Answered step by step

Verified Expert Solution

Question

1 Approved Answer

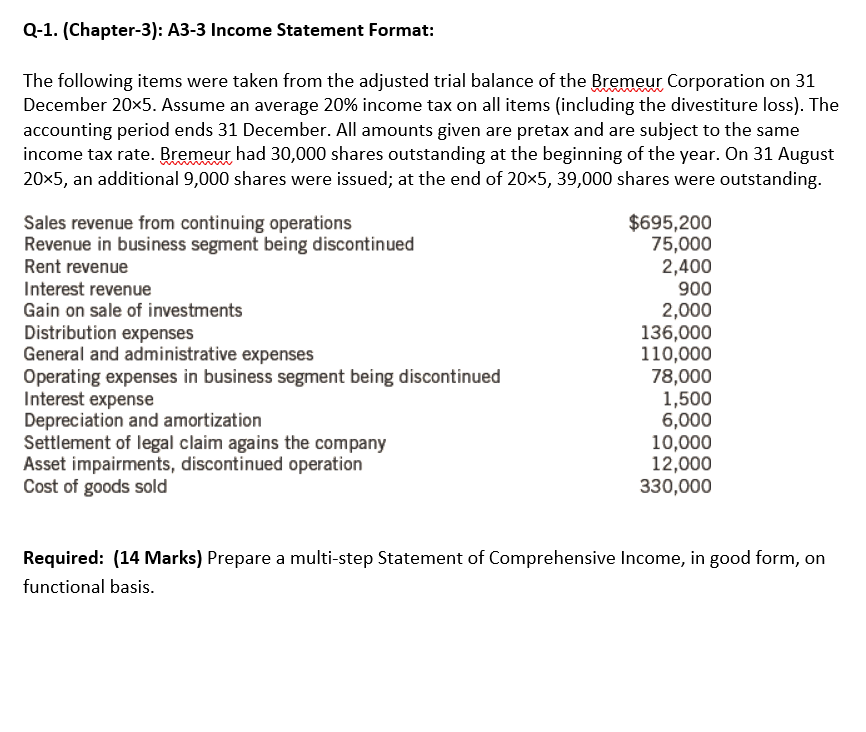

Q - 1 . ( Chapter - 3 ) : A 3 - 3 Income Statement Format: The following items were taken from the adjusted

QChapter: A Income Statement Format:

The following items were taken from the adjusted trial balance of the Bremeur Corporation on

December Assume an average income tax on all items including the divestiture loss The

accounting period ends December. All amounts given are pretax and are subject to the same

income tax rate. Bremeur had shares outstanding at the beginning of the year. On August

an additional shares were issued; at the end of shares were outstanding.

Required: Marks Prepare a multistep Statement of Comprehensive Income, in good form, on

functional basis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started