Question

Q) Incremental ERR Calculation (just one question) here's some extra information down below You will frequently find several (more than one) negative cash flows when

Q) Incremental ERR Calculation (just one question)

here's some extra information down below

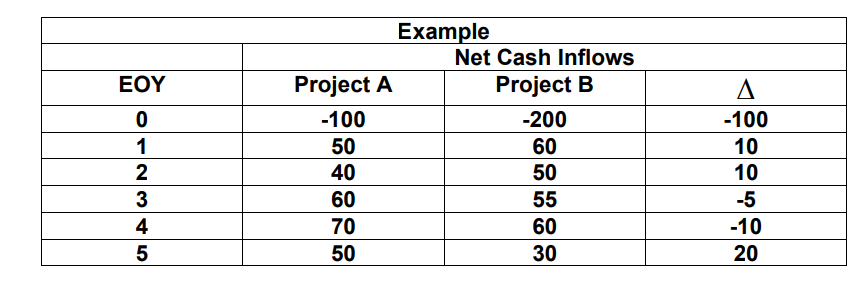

You will frequently find several (more than one) negative cash flows when calculating the differences between the net cash inflows of two projects.

As a result, the calculation of the incremental ERR is no longer direct as the calculated external rate of return (i*) must be used for all negative cash flow differences.

Using Excels Solver add-in function, determine the incremental external rate of return between the Alpha and Gamma investments.

In the example below, MARR (usually 10% for our purposes) cannot be used to calculate the future value of the negative cash flow differences at EOY0, EOY3 and EOY4.

Use the ERR (i*) to bring all negative cash flow differences to EOY5 and MARR (=10%) to bring all positive cash flow differences to EOY5.

Find the ERR (i.e., i*) which sets the future worth of negative cash flow differences equal to that of the positive cash flow differences.

With more than one negative cash flow difference, the answer obtained with Excels MIRR function will be different (and incorrect) from the answer obtained with Excels Solver.

EOY A 0 1 2 3 4 5 Example Net Cash Inflows Project A Project B -100 -200 50 60 40 50 60 55 70 60 50 30 -100 10 10 -5 -10 20 EOY A 0 1 2 3 4 5 Example Net Cash Inflows Project A Project B -100 -200 50 60 40 50 60 55 70 60 50 30 -100 10 10 -5 -10 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started