Answered step by step

Verified Expert Solution

Question

1 Approved Answer

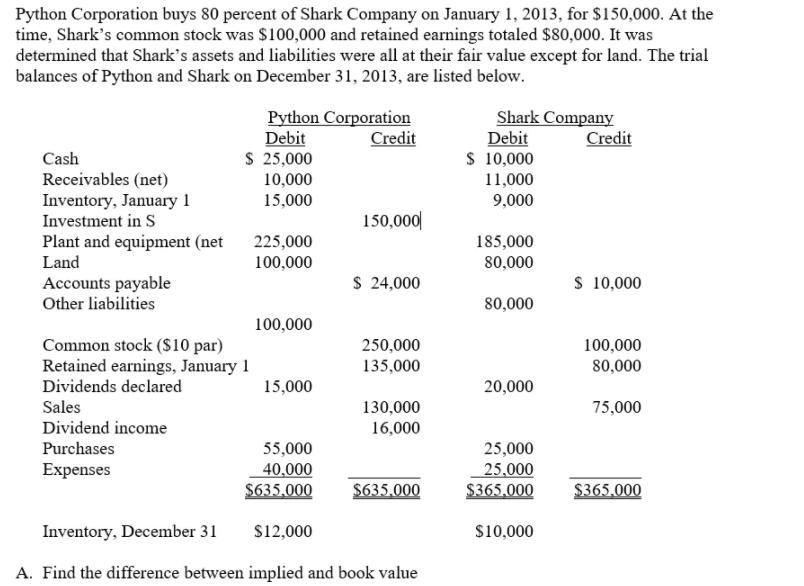

Python Corporation buys 80 percent of Shark Company on January 1, 2013, for S150,000. At the time, Shark's common stock was $100,000 and retained

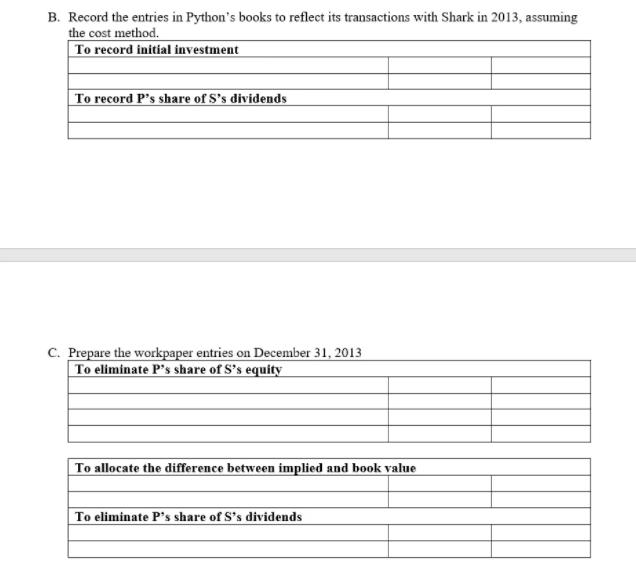

Python Corporation buys 80 percent of Shark Company on January 1, 2013, for S150,000. At the time, Shark's common stock was $100,000 and retained earnings totaled $80,000. It was determined that Shark's assets and liabilities were all at their fair value except for land. The trial balances of Python and Shark on December 31, 2013, are listed below. Python Corporation Debit S 25,000 Shark Company Debit $ 10,000 11,000 Credit Credit Cash Receivables (net) Inventory, January 1 Investment in S 10,000 15,000 9,000 150,000| Plant and equipment (net Land 225,000 185,000 80,000 100,000 Accounts payable Other liabilities S 24,000 S 10,000 80,000 100,000 Common stock (S10 par) Retained earnings, January 1 Dividends declared 250,000 100,000 135,000 80,000 15,000 20,000 Sales 130,000 75,000 Dividend income 16,000 Purchases 55,000 40,000 $635,000 25,000 25.000 $365,000 Expenses $635.000 $365,000 Inventory, December 31 S12,000 S10,000 A. Find the difference between implied and book value B. Record the entries in Python's books to reflect its transactions with Shark in 2013, assuming the cost method. To record initial investment To record P's share of S's dividends C. Prepare the workpaper entries on December 31, 2013 To eliminate P's share of S's equity To allocate the difference between implied and book value To eliminate P's share of S's dividends Python Corporation buys 80 percent of Shark Company on January 1, 2013, for S150,000. At the time, Shark's common stock was $100,000 and retained earnings totaled $80,000. It was determined that Shark's assets and liabilities were all at their fair value except for land. The trial balances of Python and Shark on December 31, 2013, are listed below. Python Corporation Debit S 25,000 Shark Company Debit $ 10,000 11,000 Credit Credit Cash Receivables (net) Inventory, January 1 Investment in S 10,000 15,000 9,000 150,000| Plant and equipment (net Land 225,000 185,000 80,000 100,000 Accounts payable Other liabilities S 24,000 S 10,000 80,000 100,000 Common stock (S10 par) Retained earnings, January 1 Dividends declared 250,000 100,000 135,000 80,000 15,000 20,000 Sales 130,000 75,000 Dividend income 16,000 Purchases 55,000 40,000 $635,000 25,000 25.000 $365,000 Expenses $635.000 $365,000 Inventory, December 31 S12,000 S10,000 A. Find the difference between implied and book value B. Record the entries in Python's books to reflect its transactions with Shark in 2013, assuming the cost method. To record initial investment To record P's share of S's dividends C. Prepare the workpaper entries on December 31, 2013 To eliminate P's share of S's equity To allocate the difference between implied and book value To eliminate P's share of S's dividends

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Onswen poge 01 AN Di ff exence between Net implied and book value asset a share...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started