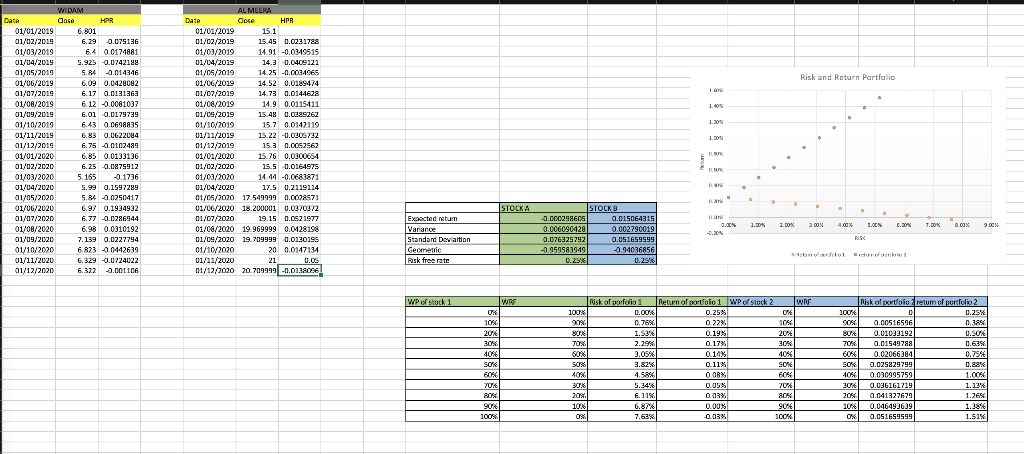

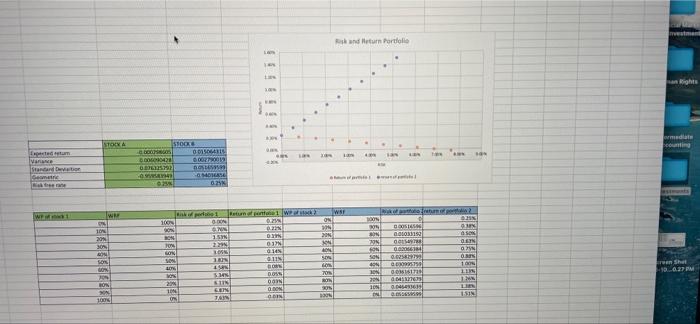

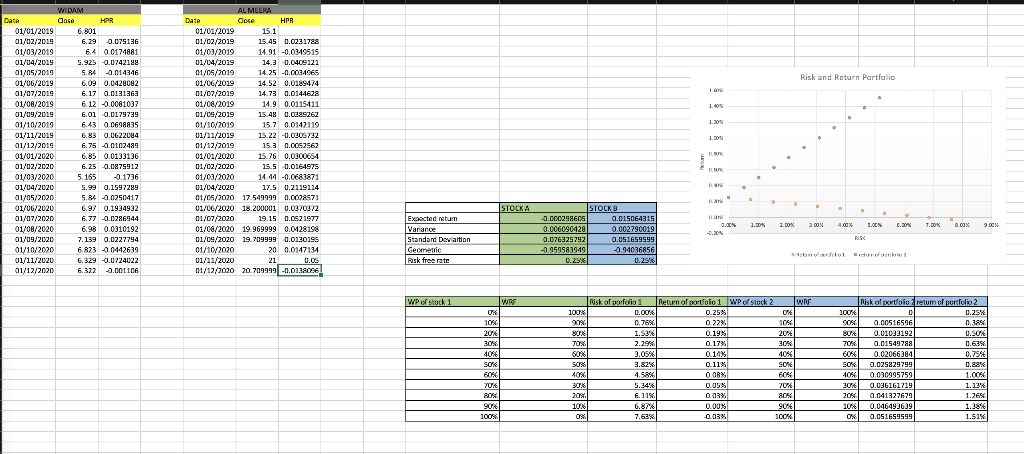

Q) Based on the graph, explain how we can see the tradeoff between risk and return and identify which stock you would prefer to combine with the risk-free asset. What motivates your preference?

Risk and Return Partfalia 1. 1.09 1.30 1.30% WIDAM Date dass HPR 01/01/2019 6.801 01/02/2019 6.29 -0.075136 01/03/2019 64 0.0174881 01/04/2019 5.925 0.0742199 01/05/2019 5.84 -0.014346 01/06/2019 6.09 0.0428092 01/07/2019 6.17 0.0131363 01/08/2019 6.12 -0.0081037 01/09/2019 6.01 0.0179739 01/10/2019 6.43 0.0698835 01/11/2019 6.83 0.0G22084 01/12/2019 6.75 -0.0102489 01/01/2020 6.85 0.0133136 01/02/2020 6.25 0.0875912 01/03/2020 5.165 -0.1736 01/04/2020 5.99 0.1597289 01/05/2020 5.84 -0.0250417 01/06/2020 6.97 0.1934932 01/07/2020 6.77 -0.0286944 01/08/2020 6.98 0.0310192 01/09/2020 7.139 0.0227794 01/10/2020 6.823 -0.0442639 01/11/2020 6.329 0.0724022 01/12/2020 6.322 0.001106 AL MEERA Date Cose HPR 01/01/2019 15.1 01/02/2019 15.45 0.0231788 01/03/2019 14.91 -0.03-19515 01/04/2019 14.3 -0.0409121 01/05/2019 14.25 -0.0034965 01/06/2019 14.52 0.0189474 01/07/2019 14.73 0.0144628 01/08/2019 14.9 0.0115411 01/09/2019 15.48 0.0988262 01/10/2019 15.7 0.0142119 01/11/2019 15.22 -0.0206722 01/12/2019 15.3 0.0062567 01/01/2020 15.76 0.0000654 01/02/2020 15.5 -0.0164975 01/03/2020 14.44 -0.0683871 01/04/2020 17.5 0.2119114 01/05/2020 17.549999 0.00087 01/06/2020 18.200001 0.0070072 01/07/2020 19.15 0.062 1977 01/08/2020 19.969999 0.0128198 01/08/2020 19.709999 0.0130195 01/10/2020 20 0.0147134 01/11/2020 210.06 01/12/2020 20.709999 -0.0136066 STOCKA 1.301 2. DOX 3.00 4.00% S.ES 2.30% T.BOX 9.00 "BOX 0.00 -0.20% STOCKE -0.000298605 0.015064315 0.006090428 0.002790019 0.076325792 0.0516595991 -0.959583949 -0.94036856 0.25% 0.25% Expected retum Variance Standard Deviation Geometric Risk free rate RISK Moldura WP of stock WR 0% 10% 206 30% 40% SO 50% 60% 706 906 % 100% Risk of porfolio 1 Return of portfolio 1 WP of stock 2 WRF 100% % 0.00% 0.25% % OM 90 0.76% 0.22% 10% 90.6 1.346 0.198 2014 70% 2.29% 0.17% % 30% 60% 2.05 0.14% 4044 50% 3.82% 0.11% % SOK 40N. 4.58% 0.00% 60% 30% 5.34% 0.05% % 70% 6.115 0.03% 80% 10% 0.00% 03 7.63% 0.03% 100% Risk of porolo return of portfolio 2 100% % D 0.25% % 90% 0.00516516 0.3% 806 0.01033192 0.50 % 70% 0.01549788 0.63% 6010 0.02066384 0.75% SOK 0.025329799 0.885 404 0.030995759 1.00% 2016 0.036161719 1.12 20% 0.041327679 1.26% 10% 0.046493639 1.38% OK 0.051659599 1.51% 9044 Return Portelle panights STO mediate im CONSOR Ivans 20 ESERCEO OOST 210019 NOSL MORSE NO WE 100 NO un 1 WE WS ON DR 20 NE NEO Sot NO NO WIL NOE BOLOS a so MUSE WO NEO 304 BO 22 ON 20 SON SON WOR NETO NO NEO con SO 1 Non GTIN BON DOW LIVE MT MES She 90.0.37 PM 70 WOT NO WZ w 0.06.14 0.025 DOWS 003117 a 0.048 Q 10 NOD NOE NE NE NEDO NO SIN EEN ON 10 ON Q.BON AN weet 100 WEWE Risk and Return Partfalia 1. 1.09 1.30 1.30% WIDAM Date dass HPR 01/01/2019 6.801 01/02/2019 6.29 -0.075136 01/03/2019 64 0.0174881 01/04/2019 5.925 0.0742199 01/05/2019 5.84 -0.014346 01/06/2019 6.09 0.0428092 01/07/2019 6.17 0.0131363 01/08/2019 6.12 -0.0081037 01/09/2019 6.01 0.0179739 01/10/2019 6.43 0.0698835 01/11/2019 6.83 0.0G22084 01/12/2019 6.75 -0.0102489 01/01/2020 6.85 0.0133136 01/02/2020 6.25 0.0875912 01/03/2020 5.165 -0.1736 01/04/2020 5.99 0.1597289 01/05/2020 5.84 -0.0250417 01/06/2020 6.97 0.1934932 01/07/2020 6.77 -0.0286944 01/08/2020 6.98 0.0310192 01/09/2020 7.139 0.0227794 01/10/2020 6.823 -0.0442639 01/11/2020 6.329 0.0724022 01/12/2020 6.322 0.001106 AL MEERA Date Cose HPR 01/01/2019 15.1 01/02/2019 15.45 0.0231788 01/03/2019 14.91 -0.03-19515 01/04/2019 14.3 -0.0409121 01/05/2019 14.25 -0.0034965 01/06/2019 14.52 0.0189474 01/07/2019 14.73 0.0144628 01/08/2019 14.9 0.0115411 01/09/2019 15.48 0.0988262 01/10/2019 15.7 0.0142119 01/11/2019 15.22 -0.0206722 01/12/2019 15.3 0.0062567 01/01/2020 15.76 0.0000654 01/02/2020 15.5 -0.0164975 01/03/2020 14.44 -0.0683871 01/04/2020 17.5 0.2119114 01/05/2020 17.549999 0.00087 01/06/2020 18.200001 0.0070072 01/07/2020 19.15 0.062 1977 01/08/2020 19.969999 0.0128198 01/08/2020 19.709999 0.0130195 01/10/2020 20 0.0147134 01/11/2020 210.06 01/12/2020 20.709999 -0.0136066 STOCKA 1.301 2. DOX 3.00 4.00% S.ES 2.30% T.BOX 9.00 "BOX 0.00 -0.20% STOCKE -0.000298605 0.015064315 0.006090428 0.002790019 0.076325792 0.0516595991 -0.959583949 -0.94036856 0.25% 0.25% Expected retum Variance Standard Deviation Geometric Risk free rate RISK Moldura WP of stock WR 0% 10% 206 30% 40% SO 50% 60% 706 906 % 100% Risk of porfolio 1 Return of portfolio 1 WP of stock 2 WRF 100% % 0.00% 0.25% % OM 90 0.76% 0.22% 10% 90.6 1.346 0.198 2014 70% 2.29% 0.17% % 30% 60% 2.05 0.14% 4044 50% 3.82% 0.11% % SOK 40N. 4.58% 0.00% 60% 30% 5.34% 0.05% % 70% 6.115 0.03% 80% 10% 0.00% 03 7.63% 0.03% 100% Risk of porolo return of portfolio 2 100% % D 0.25% % 90% 0.00516516 0.3% 806 0.01033192 0.50 % 70% 0.01549788 0.63% 6010 0.02066384 0.75% SOK 0.025329799 0.885 404 0.030995759 1.00% 2016 0.036161719 1.12 20% 0.041327679 1.26% 10% 0.046493639 1.38% OK 0.051659599 1.51% 9044 Return Portelle panights STO mediate im CONSOR Ivans 20 ESERCEO OOST 210019 NOSL MORSE NO WE 100 NO un 1 WE WS ON DR 20 NE NEO Sot NO NO WIL NOE BOLOS a so MUSE WO NEO 304 BO 22 ON 20 SON SON WOR NETO NO NEO con SO 1 Non GTIN BON DOW LIVE MT MES She 90.0.37 PM 70 WOT NO WZ w 0.06.14 0.025 DOWS 003117 a 0.048 Q 10 NOD NOE NE NE NEDO NO SIN EEN ON 10 ON Q.BON AN weet 100 WEWE