Answered step by step

Verified Expert Solution

Question

1 Approved Answer

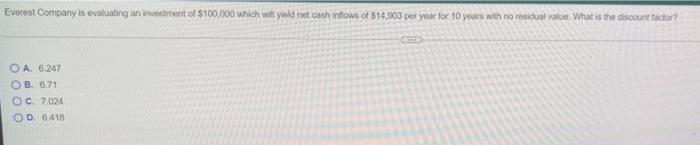

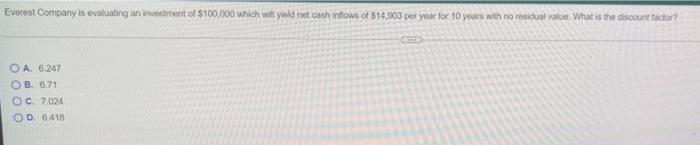

q 8 part abc Everest Company is evaluating an investment of 100,000 which wit yuld not cash inflows of $14,903 per year for 10 years

q 8 part abc

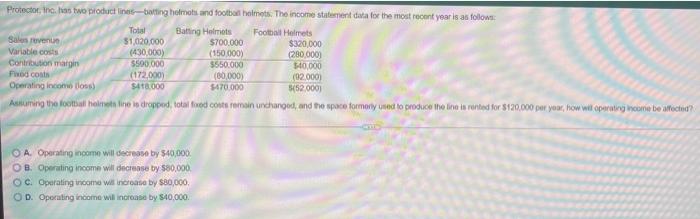

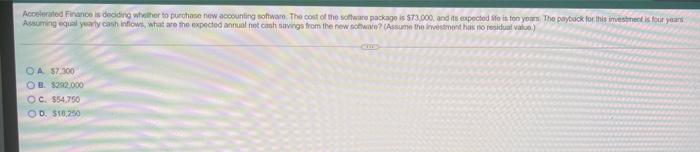

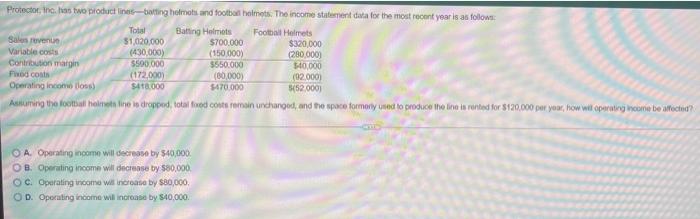

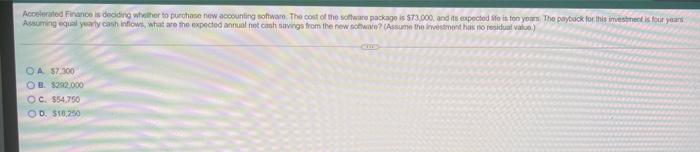

Everest Company is evaluating an investment of 100,000 which wit yuld not cash inflows of $14,903 per year for 10 years with no residual valore What is the discount factor? OA 6.247 OB. 0.71 C 7.024 OD 8.418 Protector, Inc. has two product lines-boting homes and football helmets. The income statement data for the most recent year is as follow Total Batting Helmets Football Helmets Salesuvent $1,020,000 $700.000 $320,000 Variable costs (430,000) (150.000) (280,000) Contribution margin $500.000 5550.000 $40,000 Food costs (172,0001 (80,000) (02.000) Operating incomos) $478.000 $470.000 5452.0001 Aluming the footad helmets line in dropped total fixed to remain unchanged, and the space formony used to produce the line is ranted for $120.000 per your, how will operating income be affected O A Operating income will decrease by 340,000 OB. Operating income will decrease by $80.000 OC. Operating income will increase by $80,000 OD. Operating income will increase by S40,000 Accelerated Finance is deciding whether to purchase new accounting software. The cost of the software package is 873.000, and is expected to is fon yours. The payback for this imesheet is for years Assuming equal artycash inflows, what are the expected annet cash savings from the new sowo? (Assume the westment has no residual valo) DA 57300 OB. 3292.000 OC. $54.750 O. 318,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started