Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Put the following Facts into an excel: Ken runs a successful consulting business and is known for entertaining his clients. In 2022, Ken incurred the

Put the following Facts into an excel:

Ken runs a successful consulting business and is known for entertaining his clients. In 2022, Ken incurred the following expenses:

- $42,000 membership to a golf club

- $28,000 for meals in the golf clubs clubhouse (a private establishment not considered a restaurant). Ken was present at all these meals.

- $52,000 for meals at restaurants. Ken or one of his associates was present at 70% of these meals. Sometimes he offers to pay for clients to take their spouses to dinner as a thank you for their business.

- $36,500 for a suite at eight home football games. The $36,500 includes tickets for 12 people, valued at $28,800. The remainder is for food and non-alcoholic drinks for everyone who attends the games. Ken attended six of the games. The entire $36,500 is billed as a single amount.

- $16,000 for alcoholic beverages at football games. This amount is billed separately.

- $18,000 to host a party at his house for prospective clients. Ken hired the mayors daughter to cater the party. Every other caterer in town would have charged $12,000 for the event but Ken thought by paying extra to the mayors daughter, he might get some consulting work for the city.

Under what circumstances can Ken deduct these expenses? Can you offer any suggestions for increasing the amount deductible? Estimate how much you could save if Ken took your advice. Assume his marginal rate on business income is 37%.

Looking at 274 and IRS Notice 2018-76 (but keep the 2022 exception in mind) will help.

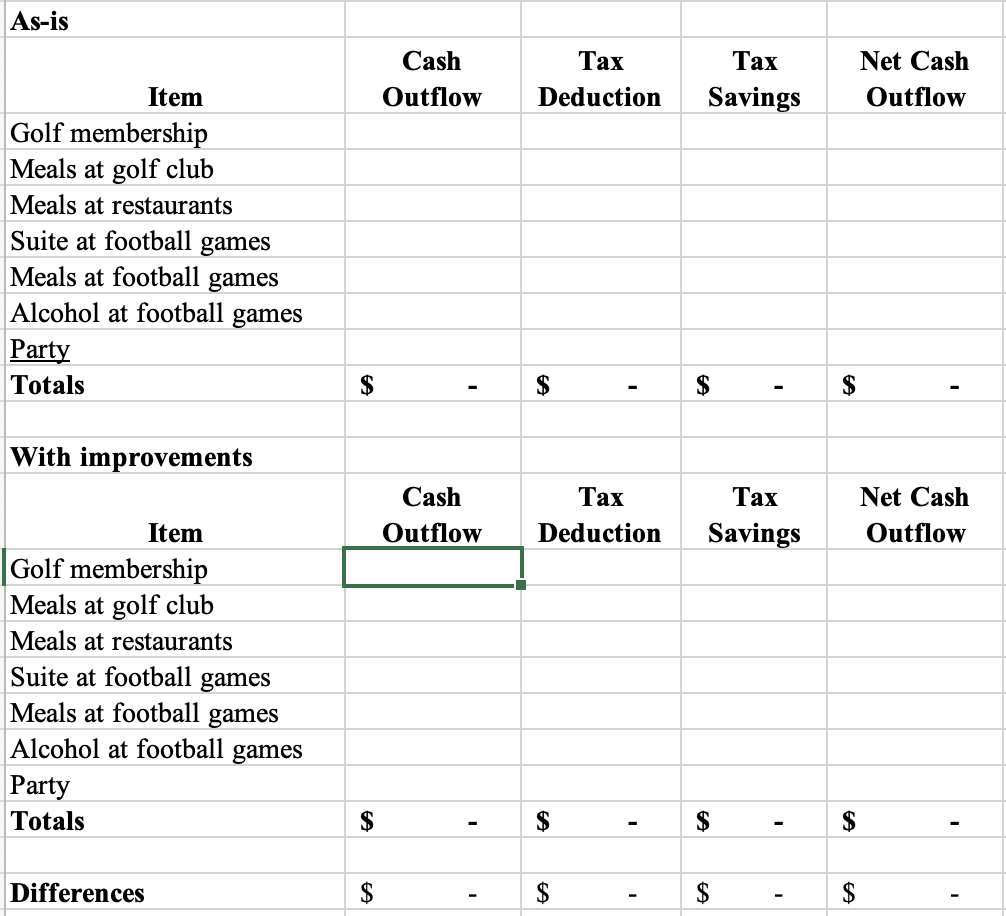

Here is the template :

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|l|}{ As-is } \\ \hline & \begin{tabular}{c} Cash \\ Outflow \end{tabular} & \begin{tabular}{c} Tax \\ Deduction \end{tabular} & \begin{tabular}{c} Tax \\ Savings \end{tabular} & \begin{tabular}{l} Net Cash \\ Outflow \end{tabular} \\ \hline Golf membe & & & & \\ \hline Meals at golf & & & & \\ \hline Meals at rest & & & & \\ \hline Suite at footh & & & & \\ \hline Meals at foot & & & & \\ \hline Alcohol at fo & & & & \\ \hline Party & & & & \\ \hline Totals & $ & $ & $ & $ \\ \hline With impro & & & & \\ \hline & \begin{tabular}{c} Cash \\ Outflow \end{tabular} & \begin{tabular}{c} Tax \\ Deduction \end{tabular} & \begin{tabular}{c} Tax \\ Savings \end{tabular} & \begin{tabular}{c} Net Cash \\ Outflow \end{tabular} \\ \hline Golf member & & & & \\ \hline Meals at golf & & & & \\ \hline Meals at resta & & & & \\ \hline Suite at footb & & & & \\ \hline Meals at foot & & & & \\ \hline Alcohol at fo & & & & \\ \hline Party & & & & \\ \hline Totals & $ & $ & $ & $ \\ \hline Differences & $ & $ & $ & $ \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|l|}{ As-is } \\ \hline & \begin{tabular}{c} Cash \\ Outflow \end{tabular} & \begin{tabular}{c} Tax \\ Deduction \end{tabular} & \begin{tabular}{c} Tax \\ Savings \end{tabular} & \begin{tabular}{l} Net Cash \\ Outflow \end{tabular} \\ \hline Golf membe & & & & \\ \hline Meals at golf & & & & \\ \hline Meals at rest & & & & \\ \hline Suite at footh & & & & \\ \hline Meals at foot & & & & \\ \hline Alcohol at fo & & & & \\ \hline Party & & & & \\ \hline Totals & $ & $ & $ & $ \\ \hline With impro & & & & \\ \hline & \begin{tabular}{c} Cash \\ Outflow \end{tabular} & \begin{tabular}{c} Tax \\ Deduction \end{tabular} & \begin{tabular}{c} Tax \\ Savings \end{tabular} & \begin{tabular}{c} Net Cash \\ Outflow \end{tabular} \\ \hline Golf member & & & & \\ \hline Meals at golf & & & & \\ \hline Meals at resta & & & & \\ \hline Suite at footb & & & & \\ \hline Meals at foot & & & & \\ \hline Alcohol at fo & & & & \\ \hline Party & & & & \\ \hline Totals & $ & $ & $ & $ \\ \hline Differences & $ & $ & $ & $ \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started