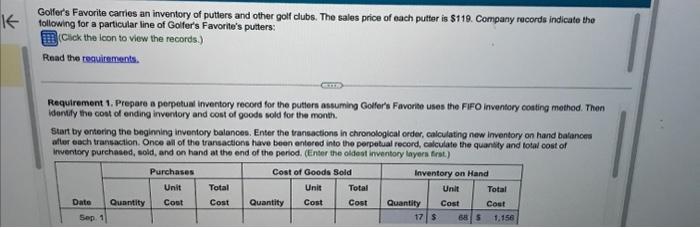

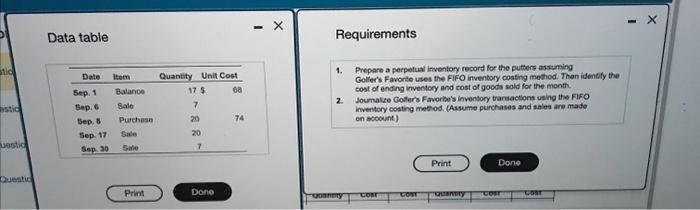

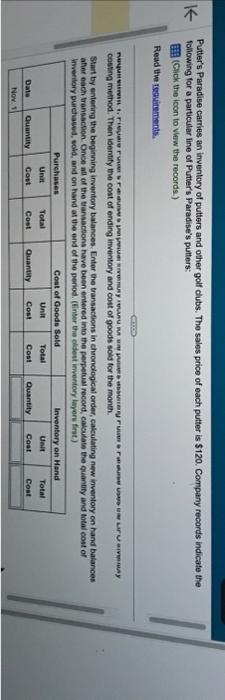

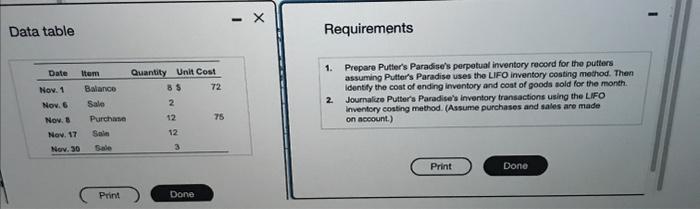

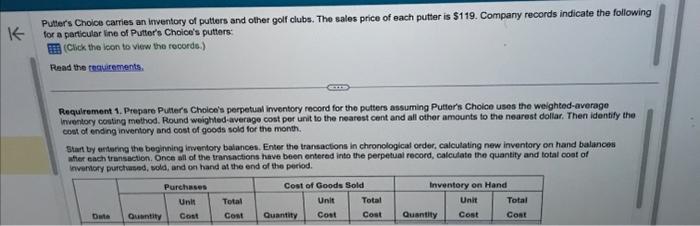

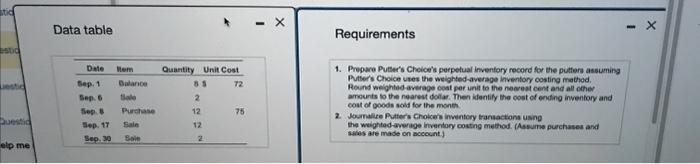

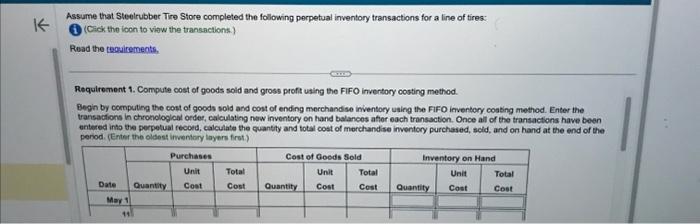

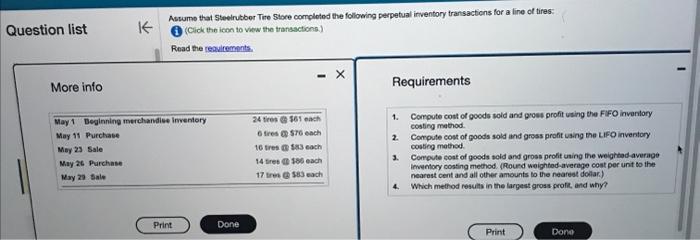

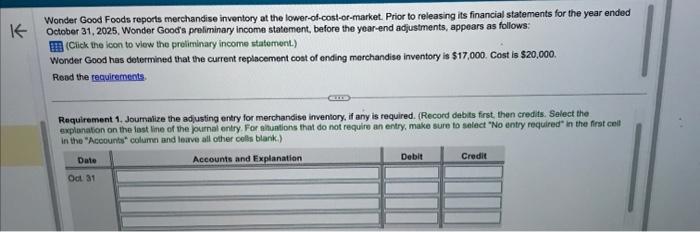

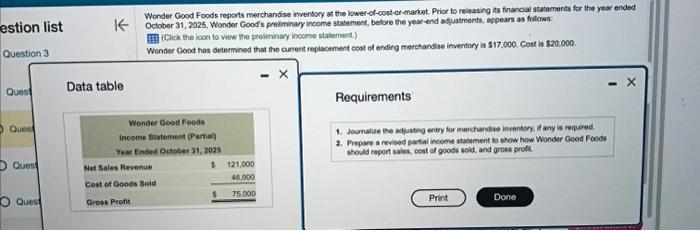

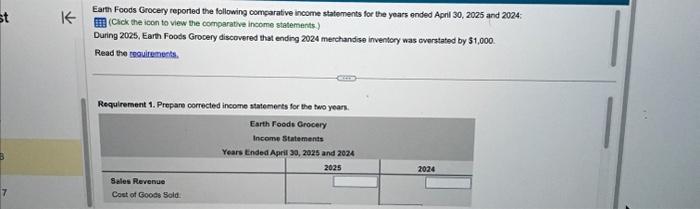

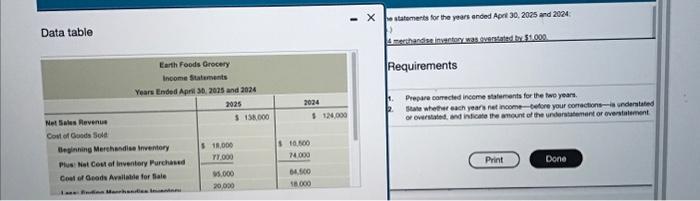

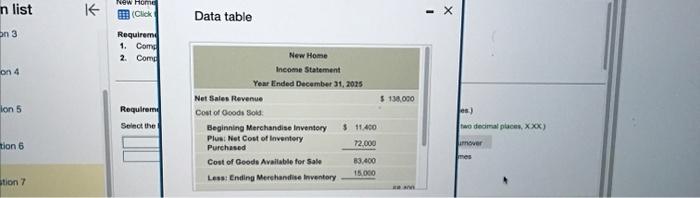

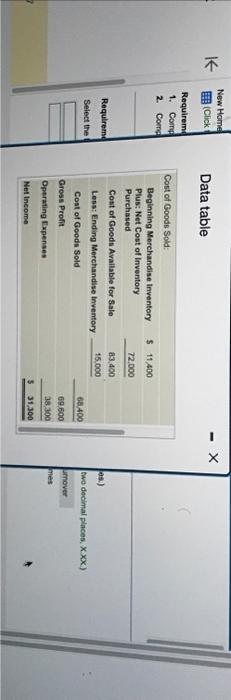

Putter's Paradise carries an inventory of putters and other golf clubs. The sales price of each putter is $120. Company records indicate the following for a particular line of Putter's Paradise's putters: (Cick the icon to vier w the records.) Read the terkitements, costrig method. Then identify the cost of ending irwentory and cost of goods sold for the month. Stat by entering the beginning inventory balances. Enter the transactions in chronological crder, calculating new inventory on hand balances afine each trankaction. Once all of the vansaesons have been entered into the perpetual record, calculate the guantify and total cost of Imvertary purchased, sold, and on hand at the end of the period. (Finber the clibet imentory tapers firnt.) Data table Requirements 1. Prepare Putter's Paradise's perpetual inventory recond for the putters assuming Putter's Paradise uses the LIFO inventory costing method. Then lidentify the cost of ending imventory and cost of goods sold for the month. 2. Journalice Putter's Paradise's inventory transactions using the LIFO Inventory costing method. (Assume purchases and sales are made on acoount.) Aswume that Steelrubber Tine Store comploted the following perpetual irventory transactions for a line of tires: (Click the icen to view the transactiona) Read the More into Requirements 1. Compute cost of goods sold and groes profit using the FFF invoritory costing mathod. 2. Compute cost of goods sold and gross profit using the LIFO inventory costing mathod. 3. Compute sost of goods sold and gross profit using the woightad average imentory costing medhod. (Roued woightod-average cont per unt to the nearest cent and all other amounts to the nearest dolar.) 4. Which method results in the largest gross profi, and why? Data table Requirements 1. Prepare a perpotual inventory record for the putters assuming Collers Favorite uses the FIFO inventory costing method. Then idendify the cost of ending inventory and cost of goods sold for the month. 2. Joumalte Cofter's Favorbu's inventory transactions uaing the FIFO inventory costing metod. (Assume purchases and sales ane made en socount ) Data table Assume that Steolrubber Tire Store completed the following perpetual inventory transactions for a line of tires: (1. (Cick the icon to viow the transactions.) Read the teouirements. Requirement 1. Compute cost of goods sold and gross proft using the FIFO imvertory costing method. Begin by computing the cost of goods sold and cost of ending merchandse inventory using the FiFO imvertory coaking method. Enter the transactions in chronological order, calculating now inventory on hand balances afier each transaction. Once all of the transactions have beon entered into the perpetual recoed, calculate the quantity and total cost of morchandise inventory purchased, scid, and on hand at the end of the penod. (Enter the oldest inventary layers first) Data table Data table Wonder Good Foods reports merchandise inventory at the lower-of-cost-or-market. Prior to releasing its financial statements for the year ended October 31, 2025. Wonder Good's proliminary income statement, before the yoar-end adjustments, appears as follows: (Click the icen to view the proliminary income statement.) Wonder Good has determined that the current replacement cost of ending merchandise inventory is $17,000. Cost is $20,000. Read the requirements Requirement 1. Joumalize the adjusting entry for merchandise imventory, if any is required. (Record debits first. then credits. Select the in the "Acoounts" columa and learve all other celks blarik.) Putier's Choice carries an inventory of putters and other golf clubs. The sales price of each putter is $119. Company records indicate the following for a particular line of Puttor's Choice's putters: (Click the icon to vierw the recorde.) Read the tequirements: Requlrement 1. Prepare Puters Choice's perpetual imvontory record for the putters assuming Putter's Choice uses the weighted-average inventory costing method. Round weighted-average cost per unit to the nearest cent and all other ameunts to the nearest dollar, Then identify the cost of ending invertory and cost of goods sold for the month. Start ty ertering the beginning irventory balances. Enter the transactions in chronclogical order, calculating new inventory en hand balances invartory putchaspd, sold, and on hand at the end of the poriod. Wonder Good Foods reports merchandise inventory at the lowet-of-cost-ot-market. Price to relhasing its fnancial statements for the year ended October 31, 2025, Wonder Good's prelminary income statement, before the year-end effuatmants, appears as follows: Efl (Click the loon to vivw the proliminary income stabernent) Wonder Good has determined that the curent repiacement cost of endirg marchandise inventory is 517.000,Cott is $20.000. Data table Requirements 1. Jounalue the adputing entry for merchandise inventorx, if any is mequined. 2. Prepare a revised partal income stasament bo show how Wonder Geod Foods New Home reported the following income statement for the year ended December 31, 2025: (Click the icon to view the income statement.) Requirements 1. Compute New Home's inventory turnover rate for the year. (Round to two decimal places.) 2. Compute New Home's days' sales in inventory for the year. (Round to two decimal places.) Requirement 1. Compute New Horne's inventory turnover rate for the year. (Round to two decimal places.) Soloct the labels and entar the amounts to compute the inventory turnover rate, (Round your answer to two decimal places, X. x.) Golfer's Favorite carries an inventory of putters and other golf clubs. The sales price of each putter is $119. Company rucords indicate the following for a particular line of Golfer's Favorite's putters: (Cick the icon to view the records.) Read the requirements. Requirement 1. Prepare a perpetual inventory record for the putiers assuming Golfor's Favorite uses the FIFO inventory coating method. Then identify the cost do ending inventory and cost of goods sold for the month. Start by ontoring the beginning inventory balances. Enter the transactions in chronological erder, calculating new imventary on hand balances after ebch transaction. Once all of the transactions have been entered into the perpetual fecord, calculate the quanity and total cost of inventory purchased, sold, and on hand at the ond of the period. (Enter the olfest inventory layern trat)