Answered step by step

Verified Expert Solution

Question

1 Approved Answer

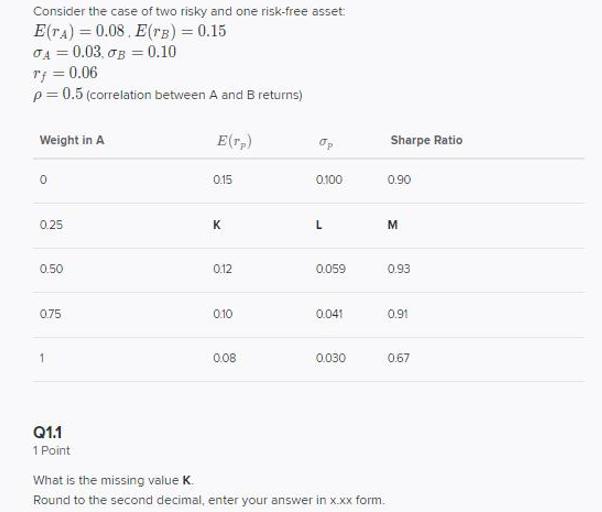

Consider the case of two risky and one risk-free asset E(rA) = 0.08. E(rB) = 0.15 OA = 0.03, oB = 0.10 rf =

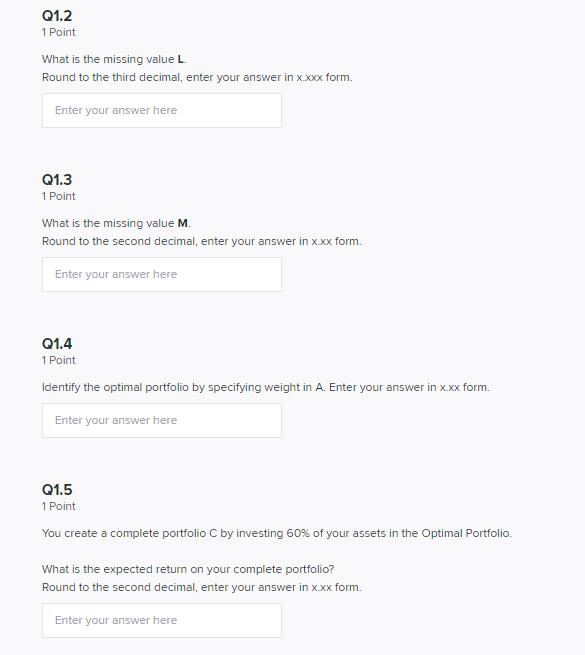

Consider the case of two risky and one risk-free asset E(rA) = 0.08. E(rB) = 0.15 OA = 0.03, oB = 0.10 rf = 0.06 p= 0.5 (correlation between A and B returns) Weight in A E(r,) Op Sharpe Ratio 0.15 0.100 0.90 0.25 K M 0.50 0.12 0.059 0.93 075 010 0.041 0.91 1 0.08 0.030 067 Q1.1 1 Point What is the missing value K. Round to the second decimal, enter your answer in x.xx form. Q1.2 1 Point What is the missing value L. Round to the third decimal, enter your answer in x.xxx form. Enter your answer here Q1.3 1 Point What is the missing value M. Round to the second decimal, enter your answer in xxx form. Enter your answer here Q1.4 1 Point Identify the optimal portfolio by specifying weight in A. Enter your answer in x.xx form. Enter your answer here Q1.5 1 Point You create a complete portfolio C by investing 60% of your assets in the Optimal Portfolio. What is the expected return on your complete portfolio? Round to the second decimal, enter your answer in x.xx form. Enter your answer here

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Solution 11 K02500807501501325 12 Lsqrt02500320750102202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started