Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q . 2 . 2 Mrs Naidoo has compared the corrected June 2 0 2 4 bank reconciliation statement and the July 2 0 2

Q Mrs Naidoo has compared the corrected June bank reconciliation statement and the July cash journals to the July bank statement. She has noted the following:

The balance per the bank statement at July is Rfavourable

The totals of the cash books for July before any adjustments, were:

Cash book receipts: R

Cash book payments: R

Deposit DS# and EFT EDD appear on the July bank statement.

An EFT payment to a creditor Mighty Tools had been recorded in the cash book payments as R instead of R The bank statement reflected the correct amount.

A deposit of R on the July bank statement does not appear in Cliff Tools' cash journals. Mrs Naidoo queried this with the bank who informed her that the deposit had been made into the incorrect bank account and would be reversed in August

A transfer of R to the fixed deposit savings account on July had been recorded in the cash book receipts.

The following entries on the July bank statement do not appear in the July cash journals:

Bank charges of R

Debit order for Metro Fibre for internet charges of R

Stop order: Santam Insurance for R

Fixed deposit interest deposited into the current bank account of R

Direct deposit by a debtor, M Biyela, for R

The following transactions in the July cash journals did not appear in the July bank statement:

Deposits: : R

Payments: : R

Required:

Q Record any differences identified in the July bank reconciliation process in

the supplementary cash book receipts and payments with columns for details and amount. Begin with the totals before any amendments.

Q Open, post to and balance the July bank account in the general ledger.

Q Prepare the bank reconciliation statement as at July

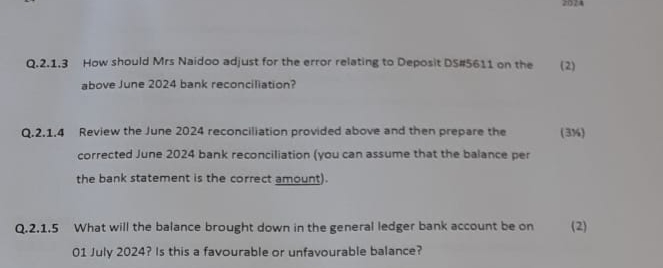

Q How should Mrs Naidoo adjust for the error relating to Deposit DSm on the

above June bank reconciliation?

Q Review the June reconciliation provided above and then prepare the

K

corrected June bank reconciliation you can assume that the balance per the bank statement is the correct amount

Q What will the balance brought down in the general ledger bank account be on

July Is this a favourable or unfavourable balance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started