Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q. 1 Engineering services division (ESD) provides engineering services (planning, basic design, detailed design, etc. for infrastructure projects). ESD has a normal capacity of

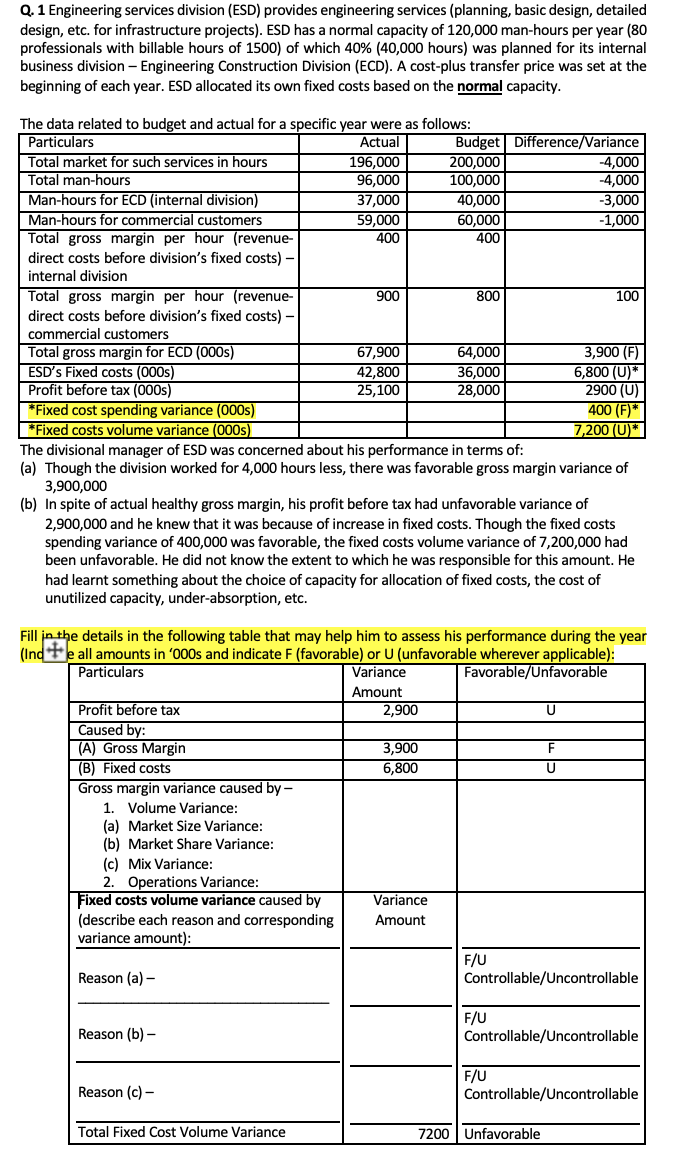

Q. 1 Engineering services division (ESD) provides engineering services (planning, basic design, detailed design, etc. for infrastructure projects). ESD has a normal capacity of 120,000 man-hours per year (80 professionals with billable hours of 1500) of which 40% (40,000 hours) was planned for its internal business division - Engineering Construction Division (ECD). A cost-plus transfer price was set at the beginning of each year. ESD allocated its own fixed costs based on the normal capacity. The data related to budget and actual for a specific year were as follows: Particulars Total market for such services in hours Total man-hours Man-hours for ECD (internal division) Man-hours for commercial customers Total gross margin per hour (revenue- direct costs before division's fixed costs) - internal division Actual Budget Difference/Variance 196,000 200,000 -4,000 96,000 100,000 -4,000 37,000 40,000 -3,000 59,000 60,000 -1,000 400 400 Total gross margin per hour (revenue- 900 800 100 direct costs before division's fixed costs) - commercial customers Total gross margin for ECD (000s) 67,900 64,000 3,900 (F) ESD's Fixed costs (000s) 42,800 36,000 6,800 (U)* Profit before tax (000s) 25,100 28,000 2900 (U) *Fixed cost spending variance (000s) *Fixed costs volume variance (000s) 400 (F)* 7,200 (U)* The divisional manager of ESD was concerned about his performance in terms of: (a) Though the division worked for 4,000 hours less, there was favorable gross margin variance of 3,900,000 (b) In spite of actual healthy gross margin, his profit before tax had unfavorable variance of 2,900,000 and he knew that it was because of increase in fixed costs. Though the fixed costs spending variance of 400,000 was favorable, the fixed costs volume variance of 7,200,000 had been unfavorable. He did not know the extent to which he was responsible for this amount. He had learnt something about the choice of capacity for allocation of fixed costs, the cost of unutilized capacity, under-absorption, etc. Fill in the details in the following table that may help him to assess his performance during the year (Inde all amounts in '000s and indicate F (favorable) or U (unfavorable wherever applicable): Favorable/Unfavorable Particulars Profit before tax Caused by: (A) Gross Margin Variance Amount 2,900 U 3,900 F (B) Fixed costs 6,800 Gross margin variance caused by - 1. Volume Variance: (a) Market Size Variance: (b) Market Share Variance: (c) Mix Variance: 2. Operations Variance: Fixed costs volume variance caused by Variance (describe each reason and corresponding Amount variance amount): F/U Reason (a)- Reason (b)- Controllable/Uncontrollable F/U Controllable/Uncontrollable F/U Reason (c) - Controllable/Uncontrollable Total Fixed Cost Volume Variance 7200 Unfavorable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Performance Analysis for ESD Table Particulars Variance FavorableUnfavorable Amount Profit before tax 2900 U Caused by A Gross Margin 3900 F B Fixed c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started