Answered step by step

Verified Expert Solution

Question

1 Approved Answer

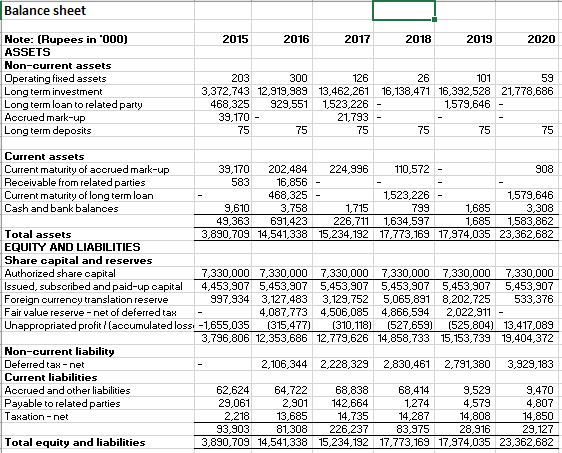

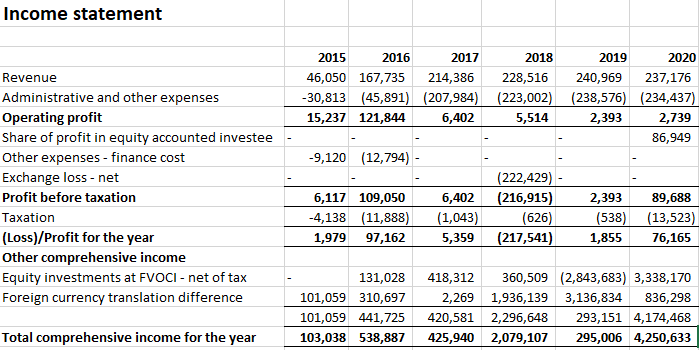

Q: Calculate and interpret the following ratios for 2018 to 2020 1. Quick ratio 2. Cash to Current Assets ratio 3. Cash to Current liabilities

Q: Calculate and interpret the following ratios for 2018 to 2020

1. Quick ratio

2. Cash to Current Assets ratio

3. Cash to Current liabilities ratio

4. A/R turnover

Balance sheet Note: (Rupees in '000) 2015 2016 2017 2018 2019 2020 ASSETS Non-current assets Operating fixed assets 203 300 126 26 101 59 Long term investment 3,372,743 12,919,989 13,462,261 16,138,471 16,392,528 21,778,686 Long term loan to related party 468,325 929,551 1,523,226 1,579,646 Accrued mark-up 39,170 - 21,793 Long term deposits 75 75 75 75 75 75 Current assets Current maturity of accrued mark-up 39,170 202,484 224,996 110,572 908 Receivable from related parties 583 16,856 Current maturity of long term loan 468,325 1,523,226 1,579,646 Cash and bank balances 9,610 3,758 1,715 799 1.685 3,308 49,363 691,423 226,711 1,634,597 1,685 1,583,862 Total assets 3,890,709 14,541,338 15,234,192 17,773,169 17,974,035 23,362,682 EQUITY AND LIABILITIES Share capital and reserves Authorized share capital 7,330,000 7,330,000 7,330,000 7,330,000 7,330,000 7,330,000 Issued, subscribed and paid-up capital 4,453,907 5,453,907 5,453,907 5,453,907 5,453,907 5,453,907 Foreign currency translation reserve 997,934 3,127,483 3,129,752 5,065,891 8,202,725 533,376 Fair value reserve - net of deferred tax 4,087,773 4,506,085 4,866,594 2,022,911 Unappropriated profit /(accumulated loss: -1,655,035 (315,477) (310,118) (527,659) (525,804) 13,417,089 3,796,806 12,353,686 12,779,626 14,858,733 15,153,739 19,404,372 Non-current liability Deferred tax-net 2,106,344 2,228,329 2,830,461 2,791,380 3,929,183 Current liabilities Accrued and other liabilities 62,624 64,722 68,838 68,414 9,529 9,470 Payable to related parties 29,061 2,901 142,664 1,274 4,579 4,807 Taxation - net 2,218 13,685 14,735 14,287 14,808 14,850 93,903 81,308 226,237 83,975 28,916 29,127 Total equity and liabilities 3,890,709 14,541,338 15,234,192 17,773,169 17,974,035 23,362,682 Income statement Revenue Administrative and other expenses Operating profit Share of profit in equity accounted investee Other expenses - finance cost Exchange loss - net Profit before taxation Taxation (Loss)/Profit for the year Other comprehensive income Equity investments at FVOCI - net of tax Foreign currency translation difference 2015 2016 2017 2018 2019 2020 46,050 167,735 214,386 228,516 240,969 237,176 -30,813 (45,891) (207,984) (223,002) (238,576) (234,437) 15,237 121,844 6,402 5,514 2,393 2,739 86,949 -9,120 (12,794) (222,429) 6,117 109,050 6,402 (216,915) 2,393 89,688 -4,138 (11,888) (1,043) (626) (538) (13,523) 1,979 97,162 5,359 (217,541) 1,855 76,165 131,028 101,059 310,697 101,059 441,725 103,038 538,887 418,312 360,509 (2,843,683) 3,338,170 2,269 1,936,139 3,136,834 836,298 420,581 2,296,648 293,151 4,174,468 425,940 2,079,107 295,006 4,250,633 Total comprehensive income for the year Balance sheet Note: (Rupees in '000) 2015 2016 2017 2018 2019 2020 ASSETS Non-current assets Operating fixed assets 203 300 126 26 101 59 Long term investment 3,372,743 12,919,989 13,462,261 16,138,471 16,392,528 21,778,686 Long term loan to related party 468,325 929,551 1,523,226 1,579,646 Accrued mark-up 39,170 - 21,793 Long term deposits 75 75 75 75 75 75 Current assets Current maturity of accrued mark-up 39,170 202,484 224,996 110,572 908 Receivable from related parties 583 16,856 Current maturity of long term loan 468,325 1,523,226 1,579,646 Cash and bank balances 9,610 3,758 1,715 799 1.685 3,308 49,363 691,423 226,711 1,634,597 1,685 1,583,862 Total assets 3,890,709 14,541,338 15,234,192 17,773,169 17,974,035 23,362,682 EQUITY AND LIABILITIES Share capital and reserves Authorized share capital 7,330,000 7,330,000 7,330,000 7,330,000 7,330,000 7,330,000 Issued, subscribed and paid-up capital 4,453,907 5,453,907 5,453,907 5,453,907 5,453,907 5,453,907 Foreign currency translation reserve 997,934 3,127,483 3,129,752 5,065,891 8,202,725 533,376 Fair value reserve - net of deferred tax 4,087,773 4,506,085 4,866,594 2,022,911 Unappropriated profit /(accumulated loss: -1,655,035 (315,477) (310,118) (527,659) (525,804) 13,417,089 3,796,806 12,353,686 12,779,626 14,858,733 15,153,739 19,404,372 Non-current liability Deferred tax-net 2,106,344 2,228,329 2,830,461 2,791,380 3,929,183 Current liabilities Accrued and other liabilities 62,624 64,722 68,838 68,414 9,529 9,470 Payable to related parties 29,061 2,901 142,664 1,274 4,579 4,807 Taxation - net 2,218 13,685 14,735 14,287 14,808 14,850 93,903 81,308 226,237 83,975 28,916 29,127 Total equity and liabilities 3,890,709 14,541,338 15,234,192 17,773,169 17,974,035 23,362,682 Income statement Revenue Administrative and other expenses Operating profit Share of profit in equity accounted investee Other expenses - finance cost Exchange loss - net Profit before taxation Taxation (Loss)/Profit for the year Other comprehensive income Equity investments at FVOCI - net of tax Foreign currency translation difference 2015 2016 2017 2018 2019 2020 46,050 167,735 214,386 228,516 240,969 237,176 -30,813 (45,891) (207,984) (223,002) (238,576) (234,437) 15,237 121,844 6,402 5,514 2,393 2,739 86,949 -9,120 (12,794) (222,429) 6,117 109,050 6,402 (216,915) 2,393 89,688 -4,138 (11,888) (1,043) (626) (538) (13,523) 1,979 97,162 5,359 (217,541) 1,855 76,165 131,028 101,059 310,697 101,059 441,725 103,038 538,887 418,312 360,509 (2,843,683) 3,338,170 2,269 1,936,139 3,136,834 836,298 420,581 2,296,648 293,151 4,174,468 425,940 2,079,107 295,006 4,250,633 Total comprehensive income for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started