Answered step by step

Verified Expert Solution

Question

1 Approved Answer

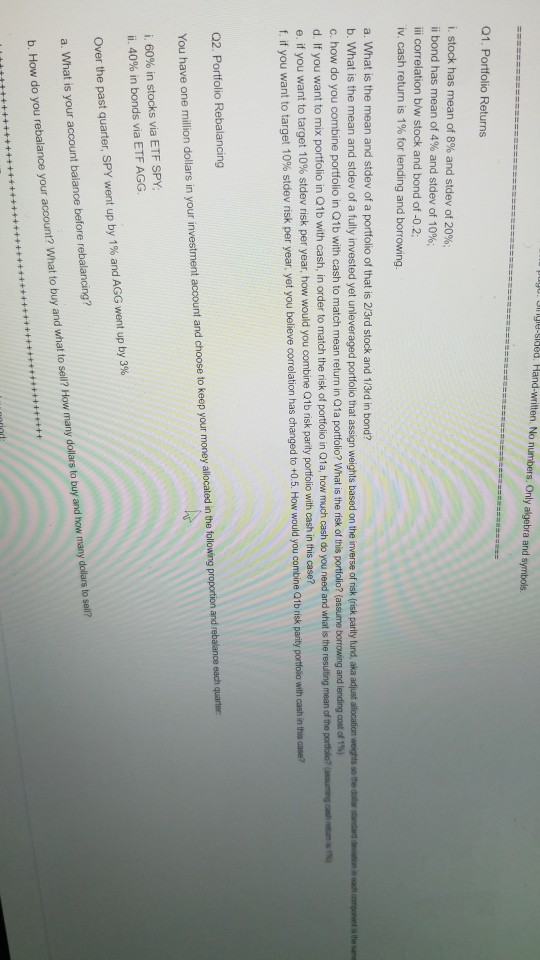

puyu. Ungle-sided. Hand-written No numbers. Only algebra and symbols. Q1. Portfolio Returns i. stock has mean of 8% and stdev of 20%, ii bond has

puyu. Ungle-sided. Hand-written No numbers. Only algebra and symbols. Q1. Portfolio Returns i. stock has mean of 8% and stdev of 20%, ii bond has mean of 4% and stdev of 10%; ili correlation b/w stock and bond of -0.2; iv. cash return is 1% for lending and borrowing. a d hom e a. What is the mean and stdev of a portfolio of that is 2/3rd stock and 1/3rd in bond? b. What is the mean and sidev of a fully invested yet unleveraged portfolio that assign weights based on the inverse of risk (risk parity fund, aka adjust a location weights so the de c. how do you combine portfolio in Q1b with cash to match mean return in Q1a portfolio? What is the risk of this portfolio? (assume borrowing and lending cost of 15) d. If you want to mix portfolio in Q1b with cash, in order to match the risk of portfolio in Q1a, how much cash do you need and what is the resulting mean of the portfolio c e. if you want to target 10% stdev risk per year, how would you combine Q1b risk parily portfolio with cash in this case? f. if you want to target 10% sidev risk per year, yet you believe correlation has changed to +0.5. How would you combine Q1b risk parity portfolio with cash in this case? . a 02 Portfolio Rebalancing You have one million dollars in your investment account and choose to keep your money allocated in the following proportion and rebalance each quarter 1.60% in stocks via ETF SPY: ii. 40% in bonds via ETF AGG. Over the past quarter, SPY went up by 1% and AGG went up by 3% a. What is your account balance before rebalancing? b. How do you rebalance your account? What to buy and what to sell? How many dollars to buy and how many dollars to sell? puyu. Ungle-sided. Hand-written No numbers. Only algebra and symbols. Q1. Portfolio Returns i. stock has mean of 8% and stdev of 20%, ii bond has mean of 4% and stdev of 10%; ili correlation b/w stock and bond of -0.2; iv. cash return is 1% for lending and borrowing. a d hom e a. What is the mean and stdev of a portfolio of that is 2/3rd stock and 1/3rd in bond? b. What is the mean and sidev of a fully invested yet unleveraged portfolio that assign weights based on the inverse of risk (risk parity fund, aka adjust a location weights so the de c. how do you combine portfolio in Q1b with cash to match mean return in Q1a portfolio? What is the risk of this portfolio? (assume borrowing and lending cost of 15) d. If you want to mix portfolio in Q1b with cash, in order to match the risk of portfolio in Q1a, how much cash do you need and what is the resulting mean of the portfolio c e. if you want to target 10% stdev risk per year, how would you combine Q1b risk parily portfolio with cash in this case? f. if you want to target 10% sidev risk per year, yet you believe correlation has changed to +0.5. How would you combine Q1b risk parity portfolio with cash in this case? . a 02 Portfolio Rebalancing You have one million dollars in your investment account and choose to keep your money allocated in the following proportion and rebalance each quarter 1.60% in stocks via ETF SPY: ii. 40% in bonds via ETF AGG. Over the past quarter, SPY went up by 1% and AGG went up by 3% a. What is your account balance before rebalancing? b. How do you rebalance your account? What to buy and what to sell? How many dollars to buy and how many dollars to sell

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started