Answered step by step

Verified Expert Solution

Question

1 Approved Answer

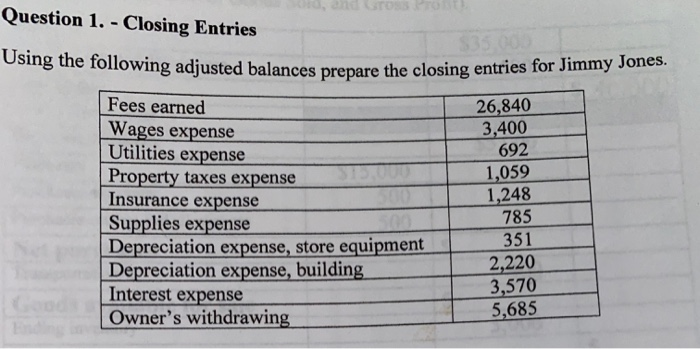

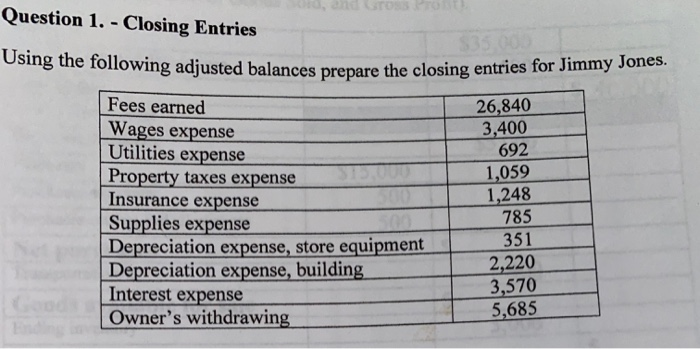

Q. 1 Closing Entries Using the following adjuster balances prepare the closing entries for Jimmy Jones Q.2 Adjusting Entries In general journal form, record adjusting

Q. 1 Closing Entries

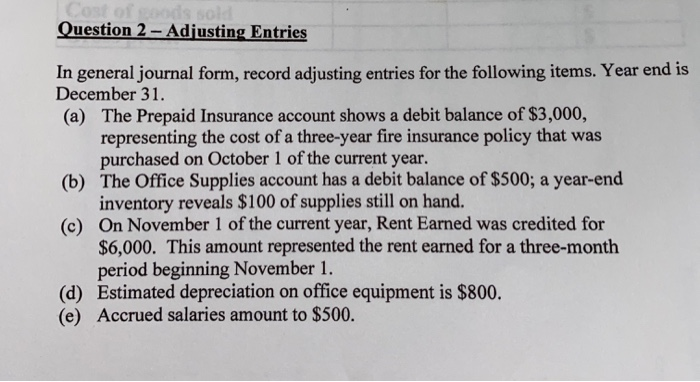

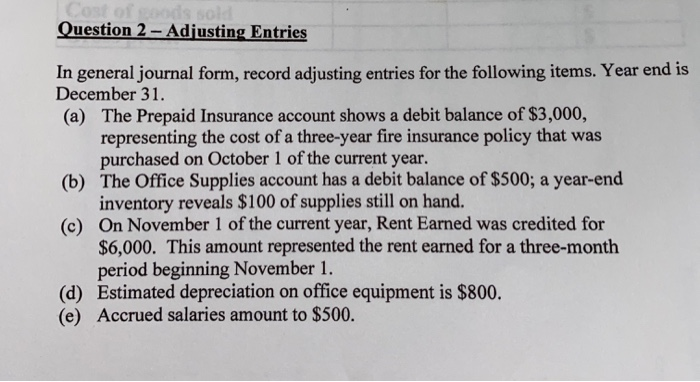

Question 1. - Closing Entries Using the following adjusted balances prepare the o mny adjusted balances prepare the closing entries for Jimmy Jones. Fees earned Wages expense Utilities expense Property taxes expense Insurance expense Supplies expense Depreciation expense, store equipment Depreciation expense, building Interest expense Owner's withdrawing 26,840 3,400 692 1,059 1,248 785 351 2,220 3,570 5,685 Question 2 - Adjusting Entries In general journal form, record adjusting entries for the following items. Year end is December 31. (a) The Prepaid Insurance account shows a debit balance of $3,000, representing the cost of a three-year fire insurance policy that was purchased on October 1 of the current year. The Office Supplies account has a debit balance of $500; a year-end inventory reveals $100 of supplies still on hand. (c) On November 1 of the current year, Rent Earned was credited for $6,000. This amount represented the rent earned for a three-month period beginning November 1. (d) Estimated depreciation on office equipment is $800. (e) Accrued salaries amount to $500 Using the following adjuster balances prepare the closing entries for Jimmy Jones

Q.2 Adjusting Entries

In general journal form, record adjusting entries for the following items. Year end is December 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started