Q1) 5 Marks Write an article on the Pakistans economic performance pre & post impact of Covid-19? (Minimum words 250) Briefly explain the difference between

Q1) 5 Marks

- Write an article on the Pakistans economic performance pre & post impact of Covid-19? (Minimum words 250)

- Briefly explain the difference between Morkowitz Modern Portfolio Theory & Single Index Model approaches? What is the basic difference between these two approaches?

Q2) 5 Marks

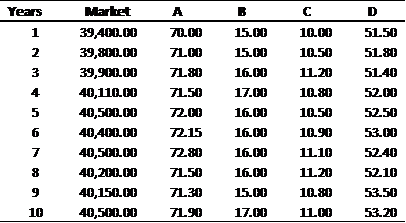

You are working as a portfolio associate and your manager assigned task to find out which investment option is feasible for existing portfolio. All of the investment options are riskier than market however still manager wants to optimize its risk in given investment options.

Requirements:

- Calculate Average of each of the investment option.

- Calculate the Risk of each of the investment option.

- Calculate the Co-efficient of Variation of each investment option.

- Calculation of correlation each of the investment option.

- Calculate Beta of each of the investment option.

- Give your conclusion or recommendation which investment option is best for you in comparison to least risky.

Q3) 5 Marks

You are working in investment advisory firm where primary job is to support your clients in their investments decisions by guiding them according to their risk appetite.

Mr. Kashif wants to investment 5 million while he doesnt have any idea how to make a portfolio which would be diversified enough to mitigate the risk. Though, you asked few questions from Mr. Kashif to know his financial health and potential to bear losses.

- Kashif is 42 years old and working in a privately owned company.

- He has 3 children, age of children are 7, 11 and 15 and the elder one is about to go collage which required annual fees of PkR 150,000.

- He wants to earn at least a return which compensate the inflationary pressure in future. Current inflation rate of Pakistan is hovering around 8.90%.

- According to him, he believe, he can able to take more risk.

- He also planned for leisure trip with family after 3 years which required PkR 2 million.

Being an advisory you gathered all the relevant data to consult him in a better way.

| Allocation | Portfolio A | Portfolio B | Portfolio C |

| Cash | 5% | 20% | 5% |

| Equities | 20% | 25% | 60% |

| Money Market Funds | 60% | 40% | 15% |

| Gold | 15% | 15% | 20% |

| Total | 100% | 100% | 100% |

| Expected Return | 15% | 18% | 22% |

| Volatility | 17% | 20% | 25% |

Requirements

Suggest which investment portfolio is feasible for Mr. Kashif in order to fulfill his objectives?

Q 4) 5 Marks

Alpha Beta Investment Company gathered the data to recommend stocks which are undervalued in the market according to Capital Assets Price Model (CAPM).

| Stock | Current Price | Dividend | Price after a year | Beta |

| A | 50.00 | 2.50 | 55.00 | 2.50 |

| B | 42.00 | 1.20 | 47.00 | 1.40 |

| C | 20.00 | 0.50 | 22.00 | 0.80 |

Market consensus for Risk free rate = 7% and Risk premium = 6%

Requirements

- Calculate the Expected Return & CAPM derived return.

- Highlight the under & over valued companies based on SML.

Q 5) 5 Marks

Portfolio manager wants to optimize the riskiness of the two assets portfolio with the given statistics below:-

| Assets | Return | Volatility | Weight |

| A | 17.00% | 15.00% | 40.00% |

| B | 21.00% | 25.00% | 60.00% |

| Correlation |

| -0.70 |

| -0.35 |

| 0.25 |

| 0.50 |

| 0.70 |

Requirements

Calculate the two assets portfolio standard deviation at different correlation levels which are mentioned above and suggest at which correlation is best suits to your portfolio.

A B D Years 1 2 3 4 Market 39,400.00 39,800.00 39,900.00 40,110.00 40,500.00 40,400.00 40,500.00 40,200.00 40,150.00 40,500.00 5 71.00 71.00 71.80 71.50 22.00 72.15 72.80 71.50 71.30 71.90 15.00 15.00 16.00 17.00 16.00 16.00 16.00 16.00 10.50 11.20 10.80 10.50 10.90 11.10 11.20 10.80 11.00 51.50 51.80 51.40 52.00 52.50 53.00 52.40 52.10 53.50 53.20 6 7 8 16.C. 15.00 9 10 17.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started