Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Putrajaya Berhad's bonds will mature in 13 years. The bonds have face value of RM1,500 and 8 percent coupon rate, paid annually. The price

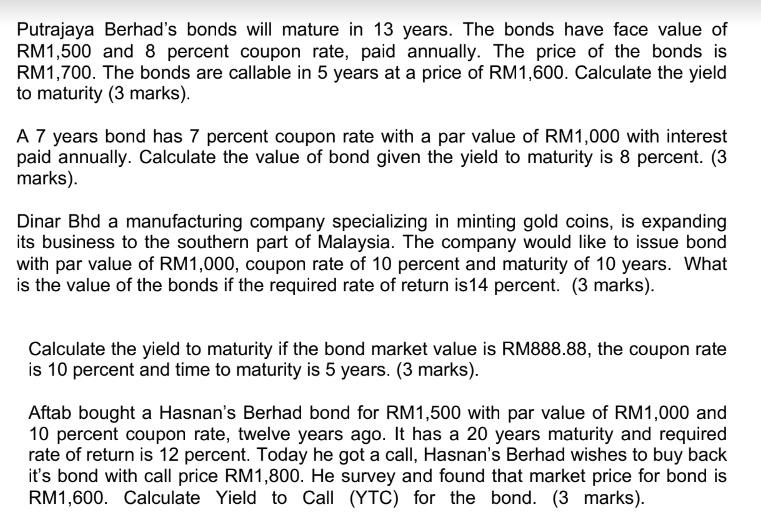

Putrajaya Berhad's bonds will mature in 13 years. The bonds have face value of RM1,500 and 8 percent coupon rate, paid annually. The price of the bonds is RM1,700. The bonds are callable in 5 years at a price of RM1,600. Calculate the yield to maturity (3 marks). A 7 years bond has 7 percent coupon rate with a par value of RM1,000 with interest paid annually. Calculate the value of bond given the yield to maturity is 8 percent. (3 marks). Dinar Bhd a manufacturing company specializing in minting gold coins, is expanding its business to the southern part of Malaysia. The company would like to issue bond with par value of RM1,000, coupon rate of 10 percent and maturity of 10 years. What is the value of the bonds if the required rate of return is 14 percent. (3 marks). Calculate the yield to maturity if the bond market value is RM888.88, the coupon rate is 10 percent and time to maturity is 5 years. (3 marks). Aftab bought a Hasnan's Berhad bond for RM1,500 with par value of RM1,000 and 10 percent coupon rate, twelve years ago. It has a 20 years maturity and required rate of return is 12 percent. Today he got a call, Hasnan's Berhad wishes to buy back it's bond with call price RM1,800. He survey and found that market price for bond is RM1,600. Calculate Yield to Call (YTC) for the bond. (3 marks).

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the values and yields for each of the bond scenarios 1 Yield to Maturity YTM for Putr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started