Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q# 1 Suppose you are expecting the stock price to move substantially over the next three months. You are considering a butterfly spread. Construct an

Q#

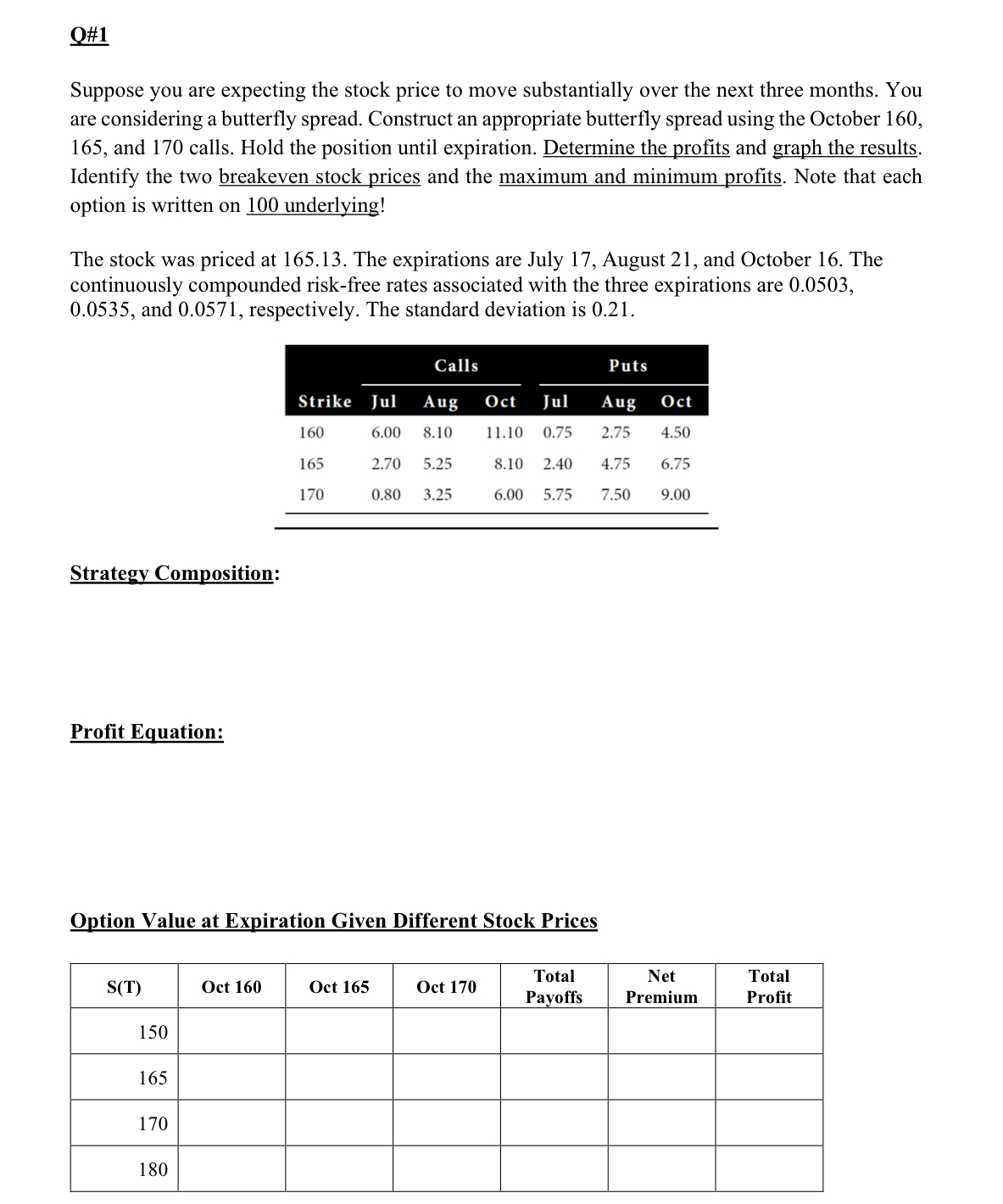

Suppose you are expecting the stock price to move substantially over the next three months. You

are considering a butterfly spread. Construct an appropriate butterfly spread using the October

and calls. Hold the position until expiration. Determine the profits and graph the results.

Identify the two breakeven stock prices and the maximum and minimum profits. Note that each

option is written on underlying!

The stock was priced at The expirations are July August and October The

continuously compounded riskfree rates associated with the three expirations are

and respectively. The standard deviation is

Strategy Composition:

Profit Equation:

Option Value at Expiration Given Different Stock Prices

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started