of such policy? Fill the Q1 e. table B31:C35. Report the table on to your answer sheet, with values rounded to the third decimal, and explain your findings. (limit your answer to 150 words) Q1e. E L w revenue forgone A B D 1 2 ONLY MODIFY CELLS COLOURED LIGHT BLUE 3 4 5 6 1.75 1.20 7 8 9 Parameters Elasticity of participation Scale of labour disutility Capital share TEP Capital stock Separation rate Job-finding rate Savings rate Depreciation rate Income tax 0.33 1.00 26.80 10 11 12 13 0.01 0.20 0.29 0.10 0.45 14 15 16 Q1 b. 17 18 E L 19 20 w 21 22 23 under consideration by the Gov. new income tax rate 0.30 24 Q1 d. E L w 25 26 27 28 29 30 31 32 33 revenue forgone Q1 e. E L 34 14