Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q 21 q 17 q 16 Liquid Mess Ltd, manufactures two products, glasses and cups, from a joint process Glasses are allocated $5 000 of

q 21

q 17

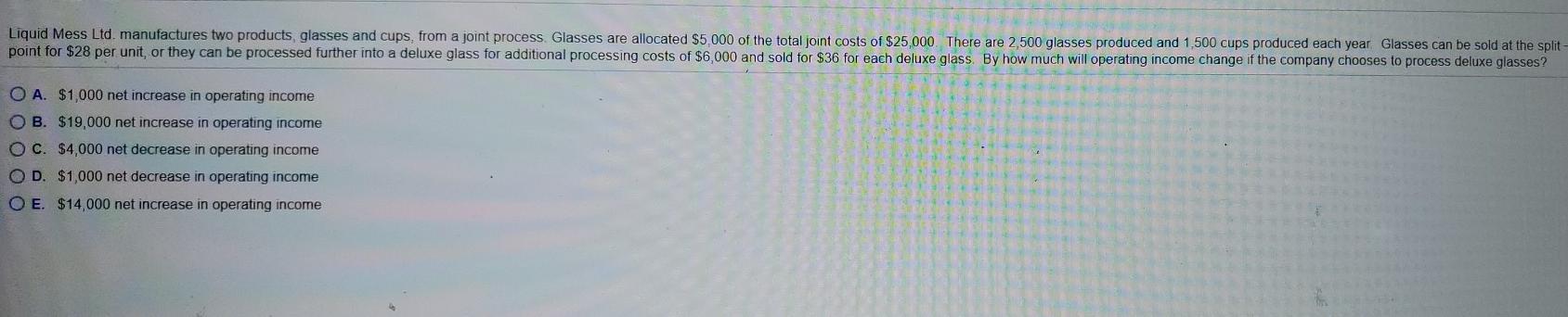

q 16

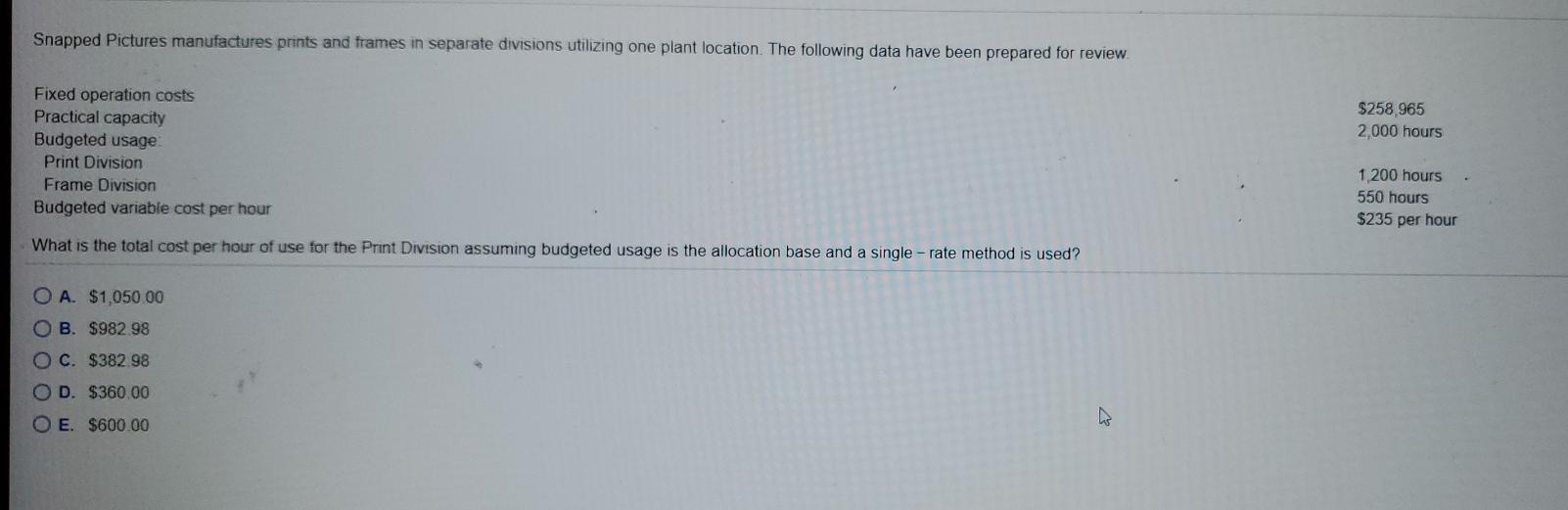

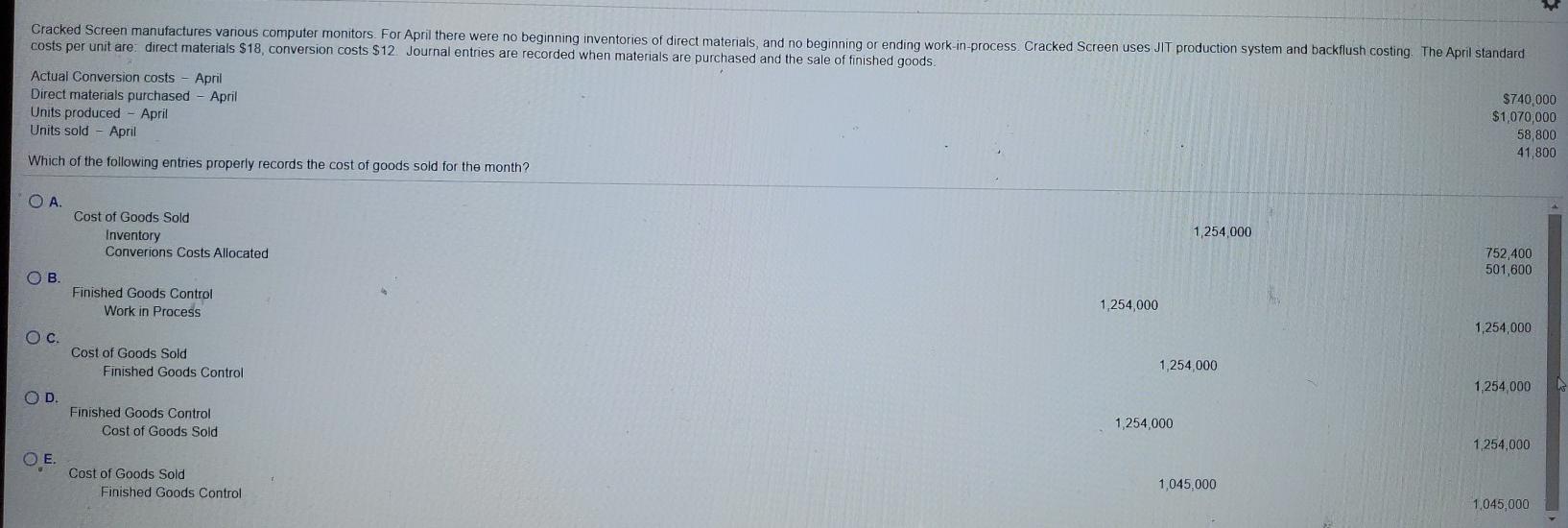

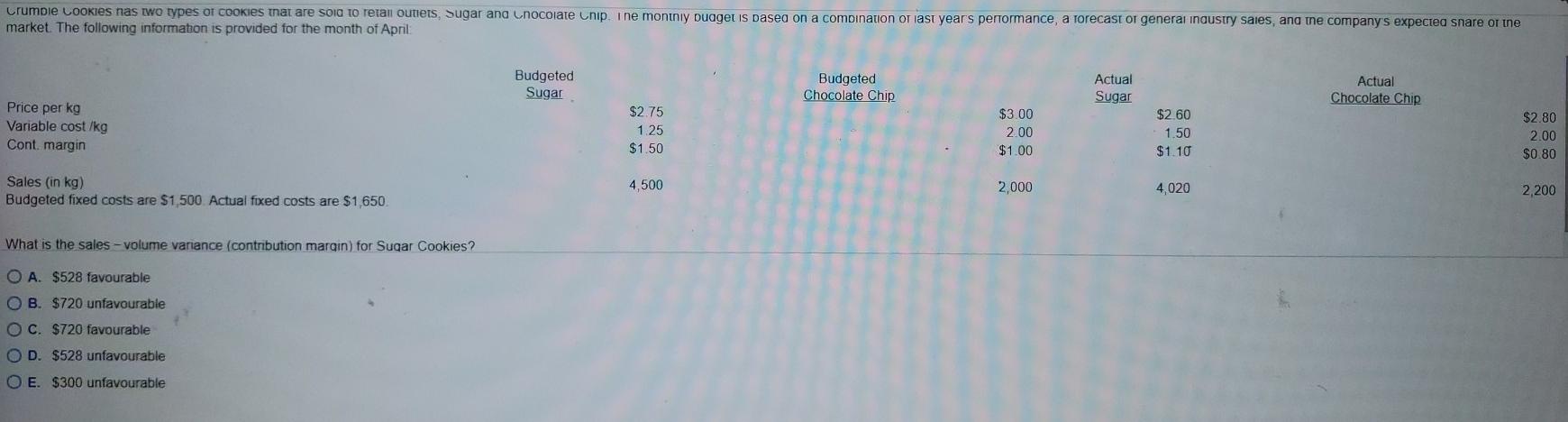

Liquid Mess Ltd, manufactures two products, glasses and cups, from a joint process Glasses are allocated $5 000 of the total joint costs of $25,000. There are 2,500 glasses produced and 1,500 cups produced each year Glasses can be sold at the split- point for $28 per unit, or they can be processed further into a deluxe glass for additional processing costs of $6,000 and sold for $36 for each deluxe glass. By how much will operating income change if the company chooses to process deluxe glasses? O A. $1,000 net increase in operating income O B. $19,000 net increase in operating income OC. $4,000 net decrease in operating income OD. $1,000 net decrease in operating income O E $14,000 net increase in operating income Snapped Pictures manufactures prints and frames in separate divisions utilizing one plant location. The following data have been prepared for review $258.965 2,000 hours Fixed operation costs Practical capacity Budgeted usage Print Division Frame Division Budgeted variable cost per hour 1,200 hours 550 hours $235 per hour What is the total cost per hour of use for the Print Division assuming budgeted usage is the allocation base and a single-rate method is used? O A. $1,050 00 OB. $982 98 OC. $382.98 D. $360.00 O E $600.00 Cracked Screen manufactures various computer monitors. For April there were no beginning inventories of direct materials, and no beginning or ending work-in-process. Cracked Screen uses JIT production system and backflush costing. The April standard costs per unit are: direct materials $18, conversion costs $12 Journal entries are recorded when materials are purchased and the sale of finished goods Actual Conversion costs - April Direct materials purchased - April $740,000 $1,070,000 Units produced April 58,800 Units sold April 41,800 Which of the following entries properly records the cost of goods sold for the month? OA. Cost of Goods Sold Inventory Converions Costs Allocated 1,254,000 752,400 501,600 . Finished Goods Control Work in Process 1,254,000 1,254,000 . Cost of Goods Sold Finished Goods Control 1,254,000 1,254,000 OD Finished Goods Control Cost of Goods Sold 1,254,000 1,254,000 O E Cost of Goods Sold Finished Goods Control 1,045,000 1,045,000 Crumple cookies nas two types of cookies that are sold to retan outlets, Sugar and Unocolate chip. Ine montniy buaget is based on a combination of last years performance, a forecast or generai industry sales, and the company's expected snare or the market. The following information is provided for the month of April Budgeted Sugar Budgeted Chocolate Chip Actual Sugar Actual Chocolate Chip Price per kg Variable cost/kg Cont margin $2.75 1.25 $1.50 $3.00 2.00 $1.00 $2.60 1.50 $1.10 $2.80 2.00 $0.80 4,500 Sales (in kg) Budgeted fixed costs are $1,500 Actual fixed costs are $1,650 2,000 4,020 2,200 What is the sales - volume variance (contribution margin) for Sugar Cookies? O A. $528 favourable OB. $720 unfavourable OC. $720 favourable OD. $528 unfavourable O E. $300 unfavourable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started