Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Python acquired 7 5 % of Slither's stock for $ 3 1 6 , 0 0 0 in cash on January 2 , 2 0

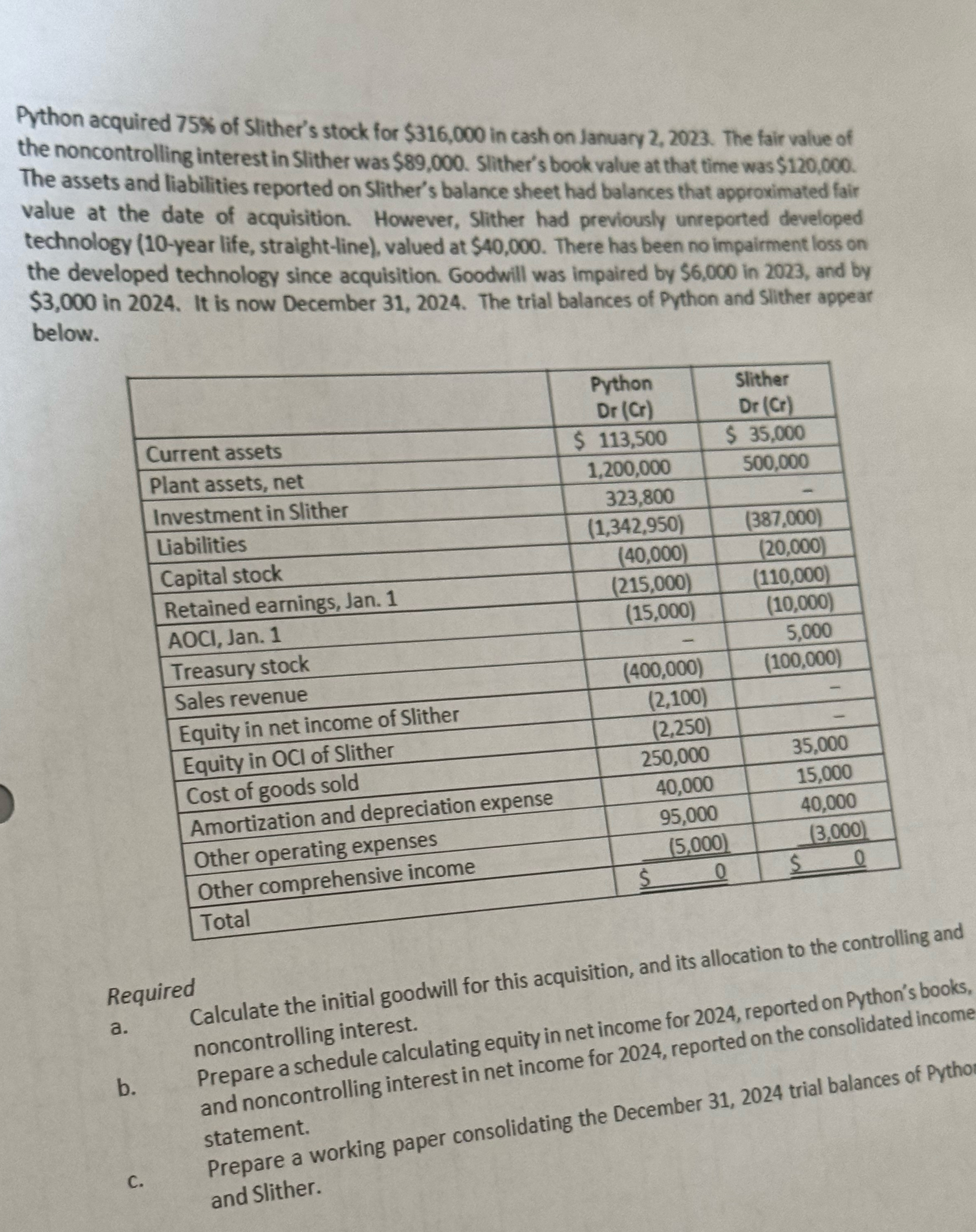

Python acquired of Slither's stock for $ in cash on January The fair value of the noncontrolling interest in Slither was $ Slither's book value at that time was $ The assets and liabilities reported on Slither's balance sheet had balances that approximated fair value at the date of acquisition. However, Slither had previously unreported developed technology year life, straightline valued at $ There has been no impairment loss on the developed technology since acquisition. Goodwill was impaired by $ in and by $ in It is now December The trial balances of Python and Slither appear below.

Required

a Calculate the initial goodwill for this acquisition, and its allocation to the controlling and noncontrolling interest.

b Prepare a schedule calculating equity in net income for reported on Python's books. and noncontrolling interest in net income for reported on the consolidated income statement.

c Prepare a working paper consolidating the December trial balances of Pytho and Slither.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started