Answered step by step

Verified Expert Solution

Question

1 Approved Answer

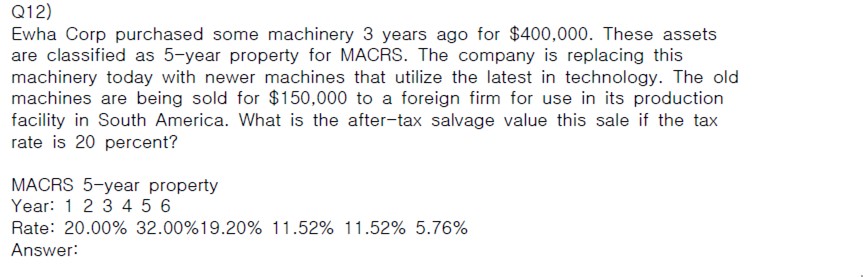

Q 1 2 ) Ewha Corp purchased some machinery 3 years ago for $ 4 0 0 , 0 0 0 . These assets are

Q

Ewha Corp purchased some machinery years ago for $ These assets

are classified as year property for MACRS. The company is replacing this

machinery today with newer machines that utilize the latest in technology. The old

machines are being sold for $ to a foreign firm for use in its production

facility in South America. What is the aftertax salvage value this sale if the tax

rate is percent?

MACRS year property

Year:

Rate:

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started