Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q 1 ( c ) . Regardless of what you found in Q 1 b , assume you received an Adjusted Sale Price of $

Qc Regardless of what you found in Qb assume you received an Adjusted Sale Price of $ million for the property at the end of Year

What is the Net Present Value assuming an discount rate and the Internal Rate of Return of this project?

Support your reasoning by listing the Unleveraged Cash Flows in each year of the holding period. You can do this with a table or simply list them ex: Year X: $ Year Y: $Understanding Cap Rates, Sale Price, and Unleveraged Cash Flows.

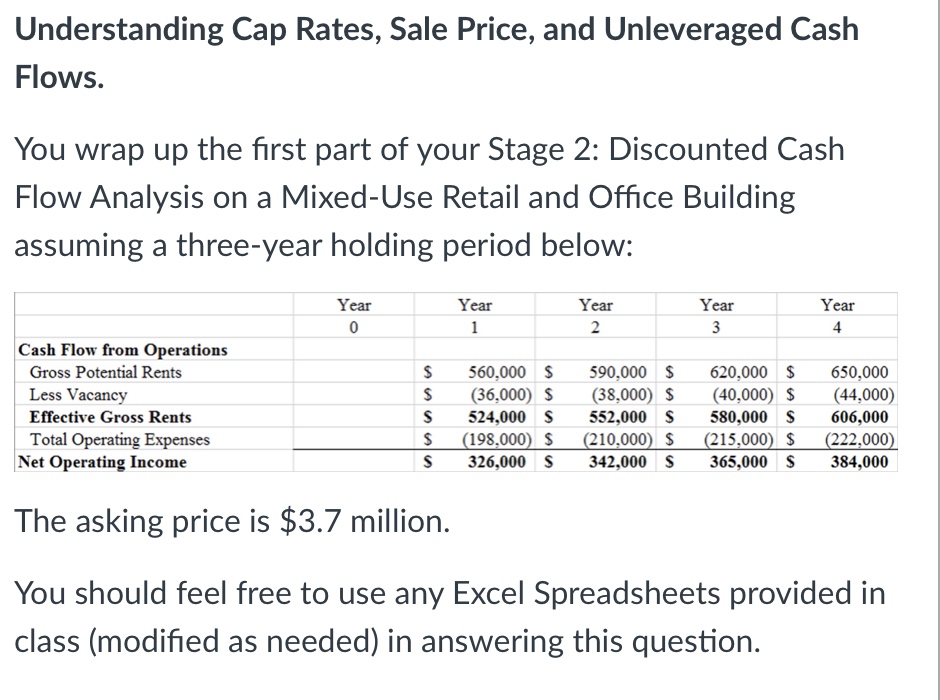

You wrap up the first part of your Stage : Discounted Cash Flow Analysis on a MixedUse Retail and Office Building assuming a threeyear holding period below:

tableYear,,Year,,Year,,Year,,YearCash Flow from OperationsGross Potential Rents,,$$$$Less Vacancy,,$$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started