Q. 1. An evaluation of lululemons financial and operating performance as displayed in case Exhibit 1

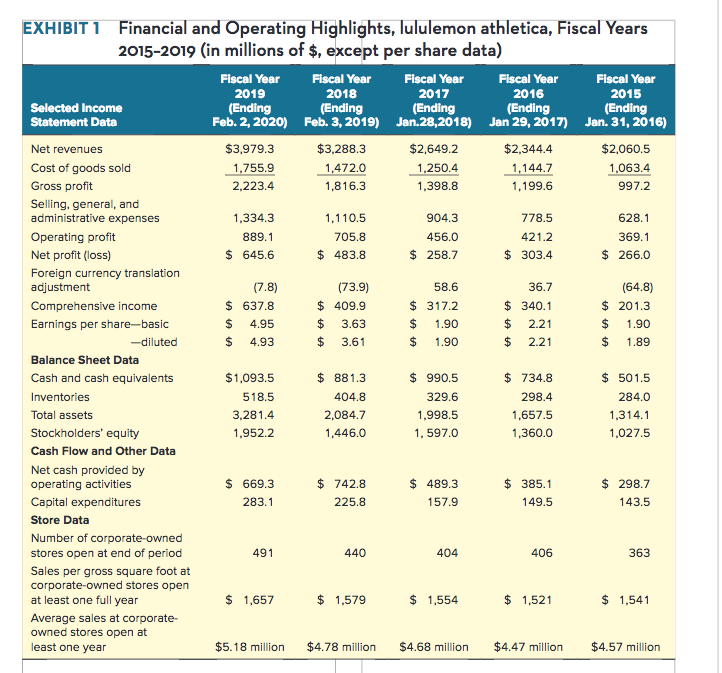

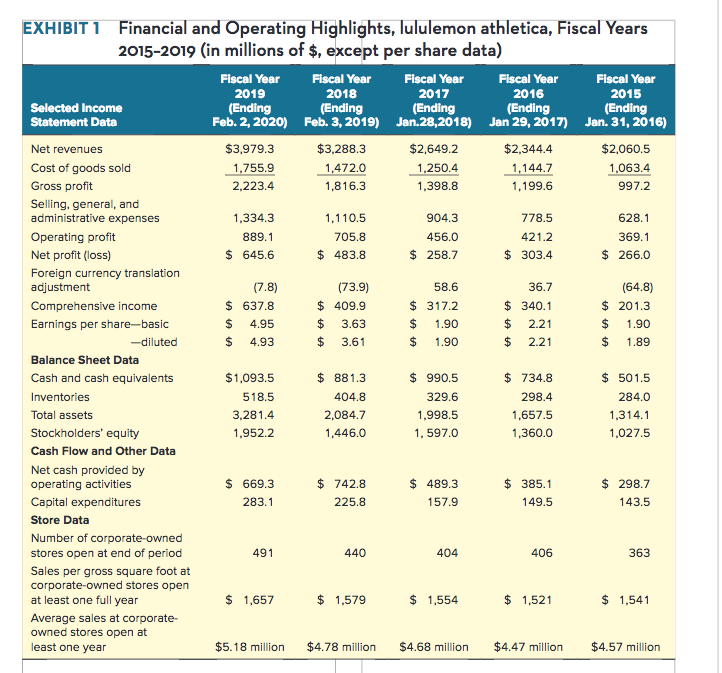

EXHIBIT 1 Financial and Operating Highlights, lululemon athletica, Fiscal Years 2015-2019 (in millions of $, except per share data) Selected Income Statement Data Net revenues Cost of goods sold Gross profit Selling, general, and administrative expenses Operating profit Net profit (loss) Foreign currency translation adjustment Comprehensive income Earnings per share-basic -diluted Balance Sheet Data Cash and cash equivalents Inventories Total assets Stockholders' equity Cash Flow and Other Data Net cash provided by operating activities Capital expenditures Store Data Number of corporate-owned stores open at end of period Sales per gross square foot at corporate-owned stores open at least one full year Average sales at corporate- owned stores open at least one year Fiscal Year 2019 (Ending Feb. 2, 2020) $3,979.3 1,755.9 2,223.4 1,334.3 889.1 $ 645.6 (7.8) $ 637.8 $ $ 4.95 4.93 $1,093.5 518.5 3,281.4 1,952.2 $ 669.3 283.1 491 $ 1,657 $5.18 million Fiscal Year 2018 (Ending Feb. 3, 2019) $3,288.3 1,472.0 1,816.3 1,110.5 705.8 $ 483.8 (73.9) $ 409.9 $ $ 3.63 3.61 $881.3 404.8 2,084.7 1,446.0 $742.8 225.8 440 $ 1,579 $4.78 million Fiscal Year 2017 (Ending Jan.28,2018) $2,649.2 1,250.4 1,398.8 904.3 456.0 $ 258.7 58.6 $317.2 $ 1.90 $ 1.90 $990.5 329.6 1,998.5 1, 597.0 $ 489.3 157.9 404 $1,554 $4.68 million Fiscal Year 2016 (Ending Jan 29, 2017) $2,344.4 1,144.7 1,199.6 778.5 421.2 $ 303.4 36.7 $340.1 2.21 2.21 $ $ $734.8 298.4 1,657.5 1,360.0 $385.1 149.5 406 $ 1,521 $4.47 million Fiscal Year 2015 (Ending Jan. 31, 2016) $2,060.5 1,063.4 997.2 628.1 369.1 $ 266.0 (64.8) $ 201.3 $ 1.90 $ 1.89 $ 501.5 284.0 1,314.1 1,027.5 $ 298.7 143.5 363 $ 1,541 $4.57 million EXHIBIT 1 Financial and Operating Highlights, lululemon athletica, Fiscal Years 2015-2019 (in millions of $, except per share data) Selected Income Statement Data Net revenues Cost of goods sold Gross profit Selling, general, and administrative expenses Operating profit Net profit (loss) Foreign currency translation adjustment Comprehensive income Earnings per share-basic -diluted Balance Sheet Data Cash and cash equivalents Inventories Total assets Stockholders' equity Cash Flow and Other Data Net cash provided by operating activities Capital expenditures Store Data Number of corporate-owned stores open at end of period Sales per gross square foot at corporate-owned stores open at least one full year Average sales at corporate- owned stores open at least one year Fiscal Year 2019 (Ending Feb. 2, 2020) $3,979.3 1,755.9 2,223.4 1,334.3 889.1 $ 645.6 (7.8) $ 637.8 $ $ 4.95 4.93 $1,093.5 518.5 3,281.4 1,952.2 $ 669.3 283.1 491 $ 1,657 $5.18 million Fiscal Year 2018 (Ending Feb. 3, 2019) $3,288.3 1,472.0 1,816.3 1,110.5 705.8 $ 483.8 (73.9) $ 409.9 $ $ 3.63 3.61 $881.3 404.8 2,084.7 1,446.0 $742.8 225.8 440 $ 1,579 $4.78 million Fiscal Year 2017 (Ending Jan.28,2018) $2,649.2 1,250.4 1,398.8 904.3 456.0 $ 258.7 58.6 $317.2 $ 1.90 $ 1.90 $990.5 329.6 1,998.5 1, 597.0 $ 489.3 157.9 404 $1,554 $4.68 million Fiscal Year 2016 (Ending Jan 29, 2017) $2,344.4 1,144.7 1,199.6 778.5 421.2 $ 303.4 36.7 $340.1 2.21 2.21 $ $ $734.8 298.4 1,657.5 1,360.0 $385.1 149.5 406 $ 1,521 $4.47 million Fiscal Year 2015 (Ending Jan. 31, 2016) $2,060.5 1,063.4 997.2 628.1 369.1 $ 266.0 (64.8) $ 201.3 $ 1.90 $ 1.89 $ 501.5 284.0 1,314.1 1,027.5 $ 298.7 143.5 363 $ 1,541 $4.57 million