Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q - 1 ) Following inventory and cost data relate to a manufacturing company for 2 0 1 7 . Calculate the Cost of Goods

Q Following inventory and cost data relate to a manufacturing company for Calculate the Cost of Goods Sold as at December

tableItemJanuary December Raw materials,Work in process,Finished goods,Raw materials purchase,,Direct labor,Factory rent,Factory utilities,Indirect materials,Indirect labor,Operating expenses,

Q Company X produces audio equipments in its factory. Raw materials cost for an audio system is TL per unit. Workers on the production lines are paid TL per hour. An audio system takes hours to complete. In addition, the rent on the equipment used tClassemble audio systems amounts to TL per month. Miscellaneous materials cost TL per unit produced. A supervisor was hired to oversee production and her monthly salary is TL Factory janitorial costs will be TL per month. Local TV and radio channels will charge TL for advertisements per month. The factory building depreciation expense per year will be TL and factory property tax is TL per year. Material handling costs in the factory are expected to be around TL per month. Calculate unit production cost if the monthly production level is units.

Q For June th of Company X reported raw materials balance of TL WIP balance of TL and finished goods balance of TL in its balance sheet. During July;

Direct labor of TL and raw materials of TL was used.

TL worth of raw materials was purchased.

Manufacturing overhead used exclusive of indirect materials was equal to of direct labor costs.

At the end of July, sales totalled TL and gross profit was of the sales. COGS available for sale equalled TL Calculate the balance of finished goods as of July st

Q Company X applies MOH to jobs on the basis of machine, hours used. MOH costs are expected to total TL for the year, and machine usage is estimated at hours.

For the year, TL MOH costs are incurred and machine hours are used. Calculate the amount of COGS adjustment at yearend. Use if the COGS adjustment is credit. eg if the required adjustment is debiting COGS by enter If if the required adjustment is crediting COGS by enter

Q For June th of Company X reported raw materials balance of TL WIP balance of TL and finished goods balance of TL in its balance sheet. During July;

Direct labor of TL and raw materials of TL was used.

TL worth of raw materials was purchased.

Manufacturing overhead used exclusive of indirect materials was equal to of direct labor costs.

At the end of July, sales totalled TL and gross profit was of the sales. COGS available for sale equalled TL Calculate the balance of finished goods as of July st

Q Company X applies MOH to jobs on the basis of machine hours used. MOH costs are expected to total TL for the year, and machine usage is estimated at hours.

For the year, TL MOH costs are incurred and machine hours are used. Calculate the amount of COGS adjustment at yearend. Use if the COGS adjustment is credit. eg if the required adjustment is debiting COGS by enter If if the required adjustment is crediting COGS by enter

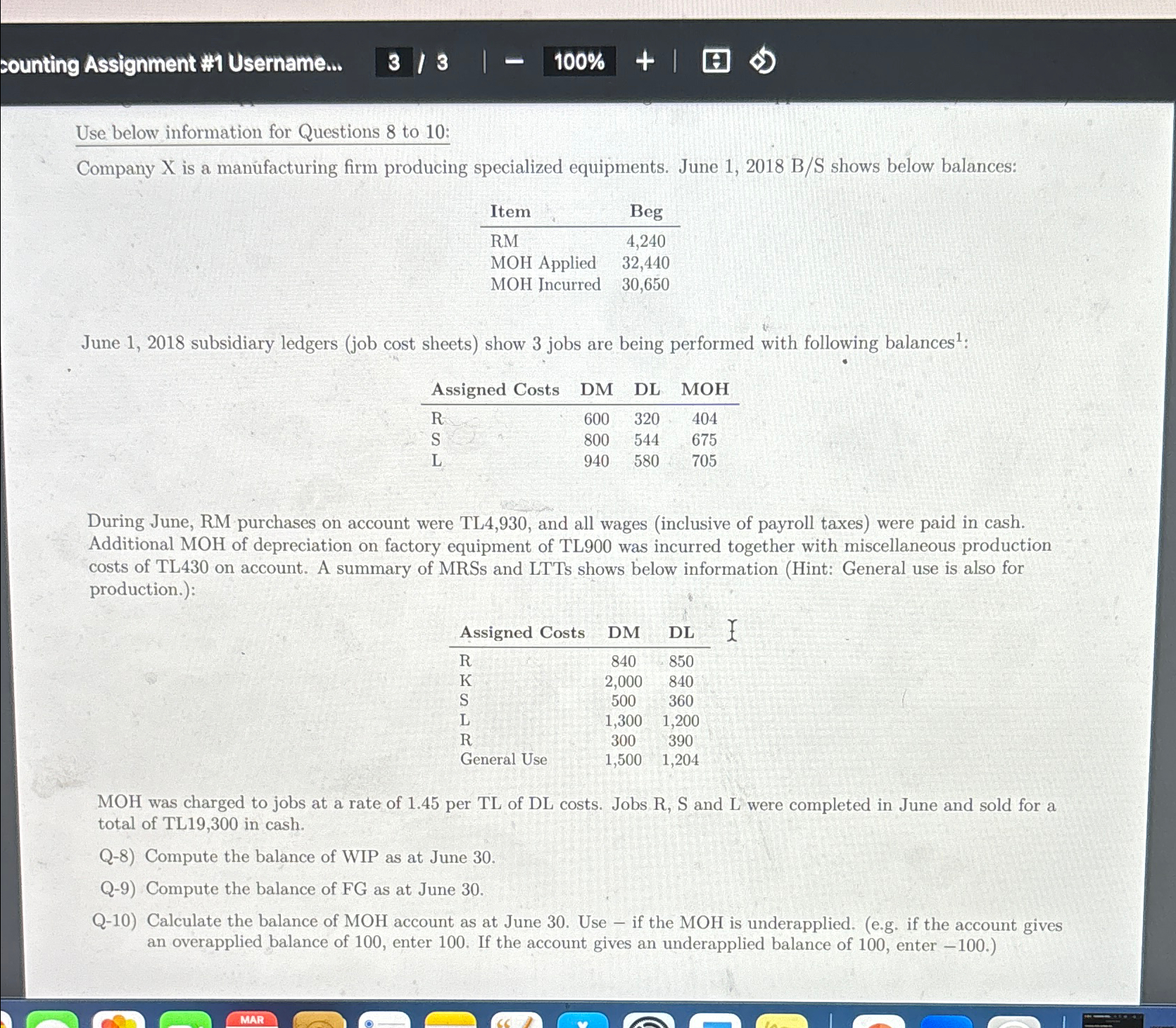

Use below information for Questions to :

Company uses a job cost system and applies overhead to production on the basis of direct labor cost. On January Job was the only job in process. The costs incurred prior to January on this job were as follows: DM of TL DL of TL and MOH of TL As of January Job had been completed at a cost of TL and was part of finished goods inventory. There was a TL balance in the raw materials inventory account.

During the month of January, Company X began production on Jobs and and completed Jobs and Jobs and were sold on account during the month for TL and TL respectively. Following additional events occurred during the month:

Purchased additional raw materials of TL on account.

Incurred factory labor costs of TL exclusive of payroll taxes. Payroll taxes amounted to TL

Incurred indirect materials of TL and indirect labor of TL

Depreciation on factory equipment totalled to TL

Other factory expenses on account were TL

During the month, Company assigned following costs to respective jobs as follows:

Company X estimates total manufacturing overhead costs of TL direct labor costs of TL and direct labor hours

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started