Question

Q1. A Manufacturing Company, which is considering updating its technology, is focusing attention on a general purpose machine that can perform many different operations. An

Q1.

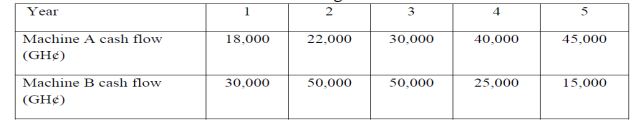

A Manufacturing Company, which is considering updating its technology, is focusing attention on a general purpose machine that can perform many different operations. An investigation of available equipment has narrowed the choice to two machines, A and B, whose cash flows are given below:

Machine A costs GH80,000 and machine B costs GH120,000. Both machines have a salvage value of zero at the end of their economic life of five years. i. Find the payback period for each machine. ii. Compute the discounted payback period. iii. Using the payback criterion, advise the Management of the Company on which machine to purchase, giving a reason for your choice of machine. iv. Would your advice in b(ii) change if the Companys objective is that of profitability? v. Determine the net present value for each machine using a discount rate of 18 percent. vi. Using the net present value criterion, advise the Management of the Company on which machine to purchase, giving a reason for your choice of machine vii. Account for any difference in the advice given using both the payback criterion and the net present value criterion.

Q2

ATAA ADWOA Ghana Ltd is considering investing in the following projects which are considered mutually exclusive:

| PROJECT GO GH 1,000,000 | PROJECT COME GH 2,000,000 | Annual cash inflows |

| Cost of Machine | 2,500,000 | 6,000,000 |

| Scrap value of Machine Expected life of the Project | 250,000 5 years | 1,000,000 5 years |

ATAA ADWOA Ghana Ltd uses the straight-line method of depreciation. However, tax-allowable depreciation is 30% on straight-line basis. The cost of capital for the company is 20% per annum. Required: i) Calculate the Accounting Rate of Return for each project. ii) Calculate the Net Present Value (NPV) for each project. iii) Compute the Internal Rate of Return (IRR) for each project. iv) Compute the Payback period and discounted payback periods for each project. (Note: In each of the above, advise the Company on which of the projects to implement or undertake)

Q3

Tobinco Pharmacy is considering a new malaria drug that has a total life span of 20 years, seven (7) of which will be used in its pre-trial and testing and the remaining thirteen (13) will be the revenue-generating years. Phase I will take two years and cost $ 35 million. Phase II will take another two years and cost $40.4 million. Phase III will take three years and cost $500 million. All costs for the individual phases will be made at the beginning of each phase. The product will then be launched at the beginning of the 8th year for another $405 million. Cash inflows of $843 million per year are expected. Since they do not have the expertise internally, you have been consulted to help management in arriving at an appropriate decision. Your terms of reference are to: Determine the viability of this project using the following techniques (the firm has a cost of capital of 20%): i) Net Present Value, (the firm has a cost of capital of 20%) ii) Profitability Index, iii) Discounted Payback ((the firm has a cost of capital of 20%) iv) Payback period

Q4.

Akrobeto Company Ltd is considering an investment of GHS 350,000 in a startup. The following cash flows are expected.

| Year | GHS |

| 1 | 50,000 |

| 2 | 100,000 |

| 3 | 200,000 |

| 4 | 150,000 |

a) Assume that the enterprise maintains a debt-to-equity ratio of 3:2. If the interest rate on a bank loan is 8% and the cost of equity is 10%, what will be the Net Present Value (NPV) of the investment? b) What is the Internal Rate of Return (IRR) for the project? c) Reinvesting at cost of capital, what will be the Modified Internal Rate of Return (MIRR) for the proposed investment? d) What will be your overall advice concerning the viability of the project?

Year 1 2 3 4 5 18,000 22.000 30,000 40.000 45,000 Machine A cash flow (GH) 30.000 50,000 50.000 25.000 15.000 Machine B cash flow (GH)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started