Question

Q1. (4 Points) Consider an example of the Mars chocolate bar; if the supply and demand curves represented as: Qs = 2p; Qd = 18

Q1. (4 Points)

Consider an example of the Mars chocolate bar; if the supply and demand curves represented as:

Qs = 2p; Qd = 18 -p

Solve:

a)Equilibrium price and equilibrium quantity and calculate total revenue?

b)If there were a price celling equal to 7 SAR per chocolate bar imposed, calculate the price elasticity of demand? Does this consider elastic, inelastic or unit elastic?Also, calculate the total revenue?

c)Now consider the Bounty chocolate bar market; if the supply and demand is:

i.Qs = 2p ; Qd = 35 - 5p, calculate the equilibrium price and equilibrium quantity.Also, calculate Total Revenue.

ii.If there were a price celling of 6 SAR imposed per each pair of bounty chocolate bar, calculate the price elasticity of demand? Do the shoes consider elastic, inelastic or unit elastic? Also calculate total revenue. Hint; plug the new price on the demand curve formula, then find the new quantity demand after change in prices, after that solve for the elasticity by comparing the percentage changes in P & Qd

d)Compare the total revenue for the Bounty bar and the total revenue for the Mars chocolate bar.Which one of product's total revenue has been increased after the price have been increase and why?Explain in words and show the difference in numbers as well.

e)Recall part a (the Mars chocolate bar); Calculate the CS & PS.Also, calculate total surplus. Hint; you need to set Qs=0 & Qd=0 to find the intercept and calculate the CS, PS. Where the CS is the area between the intercept for demand and the equilibrium price you found on part a.Do not forget that this area is a triangle so carefully calculate the area.The same thing for PS.

f)Now, if the government impose sales tax equal to 50% which is equal to 3 SAR per Mars chocolate bar; if 2 SAR of the tax bared by the buyer and 1 SAR bared by the seller.calculate the CS, PS, tax revenue, DWL and total surplus.What happened to the total surplus after imposing tax (increase/decrease/does not change)? Hint: PD = 8 and PS = 5. The intercept points for the supply and demand on this part are the same as the ones on part e. To find the quantity, plug either the price for the buyer on the demand curve formula or the price for the seller on supply curve formula.Also, remember CS, PS & DWL have triangle area, whereas tax revenue has rectangular area.Graph this manually so you can easily find the answer.

g)Without calculation, would you expect to have higher/ lower government revenue and DWL on bounty and why?

Q2. (1 point)

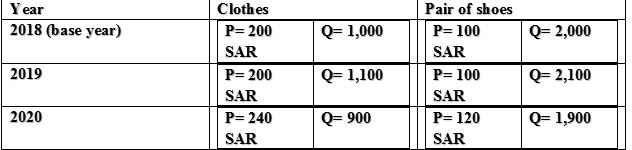

Assume that Saudi Arabia produce only two products; Clothes and Shoes where are the price and quantity produced are:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started