Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 a) Find the Present Values of the following Ordinary Annuities: $800 per year for 10 years at 10% $400 per year for 5

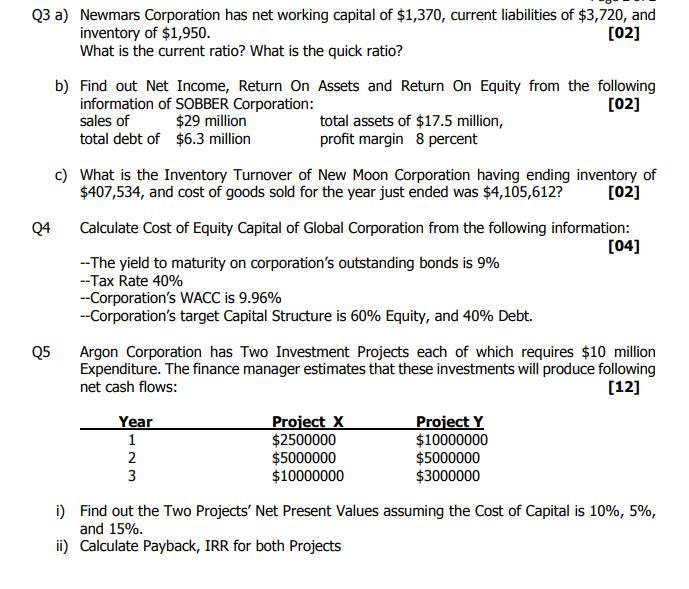

Q1 a) Find the Present Values of the following Ordinary Annuities: $800 per year for 10 years at 10% $400 per year for 5 years at 5% $500 per year for 6 years at 8% i. ii. iii. b) Find the Present Values of the following Annuities Due: $400 per year for 10 years at 10% $200 per year for 5 years at 5% $500 per year for 6 years at 8% i. ii. iii. Depreciation Expense Tax Rate Q2 a) Find the Net Income and Net Cash Flows of Graven Corporation having following data available: [02] EBIT $1500000 $400000 35% Current Assets Current Liabilities (Note: Graven Corporation is 100% Equity Financed) b) Find the Owners' Equity and Net Working Capital of ABS Corporation having following data available: [02] $ 5,300 $ 3,900 [02] Net Fixed Assets Long Term Debt [02] $ 26,000 $ 14,200 Q3 a) Newmars Corporation has net working capital of $1,370, current liabilities of $3,720, and inventory of $1,950. [02] What is the current ratio? What is the quick ratio? Q4 Q5 b) Find out Net Income, Return On Assets and Return On Equity from the following information of SOBBER Corporation: sales of $29 million [02] total debt of $6.3 million c) What is the Inventory Turnover of New Moon Corporation having ending inventory of $407,534, and cost of goods sold for the year just ended was $4,105,612? [02] Calculate Cost of Equity Capital of Global Corporation from the following information: [04] --The yield to maturity on corporation's outstanding bonds is 9% --Tax Rate 40% --Corporation's WACC is 9.96% --Corporation's target Capital Structure is 60% Equity, and 40% Debt. total assets of $17.5 million, profit margin 8 percent Argon Corporation has Two Investment Projects each of which requires $10 million Expenditure. The finance manager estimates that these investments will produce following net cash flows: [12] Year 1 2 23 3 Project X $2500000 $5000000 $10000000 Project Y $10000000 $5000000 $3000000 i) Find out the Two Projects' Net Present Values assuming the Cost of Capital is 10%, 5%, and 15%. ii) Calculate Payback, IRR for both Projects

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Q1 ai PVPMT11rnr PMT800 r10 n10 PV 8001 101010010491565 ii PMT400 r5 n5 PV 4001 100550005173179 iii PMT500 r8 n6 PV 5001 100860008231169 b i PVPMT 11rnr1r PMT400 r10 n10 PV400 11011001101 269006 iiPMT...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started